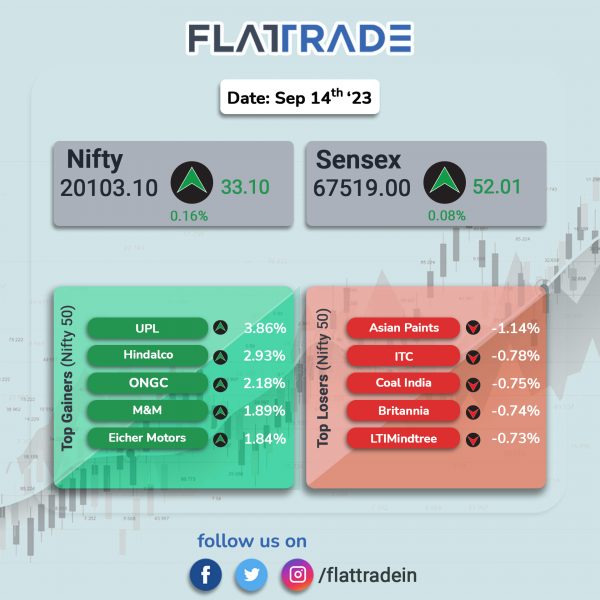

Benchmark equity indices closed with marginal gains after climbing new heights in early trade amidst a volatile session on the backdrop of weekly expiry day. The Sensex rose 0.07% and the Nifty 50 index gained 0.16%.

In broader markets, the Nifty Midcap 100 index surged 1.17% and the BSE Smallcap index jumped 1.15%.

Top gainers were PSU Bank [1.64%], Metal [1.49%], Realty [1.39%], Oil & Gas [1.1%], auto [1.09%]. Top losers were Media [0.4%], and FMCG [-0.15%].

The Indian rupee fell 5 paise to 83.04 against the US dollar on Thursday.

The annual rate of inflation based on all India Wholesale Price Index (WPI) number is (-) 0.52% (Provisional) for the month of August, 2023 (over August, 2022) against (-) 1.36% recorded in July, 2023. The negative rate of inflation in August, 2023 is primarily due to fall in prices of mineral oils, basic metals, chemical & chemical products, textiles and food products as compared to the corresponding month of previous year.

Stock in News Today

Larsen & Toubro (L&T): The EPC major said that it has partnered with BAE Systems Inc. to bring the All-Terrain Vehicle (AATV), BvS10, to the Indian market. The BvS10 will participate in Indian Army trials starting in September 2023, it added. Under the agreement, L&T is the prime bidder for the Indian market, with the support of BAE Systems Hägglunds, the Swedish manufacturer of the highly successful BvS10 family of vehicles. This new variant will be known as the “BvS10-Sindhu”.

Oil India: The company’s Chairman and Managing Director (CMD) Ranjit Rath announced that the company plans to invest Rs 25,000 crore in renewable energy by 2040. The investments would cover a wide spectrum of activities such as green hydrogen, compressed biogas, solar energy, geothermal energy, and zero-flaring initiatives. In addition, the funds will also be utilised for transitioning from diesel-fired engines to gas engines. Further, the company intends to spend Rs 8,000 crore from the total amount on 2G ethanol alone.

Adani Enterprises: The company’s arm, Adani Global Pte, has incorporated a joint venture, Kowa Green Fuel Pte. with Kowa Holdings Asia Pte., Singapore for sales and marketing of green ammonia, green hydrogen and its derivatives in Japan, Taiwan and Hawaii. Adani Global Pte., Singapore is a step down wholly owned subsidiary of Adani Enterprises.

Grasim Industries Limited: The flagship company of the Aditya Birla Group unveiled the brand name of its paints business, ‘Birla Opus’. The market launch of Birla Opus is scheduled for Q4FY24. Grasim will offer a full suite of high-quality products in the decorative paints segment.

Sun Pharmaceutical Industries: The company announced that one of its wholly-owned subsidiaries has entered into a license agreement with Pharmazz Inc., to commercialise Tyvalzi (Sovateltide) drug in India. Sovateltide is indicated for treating cerebral ischemic stroke, a condition in which the loss of blood supply to the brain prevents brain tissue from receiving oxygen and nutrients, resulting in potential brain damage, neurological deficits, or death. Pharmazz will be entitled to upfront and milestone payments, including royalties.

ACC: The cement manufacturer announced the commencement of commercial production of clinker at Ametha cement plant in Madhya Pradesh. The plant has a clinker capacity of 3.3 million tonnes per annum (MTPA) and a cement capacity of 1 MTPA. This greenfield integrated project will help in lowest cost production of clinker and cement, which will enhance ACC’s overall portfolio to 37 MTPA and aid in the overall improvement in profitability and market share of the company, said the firm.

Life Insurance Corporation of India (LIC): The company said that it has increased its stake in Mahanagar Gas from 7.015% to 9.030%. Life insurer bought 69,29,335 shares or 2.015% equity, at an average cost of Rs 918.87 via open market purchase during the period from 1 April 2022 to 12 September 2023.

Insecticides (India): The company said that the Patent Office has granted patent to the company for an invention entitled “Novel Amide Compound, Method for producing the same, and miticide”. The patent has been granted for a term of 20 years from 14th day of September 2017, which is the date of filing.

Advait Infratech (AIL): The company has signed a Memorandum of Understanding (MoU) with Goufu Hydrogen Energy Equipment (Goufu) to cater the present and future requirements for the green hydrogen technologies and projects. Under this arrangement, both the parties will exchange the technology, and will have access to the products of the either party, to meet the need of the market through assembling and manufacturing.

Aurionpro Solutions: The company’s transit business subsidiary, Aurionpro Transit Pte. Ltd., received an order for the supply of validators and hardware for the rapid transit bus project in the city of Merida, Mexico. The project will be delivered through MRP Technology Solutions, the company’s partner in the region, the technology solutions stated.

Mahindra Holidays & Resorts India: The company has signed a memorandum of understanding (MoU) with the Government of Uttarakhand to establish and develop Club Mahindra Resorts in Uttarakhand. The company stated that the estimated investment for the above development of Club Mahindra Resorts is expected to be approximately Rs 1,000 crore to be made over the next few years.

Intellect Design Arena: The company’s consumer banking arm, Intellect Global Consumer Banking (iGCB), recently announced that AFC Commercial Bank has chosen iGCB’s Core Banking offering, Intellect Digital Core (IDC) to modernise its banking operations. The partnership with Intellect will enable AFC Commercial Bank to deliver a seamless and personalised banking experience to its customers, the company said in an exchange filing.

Zee Entertainment (ZEE): The company said that the Axis Finance has approached the National Company Law Appellate Tribunal (NCLAT) against the order approving the merger of the company and Sony.