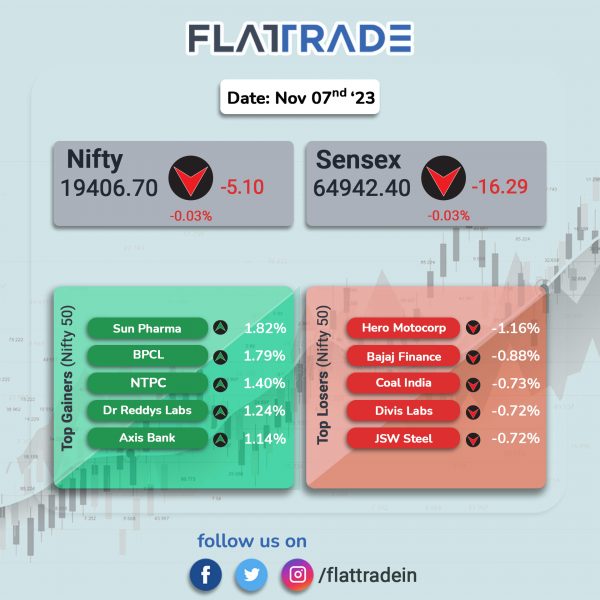

Benchmark equity indices closed nearly flat as hopes over dovish monetary policy faded. The Sensex slipped 0.02% and the Nifty inched down 0.03%.

In broader markets, the Nifty Midcap 100 rose 0.28% and the BSE Smallcap gained 0.37%.

Top losers were Realty [-1.34%], Media [-0.64%], and Auto [-0.18%]. Top gainers were Pharma [1.32%], Oil & Gas [0.66%], PSU Bank [0.46%], Private Bank [0.39%], and Bank [0.27%].

The Indian rupee depreciated by 5 paise to close at 83.27 against the US dollar on Tuesday.

Stock in News Today

Trent: The clothing retailer said its revenue from operations rose 52.73% to Rs 2,982 crore in Q2FY24 from Rs 1,953 crore in Q2FY23. Consolidated Ebitda increased 78.5% to Rs 457 crore in Q2FY24 from Rs 256 crore in Q2FY23. Its consolidated net profit jumped to Rs 228 crore in Q2FY24 from Rs 78.9 crore in Q2FY23.

Cochin Shipyard: The company’s net profit jumped 61% to Rs 181.5 crore in Q2FY24 from Rs 113 crore in Q2FY23. Revenue rose 48.1% to Rs 1,011.7 crore in Q2FY24 from Rs 683.2 crore in Q2FY23. Ebitda surged 41.2% to Rs 191.2 crore in Q2FY24 from Rs 135.4 crore in Q2FY23.

The company’s board has declared an interim dividend of Rs 8 per equity share of Rs 10 each fully paidup (80%) for FY24 and the company has fixed November 20 as the record. The aforesaid interim dividend shall be paid to the eligible shareholders on or before December 6, 2023. Further the board has approved the sub-division/ split of existing one equity share of face value of Rs 10 each fully paid up into two equity shares of face value of Rs 5 each fully paid up, subject to shareholders approval.

Larsen & Toubro (L&T): The company said that the Water & Effluent Treatment Business of L&T Construction has secured repeat orders from the Water Resources Department, Government of Odisha to execute Cluster XXII & Cluster XXV Mega Lift Irrigation Projects. The Business has also secured an add-on order from the Water Resources Department, Government of Madhya Pradesh to execute Pressurized Piped Lift Irrigation Projects. According to the company’s classification, the orders are worth up to Rs 2500 crore.

Varroc Engineering: The company reported a net profit of Rs 54.2 crore in Q2FY24 as against a net loss of Rs 795 crore in Q2FY23. Revenue from operations was up 2.9% at Rs 1,886.8 crore in Q2FY24 as against Rs 1,834.1 crore in Q2FY23. Its Ebitda jumped 35.1% to Rs 194.2 crore in Q2FY24 from Rs 143.7 crore in Q2FY23. Ebitda margin improved to 10.36% in Q2FY24 from 7.9% in Q2FY23.

Arvind Fashions: The company registered a net profit of Rs 37 crore in Q2FY24, up 32% from Rs 28 crore in Q2FY23. Its revenue rose 7.2% to Rs 1,266.9 crore in Q2FY24 from Rs 1,181.8 crore in Q2FY23. The operating profit rose 26.8% to Rs 147.3 crore in Q2FY24 from Rs 116.2 crore in Q2FY23.

