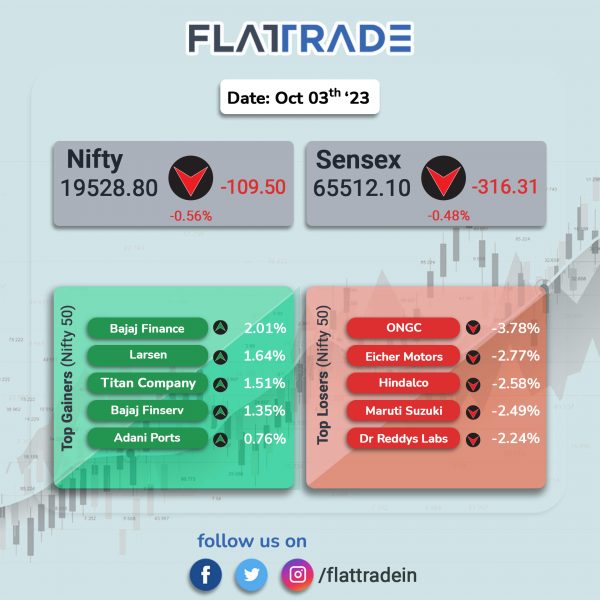

Benchmark equity indices closed lower as investors’ risk appetite declined amid weak global sentiments due to rising US Treasury yields and stronger US dollar. The Sensex fell 0.48% and the Nifty dropped 0.56%

Broader markets outperformed headline indices. The Nifty Midcap 100 index rose 0.18% and the BSE Smallcap jumped 0.6%.

Top gainers were PSU Bank [2.38%], Media [1%], Realty [0.46%]. Top losers were Auto [-1.2%], Oil & Gas [-1.17%], Pharma [-0.92%], Metal [-0.6%], and FMCG [-0.55%].

The Indian Rupee fell 16 paise to 83.21 against the US dollar on Tuesday.

The S&P Global India Manufacturing PMI came in at 57.5 in September compared with 58.6 in August.

Stock in News Today

Larsen & Toubro (L&T): The Transportation Infrastructure business vertical of L&T Construction has received Dahisar Bhayander Bridge project in Mumbai. According to the company’s project classification, the value of the project ranges between Rs 2500 crore to Rs 5000 crore. The project has been awarded by Municipal Corporation of Greater Mumbai (MCGM) for construction of 4.5 Km long bridge connecting Dahisar and Bhayander.

IndusInd Bank: The private lender’s net advances improved to Rs 3,14,928 crore in Q2FY24, registering a growth of 21% as compared to Rs 2,60,129 crore in the year-ago period. The bank reported a 14% growth in deposits at Rs 3,59,819 crore in Q2FY24 as against Rs 3,15,921 crore in the year-ago period. CASA ratio reduced to 39.4% in the quarter ended September 2023 compared with 42.4% in the same period last fiscal .

Indian Oil Corporation (IOCL): The state-owned oil refiner has firmed up plans to pump in over Rs 2,600 crore in setting up several greenfield units and expanding its facilities across the northeast over the next few years, PTI news reported citing a senior company official. The board of IOC has already approved various new projects, while some are in the process of getting the nod, with the leading energy firm in talks with the local governments in Meghalaya, Mizoram and Manipur to finalise land parcels for the greenfield units, the report added.

TVS Motor Company: The two-wheeler manufacturer said that its total sales jumped 6% to 402,553 units in September 2023, compared with 379,011 units sold in September 2022. Total two-wheeler units grew 7% from 361,729 units in September 2022 to 386,955 units in September 2023. Domestic two-wheeler sales stood at 300,493 units in September 2023, registered growth of 6% as compared with 283,878 units sold in September 2022. The company’s total exports registered a growth of 8% with sales increasing from 92,975 units in September 2022 to 100,294 units in September 2023.

UltraTech Cement: The company announced that the company’s wholly-owned subsidiary in UAE viz. Star Cement Co LLC (Star Cement) has entered into a cooperation agreement with Cemex UAE to recycle concrete waste in the construction industry as well as reduce carbon emissions and improve the overall environmental impact of construction projects.

NMDC: The company announced the revision of prices of iron ore with effect from October 1, 2023. The new price of lump ore is fixed at Rs. 5,200 per ton and revised price of fines is fixed at Rs. 4,460 per ton.

Marksans Pharma: The drugmaker announced that it has received final approval from the US Food & Drugs Administration (US FDA) for its abbreviated new drug application (ANDA) for Esomeprazole Magnesium delayed-release capsules. The capsules are used to treat certain stomach and esophagus problems such as acid reflux and ulcer by decreasing the amount of acid your stomach makes.

Granules India: The company said that it has received an approval from the US drug regulator for its abbreviated new drug application (ANDA) for Losartan Potassium and Hydrochlorothiazide Tablets, which are indicated for the treatment of Hypertension to lower blood pressure and reduce the risk of stroke in patients with hypertension and left ventricular hypertrophy. According to IQVIA July MAT, Losartan and Hydrochlorothiazide tablets is approximately $73 million in the US.

JSW Infrastructure: Shares of the company opened at Rs 143 per share against its issue price of Rs 119 apiece. The shares hit a high of Rs 157.30 and closed at Rs 157.30 per share.

Manoj Vaibhav Gems N Jewellers: Shares of the company opened at Rs 215 per share against its issue price of Rs 215 apiece. The shares hit a high of Rs 222 and closed at Rs 215.05 per share.

Man Industries (India): The company said that it has received new orders of about Rs 400 crore. The contract has been received from a domestic customer for supply of various types of pipes and it must be executed within a period of six months. With this order, the total unexecuted order book stood at Rs 1,600 crore.

NCC: The company announced that it has received three orders worth Rs 4,205.94 crore in September 2023. Out of the said orders, one order of Rs 819.20 crore is related to Water Division, another order of Rs 173.19 crore is related to Electrical Division and third order of Rs 3,213.55 crore is related to Transportation Division.

Escorts Kubota: The company’s agri machinery business division in September 2023 sold 10,861 tractors as against 12,232 tractors sold in September 2022. Domestic tractor sales in September 2023 declined 11.2% to 10,114 tractors in September 2023 from 11,384 tractors sold in September 2022.

KPI Green: The company has received a new order for executing wind-solar hybrid power project of 6.90 MW capacity comprising 4.90 MW of wind power and 2 MW solar power from General Polytex, Surat, under ‘Captive Power Producer (CPP)’ segment of the company.

Steel Strips Wheels: The company has achieved its highest ever net monthly turnover of Rs 401.88 crore in September 2023 compared to Rs 359.78 crore in September 2022, a growth of 11.7%. Gross turnover rose 9.33% YoY to Rs 486.99 crore.

Entertainment Network India (ENIL): The company announced the Ministry of Information Affairs (MIA), Kingdom of Bahrain, has granted the company the license to operate the Entertainment Radio Channel Frequency for a period of five years. ENIL will be catering to Bollywood and South Asian content within the Kingdom of Bahrain through Entertainment Radio Channel Frequency.

Piccadily Agro Industries: The company shares hit 20% after its Made In India whisky ‘The Indri’ produced by the company won the best whisky brand in the world by Whiskies of the World Awards.

Niyogin Fintech: The fintech platform announced that its gross loan book has increased by 115% to Rs 135.3 crore in Q2FY24 from Rs 63 crore in Q2FY23. The company said that the number of transactions aggregated to 4.2 crore, up 446% YoY, and gross transaction value added up to Rs 11,562.7 crore, up 293% YoY.