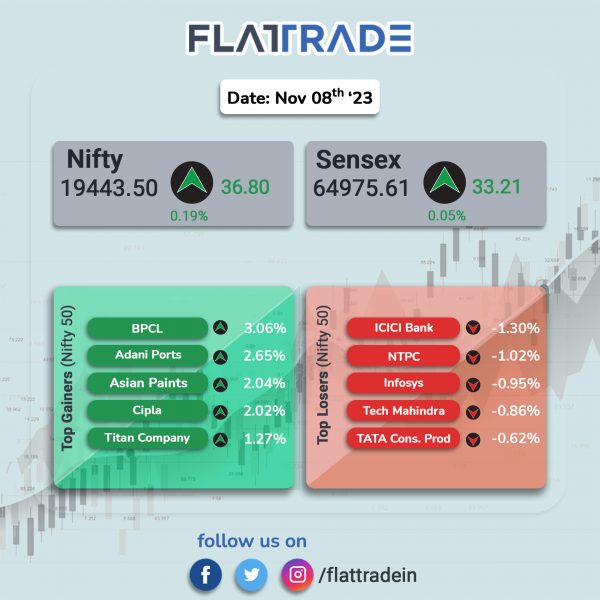

Benchmark indices closed higher as gains in pharma, Oil & Gas and FMCG stocks offset losses in IT and banking stocks. The Sensex rose 0.05% and the Nifty ended 0.19% higher.

Broader markets outperformed headline indices. The Nifty Midcap 100 index jumped 1% and the BSE Smallcap advanced 0.6%.

Top gainers were Realty [1.52%], Pharma [1.48%], Oil & Gas [0.78%], Metal [0.75%], and FMCG [0.62%]. Top losers were Financial Services [-0.25%], IT [-0.21%], Bank [-0.18%], Private Bank [-0.14%], and Media [-0.07%].

The Indian rupee closed flat at 83.28 against the US dollar on Wednesday.

Stock in News Today

Infosys: The IT consulting company announced a new strategic collaboration agreement (SCA) with Amazon Web Services. The three-year collaboration will deliver technology transformation and industry specific solutions to financial organizations supported by joint investments into go-to-market and delivery capabilities across the EMEA region. Infosys and AWS will support financial organizations, like retail banking at NatWest Group, in accelerating their cloud adoption journeys leveraging industry proven capabilities to deliver specialized end-to-end cloud migration and modernization services, the company said in a press release.

Voltas: The AC manufacturer said that its board has considered and approved the proposal of raising of Non-Convertible Debentures (NCDs) on a private placement basis for an amount up to Rs 500 crore. The Rupee Term Loan would be utilised for capital expenditure of the company for its new manufacturing plant at Chennai in Tamil Nadu and Waghodia in Gujarat.

Prestige Estates Project: The realty company posted a consolidated net profit of Rs 910.3 crore in Q2FY24 as against Rs 148.6 crore in Q2FY23. Its consolidated revenue from operations soared 56.6% to Rs 2,236.4 crore in Q2FY24 from Rs 1,427.7 crore in Q2FY23. Ebitda grew 60.7% to Rs 592.5 crore in Q2FY24 from Rs 368.6 crore in Q2FY23.

Godrej Industries: The company’s net tumbled 44.1% to Rs 87.3 crore in Q2FY24 from Rs 156.2 crore in Q2FY23. Revenue from operations was down 2.1% at Rs 3,937.6 crore in the quarter under review as against Rs 4,021 crore in Q2FY23. Ebitda grew 20.5% YoY to Rs 265.5 crore in Q2FY24 from Rs 220.3 crore in Q2FY23. Further, the board has also approved increasing the limit of issuing commercial papers by the company to Rs 3,500 crore from existing limit of Rs 2,500 crore.

Raymond: The textile company said its net profit was marginally up 0.6% at Rs 160 crore in Q2FY24 as against Rs 159 crore in Q2FY23. Revenue from operations grew 4% to Rs 2,253 crore in Q2FY24 from Rs 2,168 crore in Q2FY23. Ebitda fell 6% to Rs 314 crore in the quarter under review from Rs 335 crore in Q2FY23.

Mahindra & Mahindra (M&M): The company’s wholly owned subsidiary, Mahindra Aerospace Australia Pty Limited (MAAPL), has executed a Share Purchase Agreement with George Morgan for Sale of its entire stake in Gipps Aero Pty Ltd, GA8 Airvan Pty Ltd, GA200 Pty Ltd, Nomad TC Pty Ltd, Airvan 10 Pty Ltd and Airvan Flight Services Pty Ltd, wholly owned subsidiaries of MAAPL. As part of its capital allocation process, MAAPL has decided to exit the aircraft manufacturing business, the company said in an exchange filing.