Alkem Laboratories: The company said its consolidated revenue from operations rose 11.7% YoY to Rs 3,440 crore in Q2FY24 from Rs 3,079 crore in Q2FY23. Consolidated Ebitda surged 64.61% to Rs 746 crore in Q2FY24 from Rs 453 crore in Q2FY23. The company’s net profit increased 76.84% YoY to Rs 615 crore in Q2FY24 from Rs 348 crore in Q2FY23.

Alembic Pharma: The company’s revenue from operations grew 8.1% to Rs 1595 crore in Q2FY24 from Rs 1475 crore in Q2FY23. Consolidated Ebitda fell 10.7% to Rs 208.2 crore in Q2FY24 from Rs 233.1 crore in Q2FY23. The consolidated net profit was up 2.4% at Rs 137 crore in Q2FY24 as against Rs 133 crore in Q2FY23.

Info Edge Technologies: The company’s revenue from operations remained nearly flat at Rs 625.85 crore in Q2FY24 as against Rs 625.95 crore in Q2FY23. Consolidated Ebit slipped 0.09% to Rs 178.7 crore in Q2FY24 from Rs 178.9 crore in Q2FY23. Consolidated net profit jumped 62.6% to Rs 239.7 crore in the quarter under review from Rs 147.4 crore in the same period last fiscal.

Jyothy Labs: The company reported revenue from operations of Rs 732 crore in Q2FY24, up 11.1% YoY from Rs 659 crore in Q2FY23. Consolidated Ebitda surged 68.1% YoY to Rs 135 crore in Q2FY24, while Ebitda margin stood at 18.46% compared to 12.19% in the year-ago period. The consolidated net profit soared 59.2% to Rs 104 crore in Q2FY24 from Rs 65.3 crore in Q2FY23.

Zydus Lifesciences: The drug company said its consolidated revenue from operations increased 9.1% to Rs 4,369 crore in Q2FY24 from Rs 4,006 crore in Q2FY23. Consolidated Ebitda jumped 40.6% to Rs 1,146 crore in Q2FY24 as against Rs 815 crore in Q2FY23. Consolidated net profit surged 53.2% to Rs 801 crore in Q2FY24 as against Rs 523 crore in Q2FY23.

Devyani International: The QSR (quick service restaurant) company said its revenue from operations stood at Rs 819.4 crore in Q2FY24, up 9.63% YoY from Rs 747.4 crore in Q2FY23. Consolidated Ebitda fell 7.23% to Rs 154.3 crore in Q2FY24 from Rs 166.32 crore in Q2FY23. The company’s net profit slumped 37% to Rs 35.8 crore in Q2FY24 from Rs 56.8 crore in Q2FY23.

Alok Industries: The company said its board has approved raising funds up to Rs 3,300 crore via preferential issue of non-convertible redeemable preference shares having a face value of Re 1 each. Alok Industries has set a coupon rate of 9% per annum on the NCRPs which are redeemable at par for a period not exceeding 20 years from the date of allotment, it said in an exchange filing.

KPI Green Energy: The company informed that it has received repeat orders for 2.70 MW for executing solar power projects under ‘Captive Power Producer (CPP)’ Segment of the company. With the addition of the said order, the company’s cumulative orders of solar power projects till date have crossed 115+ MW.

Keystone Realtors: The company’s wholly owned subsidiary Kingmaker Developers will acquire 100% stake in Real Gem BuildTech Pvt. for Rs 231.42 crore. Real Gem BuildTech is a wholly owned subsidiary of DB Realty and the the acquisition is through cash.

Honasa Consumer: The company which sells personal care products under ‘Mamaearth’ brand debuted in the bouses. Shares opened at a premium of Rs 330 apiece on NSE as against an issue price of Rs 324 apiece. Shares hit a high of Rs 340.45 and closed at Rs 335.95.

Cipla: The drugmaker approved the transfer of the generics business to the unit Cipla Pharma and Life Sciences. The generics business will be transferred for a consideration of Rs 350 crore. The sale will be completed by Dec. 31, 2023.

K.P.R. Mill: The company approved an investment of Rs 250 crore for the expansion of fabric processing capacity. Fabric processing capacity is set to increase from 25,000 MT to 37,000 MT per year. It also approved an investment of Rs 100 crore to increase solar power generation capacity to 37 MW.

Sobha: The realty company posted a revenue from operations of Rs 741.2 crore Q2FY24, up 10.6% from Rs 670 crore in Q2FY23. Its consolidated Ebitda dropped 20.4% to Rs 75.4 crore in Q2FY24 from Rs 94.8 crore in Q2FY23. Consolidated net profit fell 21.9% to Rs 14.9 crore in Q2FY24 as against Rs 19.2 crore in Q2FY23.

