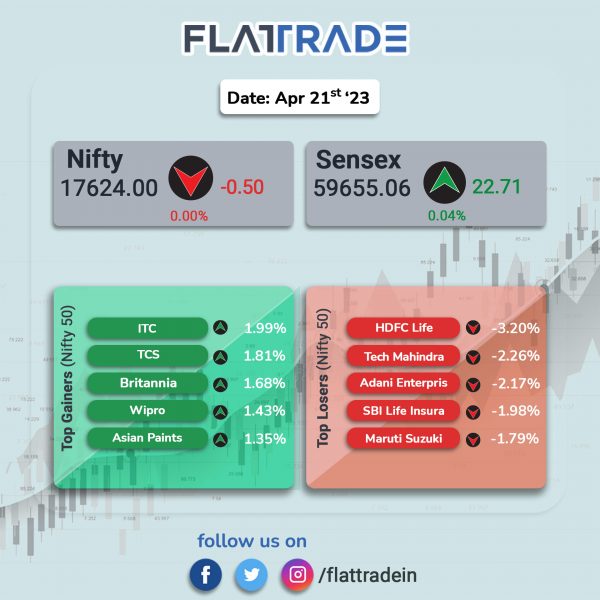

Benchmark indices ended flat as gains in FMCG, IT and pharma stock were offset by losses in realty, metal and auto stocks. The Sensex inched up 0.04% and the Nifty ended flat.

In broader markets, the Nifty Midcap 100 index fell 0.42% and the BSE Smallcap was down 0.27%.

Top losers were Realty [-2.13%], MEtal [-1.37%], Auto [-1.03%], PSU Bank [-0.84%], and Private Bank [-0.38%]. Top gainers were Media [1.33%], FMCG [0.89%], IT [0.69%], and Pharma [0.48%].

Indian rupee rose 6 paise to 82.09 against the US dollar on Friday.

Stock in News Today

Bank of Baroda (BoB): The state-owned lender said that its board has approved raising funds through bonds and certificate of deposits in single or multiple tranches. The bank will raise foreign currency funds through issuance of bonds up to $1 billion under bank’s medium term note (MTN) programme and through issuance of certificate of deposits (CDs) up to $3 billion under CD programme in single or multiple tranches at appropriate time. The board has also considered and approved to raise funds through bilateral / other borrowings up to $3 billion.

Hindustan Zinc: The company’s consolidated net profit slipped 11.8% to Rs 2,583 crore in Q4FY23 from Rs 2,928 crore recorded in Q4FY22. Revenue from operations during the quarter was Rs 8,509 crore, down 3.3% year on year (YoY) on account of lower zinc, lead & silver prices partly offset by higher metal & silver volumes and favourable exchange rates. EBITDA for the quarter was Rs 4,208 crore, down 16% YoY and up 13.2% QoQ.

Aditya Birla Money: The company’s net profit declined 3.41% to Rs 7.36 crore in Q4FY23 as against Rs 7.62 crore in Q4FY22. Total income jumped 14.37% to Rs 70.19 crore in Q4FY23 as compared with Rs 61.37 crore in Q4FY22. Revenue from broking business was at Rs 53.53 crore (up 2.43% YoY) while revenue from wholesale debt market stood at Rs 11.52 crore, up 70.92% YoY. On full year basis, the company’s net profit surged 29.74% to Rs 33.90 crore in FY23 as against Rs 26.13 crore in FY22. Total income jumped 19.18% year-on-year to Rs 278.78 crore in FY23.

Sterling and Wilson Renewable Energy: Shares of the company tumbled nearly 9% after the company reported consolidated net loss of Rs 417.45 crore in Q4FY23 as against Rs 126.30 crore in Q4FY22. Revenue from operations tumbled 91.74% to Rs 88.43 crore in Q4 FY23 as compared with Rs 1,071.03 crore in Q4 FY22. Revenue was impacted due to cost increase on account of certain cost provisions made, which impacted the percentage-of-completion and led to a revenue reversal in ongoing EPC projects.

Wendt (India): The company reported a 23% increase in net sales at Rs 53.85 crore and a 56% increase in net profit at Rs 12.45 crore for Q4FY23 over Q4FY22. The company’s domestic sales for the year ended March 2023 rose 16% YoY to Rs 137.83 crore. Exports during the same period rose 34% YoY to Rs 53.12 crore, attributed to higher sales to countries like USA, Russia, UK, Germany, Italy, and Korea. The board has proposed a final dividend of Rs 50 per share, subject to shareholder’s approval.

