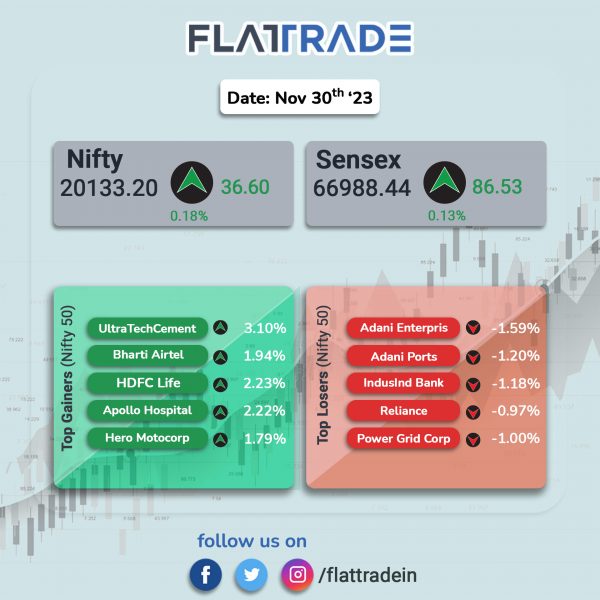

Dalal Street ended in the green as investors were optimistic about the country’s economic growth and no interest rate hikes in the US. The Sensex closed 0.12% higher and the Nifty 50 gained 0.18%.

Broader markets outperformed the headline indices. The Nifty Midcap 100 jumped 0.68% and the BSE Smallcap rose 0.95%.

Top gainers were Pharma [1.56%], Realty [1.44%], FMCG [0.55%], Media [0.47%], and Auto [0.4%]. Top losers were PSU Bank [-1.1%], Bank [-0.195], and Private Bank [-0.19%].

The Indian rupee fell 6 paise to 83.39 against the US dollar on Thursday.

Stock in News Today

Reliance Industries Limited (RIL): French fashion group, SMCP, has entered the Indian market in partnership with Reliance Industries-owned Reliance Brands Limited (RBL). RBL will be the exclusive distributor for Sandro and Maje in the Indian market. The two brands will open their first stores in 2024.

Tata Technologies: The company made a stellar debut on the bourses. Shares of the company opened at Rs 1200 apiece on the NSE as against its issue price of Rs 500. The shares hit a high of Rs 1400 and closed at Rs 1313 apiece on the NSE.

Tata Coffee: The company’s board has approved setting up of an additional 5500 Metric Tonnes (MT) freeze-dried coffee facility in Vietnam at an investment of Rs 450 crore. This facility is being undertaken by Tata Coffee Vietnam Company Ltd, a wholly-owned subsidiary of the company.

RateGain Travel Technologies: The company said that it has partnered with Best Airlines Rep for providing accurate pricing intelligence for latter’s partner airlines. This strategic alliance marks the introduction of RateGain’s airline pricing solution, AirGain, enhancing the capabilities of Best Airlines Rep’s airline partners by offering immediate access to pricing insights from over 200 sources.

Genesys International: Shares of the company surged 8.84% following the announcement of its Executive Innovation Board (EIB) formation aimed at advancing India’s first comprehensive map stack. The EIB will consist of industry experts with deep knowledge in mobility, e-commerce/logistics, and automotive sectors, playing a vital role in guiding Genesys towards innovative solutions for India’s consumer and infrastructure needs.

Aurobindo Pharma: The company’s wholly owned subsidiary, Eugia Pharma Specialities, has received final approval from the USFDA to manufacture and market Budesonide Inhalation Suspension which is used for maintenance treatment of asthma and as prophylactic therapy in children of age 12 months to 8 years. According to IQVIA, the product has an estimated market size of $226.4 million for the twelve months ending September 2023. The product is expected to be launched in FY25.

Peninsula Land: The company’s board has approved the preferential issue to Delta Corp of 1.5 crore equity shares of face value of Rs 2 per share at an issue price of Rs 44 including a premium of Rs 42 for an aggregate cash consideration of Rs 66 crore. In addition, the board has also approved 77.27 lakh unsecured Compulsorily Convertible Debentures(“CCDs”) of face value Rs 44 each for an aggregate cash consideration of Rs 33,99,88,000. Each CCD shall be converted into one fully paid-up equity share of the company having face value of Rs 2 at a premium of Rs 42 on 16th April 2025.

DreamFolks Services: The company has joined hands with Grey Wall, a Russian airport and lounge service aggregator, to enhance the travel experience for passengers crossing borders. DreamFolks’ clients and consumers can now access Grey Wall’s network of around 100 lounges in Russian airports and railway stations through the company’s proprietary tech platform.

Fedbank Financial Services: The company was listed at Rs 138 apiece as against an issue price of Rs 140 per share. The stock has hit a high of Rs 148.25 and a low of Rs 133. The shares closed at Rs 140.25 per share.

Gandhar Oil Refinery: Shares of the company was listed at Rs 298 against an issue price of Rs 169 apiece. The stock hit a high of 344.05 and a low of 295.30 on the NSE. It closed at Rs 301.4 per share.

SJVN: The power generation company has successfully synchronized the second unit of 60 MW Naitwar Mori Hydro Electric Project (“NMHEP”) with the National Grid. NMHEP is located on River Tons, a major tributary of River Yamuna in Uttarkashi district of Uttarakhand. The project will generate 265.5 million units of electricity annually.

Vascon Engineers: The company’s board has approved raising of funds for an aggregate amount not exceeding Rs 125 crore through qualified institutions placement (QIP) or other permissible mode.

Welspun Speciality Solutions: The company has secured orders for an aggregate amount of Rs 15.87 crore from a domestic, unrelated customer for the supply of duplex drade seamless tubes. The order is expected to be executed by March 2024.

Rajoo Engineers: The company’s board has approved a proposal to buyback up to 9,42,300 fully paid-up equity shares of face value of Rs 1/- each (representing 1.53 % of the total number of equity shares in the paid-up equity capital of the Company as on March 31, 2023) at a price of Rs 210 per equity share payable in cash for an aggregate consideration not exceeding Rs 19.79 crore.

Zee Entertainment Enterprises: The company clarified that the news report about risks to its merger plan with Sony as factually incorrect. Further, the company reiterated that the company is continuing to work towards a successful closure of the proposed merger as per the Composite Scheme of Arrangement approved by the NCLT, Mumbai Bench.

Ramco Systems: The company said Ramco System Korea Company Ltd. has been incorporated in South Korea as a wholly owned subsidiary of the company. The subsidiary will carry on the business operations in Korea.

Dalmia Bharat Sugar And Industries: The company’s resolution plan for the revival of Baghauli Sugar and Distillery under the corporate insolvency resolution process in terms of the Insolvency and Bankruptcy Code, 2016 was approved by the Allahabad Bench of National Company Law Tribunal. Under the resolution plan, the company will infuse Rs 140.19 crore in Baghauli Sugar through equity and unsecured loan and Baghauli Sugar will be wholly owned subsidiary of the company. The acquisition and revival of Baghauli Sugar would enable the company to increase its capacities in Uttar Pradesh.