Arvind Fashions: The company’s consolidated net profit jumped 18.88% to Rs 21.66 in Q2FY24 compared with Rs 18.22 crore in Q2FY23. Revenue from operations increased 7.20% to Rs 1,266.94 crore in Q2FY24 as compared with Rs 1181.81 crore posted in Q2FY23. Its Ebitda rose Rs 152 crore in Q2FY24 during the quarter from Rs 136 crore posted in Q2FY23, while margin improved by 50 Bps to 12% in Q2FY24.

EID Parry: The sugar manufacturer said its net profit surged 87% YoY to Rs 452.3 crore in Q2FY24 compared with Rs 241.4 crore in Q2FY23. Revenue from operations fell 20% to Rs 9,059.5 crore in the quarter under review from Rs 11,325.8 crore in Q2FY23. Ebitda was up 11.6% at Rs 1,057.4 crore in the reported quarter as against Rs 947.6 crore in the same quarter in the previous year.

CESC: The company’s net profit increased 14% to Rs 348 crore in Q2FY24 from Rs 305 crore in Q2FY23. Revenue rose 11% to Rs 4,352 crore in Q2FY24 from Rs 3,913 crore in Q2FY23. Its Ebitda jumped 32% to Rs 646 crore in Q2FY24 from Rs 490 crore in Q2FY23.

Century Plyboards: The company’s net profit rose 3.1% to Rs 97 crore in Q2FY24 from Rs 94.1 crore in Q2FY23. Revenue increased 9.7% to Rs 996.8 crore in Q2FY24 from Rs 908.6 crore in Q2FY23. Ebitda rose 17.4% to Rs 144.4 crore in Q2FY24 from Rs 123 crore in Q2FY23.

Gujarat State Fertilizers and Chemicals: The company’s consolidated revenue grew 25.4% to Rs 3,118.7 crore in Q2FY24 from Rs 2,487.7 crore in Q2FY23. Consolidated Ebitda slumped 39.3% to Rs 237.3 crore in Q2FY24 from Rs 390.9 crore in Q2FY23. Its consolidated net profit rose 8.3% to Rs 308.9 crore in Q2FY24 from Rs 285.3 crore in Q2FY23.

Skipper: The company’s consolidate revenue surged 67% to Rs 772.4 crore in Q2FY24 from Rs 462 crore in Q2FY23. Its consolidated Ebitda jumped 85% to Rs 73.7 crore in Q2FY24 from Rs 39.8 crore in Q2FY23. Its net profit soared more than 6.5 times to Rs 19.78 crore in the quarter under review from Rs 3 crore in the year-ago period.

Schneider Electric Infrastructure: The company said its consolidated revenue from operations grew 17.82% to Rs 495.81 crore in Q2FY24 from Rs 420.81 crore in Q2FY23. Consolidated Ebitda was at Rs 62.63 crore in the reported quarter as against Rs 18.86 crore in Q2FY23. The company’s net profit surged to Rs 42.86 crore in Q2FY24 from Rs 8.84 crore in Q2FY23.

Grindwell Norton: The company posted a net profit of Rs 102 crore in Q2FY24, up 13% Rs 90 crore in Q2FY23. Revenue from operations was up 5.2% at ͅRs 667.4 crore in Q2FY24 as against Rs 634.6 crore in Q2FY23. Ebitda rose 7.3% to Rs 131.4 crore in Q2FY24 from Rs 122.5 crore in Q2FY23.

Man Industries: The company recorded a net profit of Rs 39 crore in Q2FY24 as against a net loss of Rs 5.1 crore in Q2FY23. Revenue from operations increased to Rs 1,018 crore in Q2FY24 from Rs 465 crore in Q2FY23. Ebitda surged to Rs 69.6 crore in the reported quarter from Rs 15.2 crore in the year-ago period.

Avadh Sugar: The company’s revenue jumped 35.4% to Rs 797.5 crore in Q2FY24 as against Rs 589.2 crore in Q2FY23. The company’s net profit was at Rs 28.8 crore in Q2FY24 as against a net loss of Rs 16.3 crore in Q2FY23. Ebitda jumped to Rs 77 crore in the quarter under review from Rs 0.5 crore in Q2FY23.

Firstsource: The company reported a net profit of Rs 126.5 crore in Q2FY24, up 0.4% at Rs 126.5 crore as against Rs 126 crore in the preceding quarter. The company’s revenue rose 1% to Rs 1,540 crore in Q2FY24 from Rs 1,528 core in Q1FY24. EBIT fell 8% to Rs 163 crore in Q2FY24 as against Rs 177 crore in Q1FY24.

Gland Pharma: The company said it has received Establishment Inspection Report (EIR) from the USFDA indicating closure of the inspection of the company’s VSEZ Sterile Oncology facility at Visakhapatnam, Andhra Pradesh.

Genus Power Infrastructures: The company’s wholly owned subsidiary has received a letter of award (LOA) worth Rs 2,259.94 crore (net of taxes) for the appointment of advanced metering infrastructure service providers (AMISPs), including design of advance metering infrastructure (AMI) system with supply, installation and commissioning with FMS of 27.33 lakh smart prepaid meters, system meters, including DT Meters with corresponding energy accounting on DBFOOT basis.