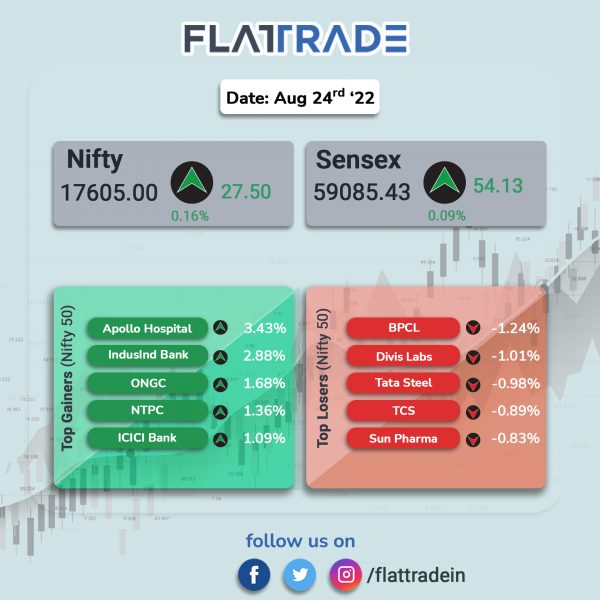

Benchmark indices ended slightly higher in a volatile sessions, aided by realty, bank and metal stocks. The Sensex edged up 0.09% and the Nifty 50 index gained 0.16%.

Broader markets outperformed headline indices. The Nifty Midcap 100 rose 0.74% and BSE SmallCap advanced 0.73%.

Top Nifty sectoral gainers were Realty [1.81%], Media [1.74%], Private Bank [1.59%], Bank [0.88%] and Metal [0.71%]. Top losers were IT [-0.34%] and Pharma [-0.31%]

The Indian rupee rose 7 paise to 79.81 against the US dollar on Wednesday.

Stock in News Today

IDBI Bank: The Indian Government is planning to sell at least 51% of state-backed IDBI Bank, according to Bloomberg news report. The government owns 45.48% in the bank, while LIC owns another 49.24 per cent stake in the lender. The government and LIC will formally seek to gauge buyer interest as soon as the end of September, sources said. Shares of the lender rose 5.13% in intraday trading.

DLF: The construction behemoth said that the credit rating agency ICRA has reaffirmed its rating and revised outlook to ‘positive’ from ‘stable’ on the instruments and bank facilities of the company. ICRA said that the reaffirmation of the ratings reflects DLF’s robust sales and collections in FY2022 and Q1 FY2023, which enabled significant reduction in the net debt.

The company recorded a net sales of Rs. 5,321 crore and collections from customers worth Rs. 4,529 crore in FY2022, registering a year-on-year (YoY) growth of 73% and 96%, respectively. Its net debt level reduced to Rs 2,259 crore as of June 2022 from Rs 4,885 crore at the end of March 2021.

TVS Motor: The two-wheeler manufacturer plans to acquire 48.27% stake in Narain Karthikeyan’s Startup Nkars Mobility Millenial Solutions for Rs 86.41 crore. Nkars Mobility is engaged in leasing two-wheeler, selling, trading and distributing pre-owned two-wheeler motor cycles and scooters.

The acquisition will be done through subscription of shares issued by way of preferential allotment and purchase of shares from some existing shareholders. TVS will obtain 48.27% stake in Nkars Mobility through subscription of shares issued by way of preferential allotment and through purchase of shares from certain existing shareholders of Nkars Mobil

Parag Milk Foods: The dairy company has raised a total of Rs 131 crore through preferential allotment from marquee investors and promoters. The promoters also plans to invest Rs.18.75 crore. The funds raised will be used for the working capital requirements of the company.

Aurobindo Pharma: The company said that its wholly owned subsidiary company, Eugia Pharma Specialties, has received a final approval from the US drug regulator to manufacture and market Medroxyprogesterone Acetate Injectable Suspension USP, 150 mg/mL, 1 mL SingleDose Vial. The product is expected to be launched in Q3FY23 and the product has an estimated market size of around $62 million for the twelve months ending June 2022, according to IQVIA.

Procter & Gamble Hygiene and Healthcare: Shares of the company fell 1.22% after it posted lower-than-expected results. The company’s net profit fell to Rs 42.55 crore in April-June quarter from Rs 102.85 in the January-March quarter of 2022. Revenue declined to Rs 776.38 crore in the reported quarter as against Rs 973.26 crore in the prior quarter.

Lupin: The pharma company said that it has received the US FDA approval for Formoterol Fumarate Inhalation solution. The drug is used in the treatment of breathing problems due to lung diseases, COPD, chronic bronchitis and emphysema. The drug has an estimated annual sales of $282 million in the US, according to IQVIA June 2022 data.

Artson Engineering: Shares of the company surged 10.19%. after the company secured order worth Rs 61.77 crore, including taxes from Tata Projects. The order pertains to the manufacture and supply of structures for Tata Steel’s Noamundi project. The contract is to be executed within 10 months.

KIOCL: The company in an exchange filing said that it has temporarily suspended operation of its pellet plant at Mangalore from 23 August 2022. The temporary suspension of operation is due to shed full condition, resulting out of lack of demand in domestic market and unviability in international market in view of levy of duty on export of pellets by Indian government.

Bharat Gears: Shares of the company closed 2.1% higher after the company approved the issue of bonus shares in the ratio of 1:2. The company will issue one equity share for every two shares held by the members and the record date has been fixed at September 13.