Jamna Auto: The auto ancillary company registered a revenue from operations of Rs 607 crore in Q2FY24, up 9.87% from Rs 553 crore in the year-ago period. Consolidated Ebitda jumped 40.9% to Rs 79.1 crore in Q2FY24 from Rs 56.1 crore in Q2FY23. Consolidated net profit climbed 34.31% to Rs 50.1 crore in Q2FY24 from Rs 37.3 crore Q2FY23.

Hitachi Energy India: The company reported a revenue from operations of Rs 1228 crore in Q2FY24, up 10.2% from Rs 1,114.6 crore in Q2FY23. Consolidated Ebitda fell 13.8% to Rs 65.3 crore in Q2FY24 as against Rs 75.8 crore in Q2FY23. Consolidated net profit fell 33.4% to Rs 24.8 crore in Q2FY24 from Rs 37.2 crore in Q2FY23.

Radico Khaitan: The liquor maker said its consolidated revenue from operations was up 23.1% at Rs 925 crore in Q2FY24 as against Rs 761 crore in Q2FY23. Consolidated Ebitda jumped 34.6% YoY to Rs 121 crore in Q2FY24 from Rs 90.1 crore in Q2FY23. Consolidated net profit was up 18.9% at Rs 64.8 crore in Q2FY24 as against Rs 54.5 crore in Q2FY23.

Indo Count Industries: The company said its consolidated revenue from operation rose 19.5% to Rs 1,009 crore in Q2FY24 from Rs 844.1 crore in Q2FY23. Consolidated Ebitda was up 43.4% at Rs 164.6 crore in Q2FY24 from Rs 114.8 crore in Q2FY23. The company’s net profit soared 70.5% to Rs 114.2 crore in the reported quarter from Rs 67 crore in the corresponding quarter last year.

Dalmia Bharat Sugar and Industries: The company’s revenue from operations was up 26.4% to Rs 732 crore in Q2FY24 from Rs 579 crore in Q2FY23. Consolidated Ebitda was at Rs 65.5 crore in Q2FY24 as against Rs 7.3 crore in Q2FY23. Its consolidated net profit stood at Rs 54.9 crore in Q2FY24 from Rs 11.7 crore in Q2FY23.

Fertilisers And Chemicals Travancore: The company recorded a consolidated revenue from operations of Rs 1,663 crore in Q2FY24 as against Rs 1935 crore in Q2FY23. Consolidated Total expenses stood at Rs 1597.41 crore in Q2FY24 as against Rs 1767.86 crore in the year-ago period. The company’s net profit fell 27.2% to Rs 105 crore in Q2FY24 from Rs 144.6 crore in Q2FY23.

HG Infra Engineering: The company reported an increase in consolidated revenue from operation by 20% at Rs 954.5 crore in Q2FY24 as against Rs 795.7 crore in Q2FY23. Consolidated Ebitda rose 36.7% YoY at Rs 220.2 crore in Q2FY24, while Ebitda margins improved to 23.06% in Q2FY24 from 20.24% in the year-ago period. Consolidated net profit rose 17.3% to Rs 96.1 crore in Q2FY24 from Rs 81.9 crore in Q2FY23.

Honeywell Automation India: The company’s revenue from operations rose 39% to Rs 1,104.2 crore in Q2FY24 from Rs 794.3 crore in Q2FY23. Consolidated Ebitda was up 8.2% at Rs 138.3 crore in Q2FY24 as against Rs 127.8 crore in Q2FY23. Its consolidated net profit rose 3.4% to Rs 12.2 crore in Q2FY24 as against Rs 11.8 crore in Q2FY23.

TVS Supply Chain Solutions: The company’s consolidated revenue was down 15.6% at Rs 2,262.9 crore in Q2FY24 as against Rs 2,680.8 crore in Q2FY23. Consolidated Ebitda was up 12.2% at Rs 185.1 crore in Q2FY24 from Rs 165 crore in Q2FY23. The company reported a net loss of Rs 40.6 crore in Q2FY24 as against a net profit of Rs 39.8 crore in Q2FY23.

Quess Corp: The company said its consolidated revenue was up 3.2% at Rs 4,748.3 crore in Q2FY24 as against Rs 4,600.2 crore in Q1FY24. Consolidated EBIT was up 10.1% at Rs 93.9 crore in the reported quarter as against Rs 85.3 crore in the preceding quarter. Consolidated net profit jumped 47.4% to Rs 71 crore in Q2FY24 compared to Rs 48.1 crore in the previous quarter. Shares of the company rose over 6% in intraday trading.

Quess Corp approved buying a 4.5% stake in Vedang Cellular Services from the promoter for Rs 6.05 crore, increasing its total stake to 96.97%. The board also approved the acquisition of an additional 46.09% stake in unit Stellarslog Technovation for Rs 6.8 crore, increasing its total stake to 100%.