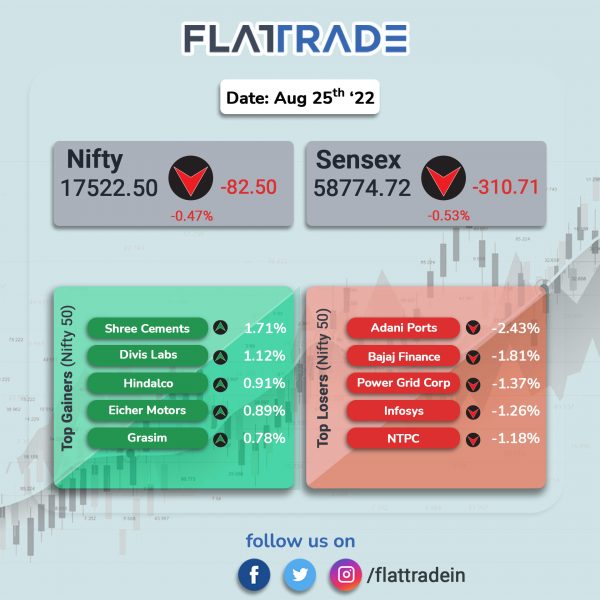

Dalal Street pared gains and slipped into negative territory in the fag-end of the session on the expiry day of August series derivatives contracts. The Sensex fell 0.53% and the Nifty 50 index lost 0.47%.

Broader markets were mixed compared to headline indices. The Nifty Midcap 100 inched down 0.06% and the BSE SmallCap advanced 0.17%.

Top Nifty sectoral losers were IT [-0.87%], Metal [-0.51%], Pharma [-0.4%], FMCG [-0.39%] and Financial Services [-0.39%]. Top gainers were PSU Bank [2.74%] and Realty [1.47%].

The Indian rupee fell 7 paise to 79.88 against the US dollar on Thursday.

Stock in News Today

Bharti Airtel: The company’s promoter, Bharti Telecom, will buy a 3.33% stake from Singtel for about Rs 12,895 crore within 90 days, the telecom operator said. According to exchange filing, Bharti and Singtel will work towards equalising their stake in Airtel over a period of time.

PB Fintech: The company has approved a capital infusion of Rs 250 crore in Paisabazaar Marketing and Consulting and Rs 650 crore in Policybazaar Insurance Brokers, respectively during FY23. The company also incorporated a step-down subsidiary in Abu Dhabi to extend its technology hub in UAE. It will acquire 45% to 51% stake in UAE-based YKNP Marketing Management through its Dubai arm for $4 million.

Union Bank of India (UBI): The public sector bank has plans to put its Rs 2,077 crore outstanding loan to KSK Mahanadi Power on sale, according to The Economic Times news report. UBI, the second biggest lender to KSK Mahanadi Power, has set a reserve price of Rs 919 crore in cash for its exposure. At this price, the lender expects to recover 44% of the outstanding amount with a 56% haircut. The last date for expression of interest from buyers is August 31, which will be followed by an electronic auction on September 1, the report said.

Indian Oil Corp (IOCL): The oil refiner plans to invest more than $25 billion to achieve net-zero emissions from its operations by 2046, its chairman S. M. Vaidya said at an annual shareholders meeting, according to Reuters news report.

Tata Consultancy Services (TCS): The company said that it is launching an advanced research and innovation hub in Hyderabad, for incubating digital solutions for Consumer Packaged and Goods (CPG) companies, using SAP solutions. The TCS CPG Innovation Hub will address industry-specific use cases around Industry 4.0 and the digital supply chain.

Adani Enterprises: The company has incorporated two wholly-owned subsidiaries — Hirakund Natural Resources and Vindhya Mines and Minerals on August 23 with an initial authorized share capital of Rs. 10 lakh and paid-up share capital of Rs. 5 lakh, each, to carry on business in Mining of Coals and Other Minerals.

Max Healthcare Institute : In an exchange filing, the company said that Gaurav Trehan, nominee of Kayak Investments Holding, has resigned from the position of Non-Executive Non-Independent Director of the company with effect from August 24, 2022 on account of the shareholding of Kayak falling to approximately 0.7% of the equity share capital of the company.

Power Grid Corp: The state-owned company has acquired a special purpose vehicle Neemuch Transmission, which has been set up to establish an inter-state transmission link to evacuate power from Neemuch special economic zone. According to its exchange filing, the company acquired Neemuch Transmission from the bid process coordinator, REC Power Development and Consultancy.

Lupin: The drug maker said that it has signed a licensing pact with Japan-based I’rom Group for a product used in the treatment of postmenopausal women with osteoporosis, among others. Under the pact, I’rom and Lupin will conduct clinical trials, register, distribute and market biosimilar Denosumab in Japan on an exclusive basis.

Uno Minda: The company plans to invest about Rs 300 crore to expand its manufacturing capacity of 4W Alloy Wheels and 4W Automotive switches to meet rising demand.

One of the subsidiary of the company, Minda Kosei Aluminum Wheel, will expand its 4W Alloy wheel capacity by 60,000 wheels/month to 240,000 wheel/month at its plant in Bawal, Haryana, at an additional capital expenditure of Rs 190 crore.

Another subsidiary, Mindarika, will set up a new manufacturing plant at Farrukhnagar, Gurugram, Haryana, to cater to increased demand of 4W Automotive switches from Indian and International customers. The project cost for setting up Phase 1 of the plant at Farrrukhnagar will be about Rs. 110 crore and expected to be completed by September 2023.