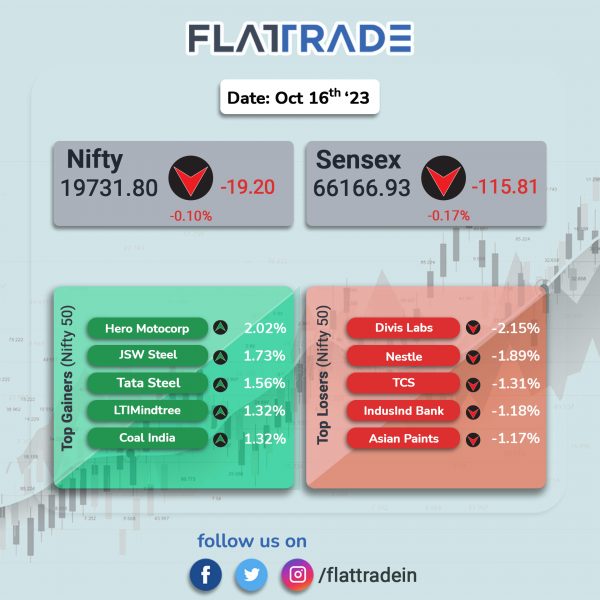

Sensex, Nifty closed lower as investors’ sentiments were dampened due to weak global cues amid the ongoing war between Israel and Hamas. The Sensex fell 0.17% and the Nifty slipped 0.1%.

In broader markets, the Nifty Midcap 100 index rose 0.21% and the BSE Smallcap gained 0.34%.

Top gainers were Metal [0.91%], PSU Bank [0.72%], Auto [0.45%], Oil & Gas [0.27%], Energy [0.21%]. Top losers were Pharma [-0.46%], Realty [-0.34%], Media [-0.23%], FMCG [-0.23%], and IT [-0.18%].

The Indian rupee stood at 83.28 against the US dollar on Monday.

Stock in News Today

Adani Green Energy: The company said its operational capacity increased by 24% YoY to 8,316 MW with addition of 1,150 MW solar–wind Hybrid, 212 MW solar and 230 MW wind power plants. Sale of Energy increased by 78% to 11,760 million units driven by robust capacity addition and improved CUF performance. The company said that 8404 MW was operational, while 10131 MW was under execution and 1899 MW was near construction, wherein, Letter of Award has been received and PPA has to be signed.

Infosys: The IT major announced the inauguration of its latest development center (DC) in Visakhapatnam, Andhra Pradesh. It is spread across 83,750 sq. ft., and will accommodate approximately 1,000 employees. The new center will enable Infosys to also attract, re-skill, and up-skill local talent to work on global opportunities through next-gen technologies like Cloud, AI, and Digital.

Federal Bank: The private sector lender reported a 35.54% YoY rise in net profit at Rs 953.82 crore for the July–September 2023 quarter of current fiscal year. Net Interest Income grew 16.72% from Rs. 1761.83 crore in Q2FY23 to Rs 2,056.42 crore in Q2FY24. Total deposits rose 23.12% YoY to Rs 2.23 lakh crore in the reported quarter compared to Rs 1.89 lakh crore in the year-ago period. Its net advances rose 19.58% YoY to Rs 1.93 lakh crore in the reported quarter.

Cochin Shipyard: The Ministry of Defence signed a contract for Mid Life Upgrade and Re-Powering of “INS Beas” with the Kochi-based company at an overall cost of Rs 313.42 crore, according to the ministry’s press release. The press release said that the project would involve more than 50 MSMEs and would lead to generation of employment for more than 3500 personnel.

Oriental Hotels: The company’s net profit declined 45.71% to Rs 4.37 crore in the quarter ended September 2023 as against Rs 8.05 crore during the the period quarter ended September 2022. Sales rose 2.51% to Rs 91.03 crore in the reported quarter as against Rs 88.80 crore during the corresponding quarter of FY23.

Jai Balaji Industries: The company consolidated revenue rose 12.94% YoY at Rs 1546.63 crore in Q2FY24 as against Rs 1369.38 crore in Q2FY23. Ebitda rose to Rs 213.48 crore in the reported quarter from Rs 62.82 crore in the year-ago period. Consolidated net profit at Rs 201.55 crore in Q2FY24 as against Rs 21.18 crore in Q2Fy23.

Bank Of Maharashtra: The company’s standalone net profit stood Rs 919.78 crore in the second quarter of FY24, a growth of 72% from Rs 535.06 crore in the corresponding quarter of last fiscal. Net Interest Income during Q2FY24 rose 28.9% YoY to Rs 2,432 crore from Rs 1,887 crore in the year-ago period. Gross non-performing assets (NPA) at the end of September 2023 quarter declined by 9 basis points to 2.19% from 2.28%, while Net NPA eased to 0.23% from 0.24%, QoQ.

Yatra Online: The online travel agency posted second quarter profit at Rs 5.99 crore, up 2.7% from Rs 5.83 crore during the same period last year. It posted revenue from operations at Rs 110.18 crore, up 23.9% from Rs 88.96 crore during the second quarter of FY23. The company EBITDA stood at Rs 15.9 crore, up 34.4% YoY. The company said that it has signed 19 new corporate customer accounts in corporate business with an annual billing potential of Rs 151 crore.

Aurobindo Pharma: The company has inaugurated a green-field manufacturing unit of Eugia Steriles worth about Rs 600 crore in Vishakhapatnam. The unit will manufacture general injectables and supply globally in phases. Eugia Steriles is a step-down subsidiary of Aurobindo Pharma.

J Kumar Infraprojects: The company has secured a Letter of Acceptance for Rs 99.3 crore project from Mumbai Metropolitan Regional Development Authority. The project entails design, supply, fabrication, erection of pre-engineering building structural steel works and the project is expected to be executed within 56 Weeks.

BLS International Services: The outsourcing services company has signed an exclusive global visa outsourcing contract for Slovakia in 18 countries with more than 54 offices. With this new contract, BLS International will be entrusted with the responsibility of not only offering Tourist visa services and Business visa services but also national visa services, all with the aim of facilitating seamless travel and immigration procedures.

Venus Remedies: The company received marketing approval for six chemotherapy drugs from Philippines. The marketing authorisation is for bortezomih cisplatin, doxorubicin, docetaxel, flurouracil and paclitaxe. The company’s oncology division has won marketing authorisation from Myanmar for another chemotherapy drug.

Kalpataru Projects International: The company said it has secured new orders worth Rs 2,217 crore. Orders in the Transmission and Distribution business is worth Rs 1,993 crore in India and overseas markets, while orders in Buildings & Factories business in India is worth Rs 224 crore.

Sterlite Technologies: The company announced the expansion of its Enterprise Networking solutions with the introduction of Estelan, an end-to-end solution for fiber and copper cable connectivity. Estelan, an end-to-end solution in fibre and copper cable connectivity, enables enterprises to modernise and digitise their large-scale network infrastructure

Karur Vysya Bank: In Q2FY24, the lender’s net profit surged to Rs 378 crore, an increase from the Rs 250 crore recorded in the corresponding period last year. Gross non-performing assets (NPA) for the quarter stood at 1.73%, down from 1.99% in the previous quarter. The bank’s net interest income saw an 11.45% rise to Rs 915 crore, from Rs 821 crore in the corresponding quarter last year. Its net interest margin slightly dipped to 4.07% from 4.1% YoY.