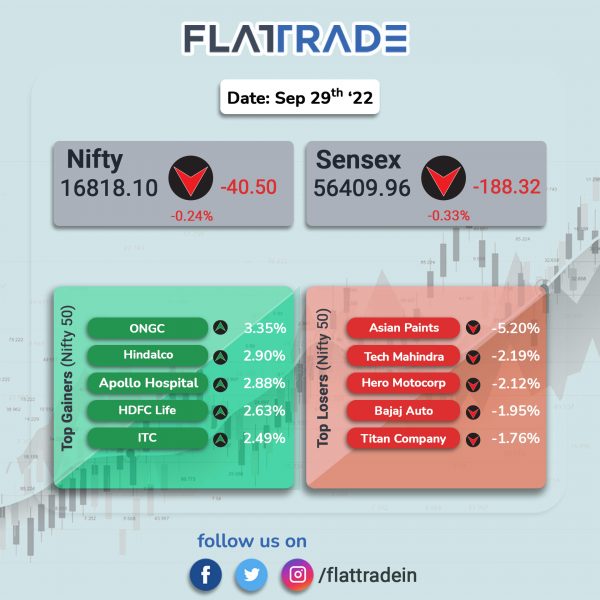

Benchmark stock indices closed lower ahead of the RBI’s monetary policy decision tomorrow. The Sensex fell 0.33% and the Nifty 50 index dropped 0.24%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index rose 0.40% and the BSE Smallcap gained 0.63%.

Top gainers in Nifty sectoral index were Pharma [1.33%], Media [1.2%], PSU Bank [1.16%], FMCG [0.89%] and Metal [0.5%]. Top losers were IT [-0.92%], Energy [-0.83%], Financial Services [-0.51%], Auto [-0.32%] and Bank [-0.3%]

Indian rupee closed 3 paise higher to 81.86 against the US dollar on Thursday.

Stock in News Today

Adani Enterprises (AEL): The company has announced that its wholly owned subsidiaries — Budaun Hardoi Road, Hardoi Unnao Road and Unnao Prayagraj Road — have achieved financial closure for the greenfield Ganga Expressway project in Uttar Pradesh. The project concession period is for 30 years with traffic link extension provision of 6 years, including three years construction period, the company stated. Adani Enterprises has secured Rs 10,238 crore from the lenders to finance the construction of the Ganga Expressway.

Meanwhile, Adani Enterprises would be included in the Nifty 50 index on Friday and it will replace Shree Cement. The stock will be excluded from Nifty Next 50 index and it is expected to attract net inflow of $189 million, according to Edelweiss Securities.

State Bank of India (SBI): The country’s biggest lender has filed a corporate insolvency petition against construction firm Jaiprakash Associates Limited (JAL) for a debt default of Rs 6,892.48 crore, businessline reported. The lender filed the petition before the Allahabad Bench of the National Company Law Tribunal (NCLT) on September 20. Currently, JAL has a outstanding debt estimated at about Rs 26,000 crore and has failed to convince its lenders of a restructuring proposal outside the IBC.

Tata Consultancy Services (TCS): The company is helping CareScout, a Genworth Financial company, in its purpose-led journey to help American families access quality long-term care in a timely and effortless manner by connecting them with the right care facilities through a marketplace. The marketplace offers a seamless self-onboarding experience to CareScout users, with smart notifications and alerts assisting them to complete their profiles.

Adani Green Energy: The company has commissioned 600 MW of Wind-Solar Hybrid power plant ”Hybrid Power Plant” at Jaisalmer, Rajasthan. The plant has Power Purchase Agreements (PPA) with SECI at Rs 2.69/kwh for 25 years. This Hybrid Power Plant has been implemented consisting of 600 MW Solar and ~150 MW Wind plants.

FSN E-Commerce Ventures (Nykaa): The company announced that its board will consider and approve the issuance of bonus shares to the equity shareholders of the company. The bonus shares would be issued in the ratio as the board may deem fit and the board will seek shareholders’ approval by way of postal ballot for the same.

Indian Oil Corporation Ltd (IOCL): The state-owned oil refiner has signed a long-term agreement with Brazil’s Petrobras and Colombia’s Ecopetrol SA to get crude oil to boost India’s energy security, reported Mint news. Under the agreement, Petrobras will supply 1.7 million tonnes per annum to IOCL, the news report said.

Torrent Pharmaceuticals: The company said that the USFDA has issued Form 483 to the company with 3 observations post the inspection of the drug maker’s Indrad-based manufacturing facility. The company said it will respond to the USFDA within stipulated timeline and work closely with the USFDA to address the observations.

Go Fashion: Shares of the company surged 6.15% to touch a new lifetime high in intraday trade on the back of healthy outlook. The shares touched a record high of Rs 1374.6 per equity share ahead of strong wedding and festive season. The retailers also showed robust topline growth during the first quarter of this fiscal.

Lupin: Shares of the company dropped 3.8% intraday trade after the company received warning letter for its Tarapur, Maharashtra facility. In an exchange filing, the company said that it has received a warning letter from the US drug regulator for its Tarapur facility in Maharashtra after the USFDA inspected the facility in March and April of 2022. The company said the warning letter will not affect supplies or the existing revenues from operations of this facility. The company also said it is committed to addressing the concerns raised by the USFDA.

Chemcon Speciality Chemicals: The company has announced it has commenced commercial production at P9 facility at Manjusar, Near Vadodara, Gujarat. The company has added a capacity of 2,400 MTPA of Bromo Benzene at the P9 facility. The company is also evaluating to add a pharma chemical, Guanine, at the same unit.

IT Hardware Companies: The government is likely to sweeten the production-linked incentive (PLI) scheme for IT hardware, according to a report by The Economic Times. The reworked scheme aims to provide incentives of 4-5.75% over five years, against 1-4% over a tenure of four years at present. The financial outlay will touch about Rs 19,000 crore, from Rs 7,350 crore, according to the report.

Uno Minda: The company’s board has approved the joint venture with Tachi-S for manufacturing and marketing of seat recliners for four wheeler passenger vehicle in India. The joint venture will offer various products including recliners in first phase with the intention of expanding into other seating mechanisms, seat frames and complete seating assembly. Uno Minda will hold 51% stake in the joint venture, while the remaining stake will be held by Tachi-S.

MapmyIndia: The Government of National Capital Territory (NCT) of Delhi and MapmyIndia Mappls have signed a Memorandum of Understanding to develop a web-application which will be a geo spatial decision-making tool to ensure effective sighting of EV charging stations. The tool will supplement the planning and deployment of an accessible and connected network of EV charging stations within the city.

Bayer CropScience: The company’s board has approved the sale of its Environmental Science Business to 2022 ES Discovery India on a slump sale basis, for a consideration of Rs. 111.1 crore pursuant to regulatory conditions.

Hindustan Copper: The company rose 2.4% after company approved 23.2% dividend for FY 2022, according to its regulatory filing. The date of payment of the dividend is fixed at October 26, the company said.