JSW Energy: The power generation company announced that its step-down subsidiary, JSW Renew Energy Two, has commissioned 51 megawatt (MW) of wind power capacity at Tuticorin, Tamil Nadu. The wind power capacity was commissioned under phase-wise commissioning of 450 MW inter state transmission system (ISTS)-connected wind power project awarded under Solar Energy Corporation of India (SECI) tranche X at Tuticorin, Tamil Nadu. With this, the cumulative wind capacity commissioned by the company under SECI X stands at 78 MW.

In addition, the company has forayed into energy storage space and has currently locked in 3.4 Gigawatt hours (GWh) of energy storage capacity by means of battery energy storage system and hydro pumped storage plant. The firm has set a target for 50% reduction in carbon footprint by 2030 and achieving carbon neutrality by 2050 by transitioning towards renewable energy, it added.

Laxmi Organic: The specialty chemical manufacturer announced that its board has approved borrowing funds up to Rs 2,000 crore. Laxmi Organic Industries intends to raise additional funds through equity and/or debt as deemed fit and necessary by the board of directors. Moreover, the board has authorized the creation of a charge or mortgage on both movable and immovable assets of the company, present and future, for borrowing up to Rs 2,000 crore.

Angel One: The company said it is investigating a potential data breach after receiving emails on 20 April 2023 claiming unauthorised access to clients’ data. The company said it is verifying the claims, which suggest that certain client profile and holding data may have been accessed without authorisation. Angel One has confirmed that the breach does not impact clients’ securities, funds, or credentials, and all accounts are secure.

Shriram Finance: The company announced that its board will meet on Thursday [27 April 2023] to consider the approval of resource mobilisation plan for the financial year 2023-24. Under the plan, the company might issue redeemable non-convertible debentures/subordinated debentures (NCDs) on private placement basis in tranches, bonds/notes in off-shore markets, external commercial borrowings (ECBs) and other methods of borrowing for the purpose of business.

Dr Reddy’s Lab: The drug major announced the launch of Treprostinil Injection in the US market, after it received an approval from the USFDA. Treprostinil injection is used to treat the symptoms of pulmonary arterial hypertension. Treprostinil works by relaxing blood vessels and increasing the supply of blood to the lungs, which reduces the workload of the heart.

Power Mech Projects: The engineering company has received orders worth Rs 720 crore for various works. Among the various orders, the company received the largest order worth Rs 362 crore for construction of Government Medical College & Hospital for Uttara Khand Pey Jal Nigam, Uttarakhand. The second biggest order worth Rs 162 crore was for distribution works under RDSS (Revamped Distribution Sector Scheme) for Madhya Pradesh Poorv Kshetra Vidyut Vitaran Company (MPPKWCL), Khargone Circle, Indore, Madhya Pradesh and railway electrification of 25 KV OHE works, Mysuru Division, Karnataka.

Solar Industries India: The explosives manufacturing company announced that its wholly owned subsidiary, Economic Explosives, has signed a contract with Ministry of Defense, Government of India for supply of loitering munition, aggregating to Rs 212 crore and it is expected to be delivered within a period of one year.

Oberoi Realty: The company said its sales booking value jumped over six times to Rs 6,023 crore in Q4FY23 as against Rs 925 crore in the year-ago period. On an yearly basis, the real estate developer’s booking value soared 120.4% to Rs 8,572 crore in FY23 over FY22. In terms of volume, it sold nearly 14.12 lakh square feet area in Q4 compared with over 5.24 lakh sq. ft. area in the corresponding period of the previous year.

PNC Infratech: The company received letter of acceptance (LoA) from the Ministry of Road Transport & Highways (MORT&H) for construction of highway in Uttar Pradesh. The order includes construction of four lane highway from Singraur Uphar to Baranpur Kadipur Ichaul with paved shoulders in Uttar Pradesh on hybrid annuity mode (Package-III). The project cost is Rs 819 crore and the construction period of the project is 24 months and operation period is 15 years, post construction.

Rajratan Global Wire: The company reported 45.26% YoY decline in consolidated net profit to Rs 20.27 crore in Q4FY23 as against Rs 37.03 crore in Q4FY22. Revenue from operations fell 11.37% year-on-year to Rs 219.43 crore in the quarter ended 31 March 2023. Meanwhile, the company’s board has recommended a final dividend of Rs 2 per equity share for financial year 2022-23, subject to approval of members.