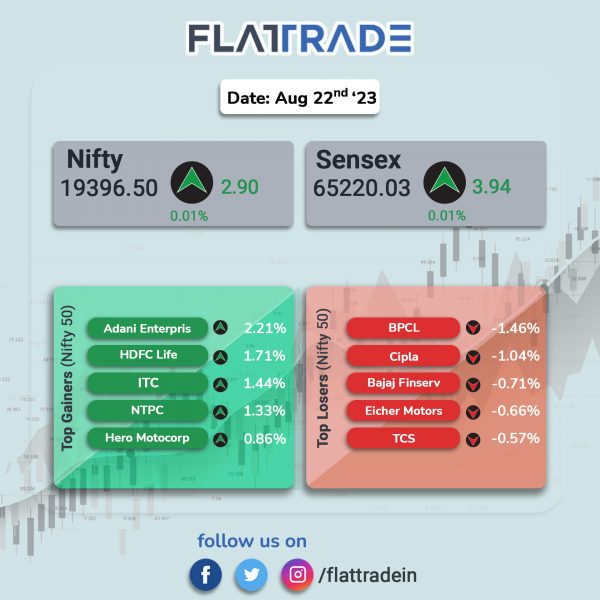

Headline indices closed flat as investors turned their focus to midcap and smallcap stocks amid positive global sentiments. The Sensex and the Nifty closed 0.01% higher. Meanwhile, the Nifty Midcap 100 jumped 1.1% and the Nifty Smallcap 100 rose 0.81%.

Top gainers were Metal [0.85%], FMCG [0.66%], Media [0.59%], Auto [0.52%], and Realty [0.21%]. Top losers were PSU Bank [-0.49%], Pharma [-0.2%], IT [-0.11%], and Financial Services [-0.1%].

The Indian rupee strengthened by 18 paise to 82.93 against the US dollar on Tuesday.

Stock in News Today

Jio Financial Services: The company shares will now be excluded from the Nifty 50 and Sensex on August 28, instead of August 23 as indicated earlier. The exclusion comes amid the newly-listed stock hitting a lower circuit for two consecutive sessions after a muted listing on Monday (August 21). Shares fell 5% to Rs 236.45 on the NSE.

One 97 Communications (Paytm): Shares of the company rose over 2% after the company said that it is investing in AI to build Artificial General Intelligence software stack. In its letter to shareholders, the company said it estimates 500 million payment consumers and 100 million merchants, and also expanding into areas like health and retail. Further, the company is focused on building advanced AI capabilities to manage risks and frauds, while complying with regulatory guidelines. Paytm’s partnership with PayPay Japan and the possibilities of the Open Network of Digital Commerce (ONDC) initiative add to its growth prospects, the company said.

Mahanagar Telephone Nigam (MTNL): Shares of the company jumped 9% in intraday trade after media reports hinted that the company’s plans to issue government-guaranteed bonds, aiming to raise funds of around 1,200 crore. Bidding for the bond sale is expected to occur on 23 August 2023, as per the reports.

Patel Engineering, Dilip Buildcon: The company along with its joint venture partner Dilip Buildcon has been declared as lowest bidder (L1) for urban infrastructure development project worth Rs 1,275.30 crore from Madhya Pradesh Jal Nigam. The contract includes engineering, procurement, construction, testing, commissioning, trial run and operation & maintenance for 10 years of Narmada-Gambhir, District Ujjain & Indore multi-village drinking water supply scheme in a single package on ‘Turn-key Job Basis’. The project is to be completed within 24 months and further operations and maintenance for the whole scheme to be carried out for a period of 10 years.

Marksans Pharma: The company has received the final approval from US Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Guaifenesin extended-release tablets. Guaifenesin tablets help to loosen phlegm (mucus) and thin bronchial secretions to rid the bronchial passageways of bothersome mucus and make coughs more productive.

Newgen Software Technologies: The IT company announced that it has received a purchase order for the License Product, implementation and support services from an international client. The aggregate value of the aforesaid purchase order is $9,90,000 plus applicable taxes. The time period within which the aforementioned contract has to be executed is three years.

Greaves Cotton: The company said that its retail arm Greaves Retail has partnered with Usha Financial Services to finance customers within the electric three-wheeler segment. With this partnership, Greaves Retail aims to extend its reach and make financing more accessible and seamless across India. Through this collaboration, Usha Financal’s distinctive dealer delivery model will be harnessed to bring the benefits of convenient and localised financing solutions to customers across the country.

Oriana Power: Shares of the company hit the upper circuit of 5% after the company said that it has bagged a 20 MW AC solar photovoltaic (PV) project by Bharat Coking Coal Limited (BCCL), a subsidiary of Coal India, worth Rs 138 crore. The company will build a 20MW AC ground-mounted solar PV power plant in Dugdha Washery Area, Dhanbad in Jharkhand. The EPC phase is expected to be completed within 12 months and it has 5-year operation and maintenance commitment.

Ucal: The company shares hit an upper circuit of 5% after the company said it plans to venture into automotive electronics space by strategically positioning itself through its cutting-edge electronic products and solutions.

Power Mech Projects: The civil construction company announced that its board will meet on Friday (August 25) to consider a proposal for raising of funds through issue of securities including convertible preference shares, and/or bonds including foreign currency convertible bonds / debentures / non-convertible debt instruments along with warrants / convertible debentures / securities and / or any other equity based instrument(s) or any combination thereof in one or more tranches on private placement basis.