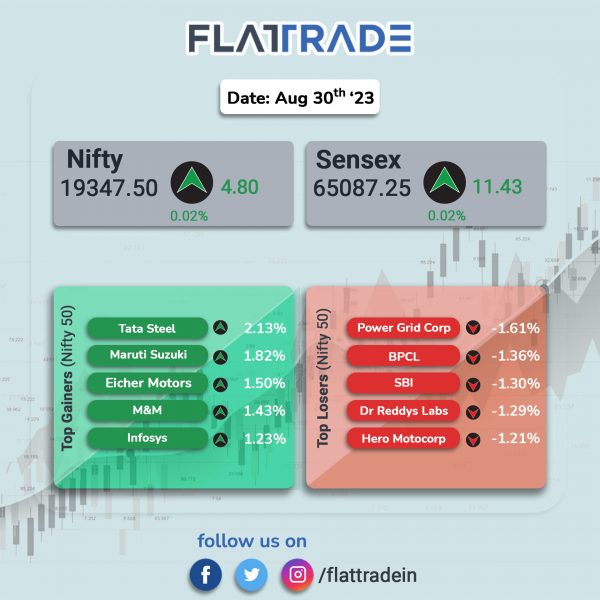

Sensex and Nifty ended nearly flat as gains in IT, Auto and FMCG stocks were offset by losses in banking and financial services stocks. The Sensex and the Nifty closed 0.02% higher, each.

Broader markets performance were better than headline indices. The Nifty Midcap 100 index rose 0.73% and the BSE Smallcap jumped 0.83%.

Top gainers were Realty [1.42%], Metal [0.92%], IT [0.77%], Auto [0.64%], and FMCG [0.57%]. Top losers were Bank [-0.59%], Financial Services [-0.5%], Private Bank [-0.41%], Oil & Gas [-0.34%], and PSU Bank [-0.33%].

The Indian rupee depreciated by 2 paise to close at Rs 82.73 against the US dollar on Wednesday.

BSE has decided to move the expiry day of Bankex derivatives contracts from Friday to Monday, effective from October 16, the bourse announced in a notice on Wednesday.

Stock in News Today

Indian Bank: The lender said that its committee of directors approved raising of equity capital aggregating up to Rs 4,000 crore through qualified institutions placement (QIP). The funds will be raised in one or more tranches, subject to all statutory and regulatory approvals.

Trigyn Technologies: The company has received Letter of Award from Digital India Corporation, Ministry of Electronics and Information Technology, Government of India, for providing technical manpower for LokOS project. The project duration will be three years from award of work, and further extendable based on the performance. The project value is approximately Rs 35 crore for three years and Rs 65 crore for five years.

MTAR Technologies: The company has received Industrial Defence License From Government of India. The license is for manufacturing command control computers, communication intelligence surveillance and reconnaissance systems. The equipment will be used for fitting submarines and other naval equipment, the company said.

PNC Infratech: The company said that its board approved appointment of Devendra Kumar Agarwal as chief financial officer (CFO) of the company with effect from 30 August 2023. Agarwal has over 40 years of experience in the field of accounts, finance and taxation. He earlier worked as CFO of the company and also worked with Vacmet India as a CFO.

Titagarh Rail: The company has bagged orders from GMRC worth Rs 350 crore. The order includes design, manufacture, supply, testing, commissioning and training of 30 standard gauge cars for Ahmedabad Metro Rail Phase-II Project. The prototype has to be delivered within 70 weeks from LOA and delivery completion is 94 weeks from LOA.

Shakti Pumps (India): The company has received work order from Haryana Renewable Energy Department (HAREDA) for Rs 358 crore. The order constitutes supply of 7,781 pumps under the KUSUM-3 scheme to Haryana Government.

REC: The company said that its board has approved the sale and transfer of the entire shareholding of Beawar Transmission (SPV) held by its wholly owned subsidiary, REC Power Development and Consultancy (RECPCL), to Sterlite Grid 27. The transaction is expected to be completed by FY24.

Ami Organics: Morgan Stanley Asia Singapore Pte non-ODI bought 1.70% equity in the firm through open market transactions on Tuesday. As per the bulk deal data on the BSE, Morgan Stanley Asia Singapore Pte non-ODI purchased 6,21,898 shares at Rs 1250 each. Meanwhile, Girishkumar Limbabhai Chovatia sold 6,25,000 shares at Rs 1250.39 per share.

Unichem Laboratories: The company announced that it has received ANDA approval from the United States Food and Drug Administration (USFDA) to market Prasugrel tablets USP. Prasugrel tablets are indicated to reduce the rate of thrombotic CV events (including stent thrombosis) in patients with acute coronary syndrome. The drug will be commercialized from Unichem’s Goa plant.

Strides Pharma Science: The company announced that it step-down subsidiary, Strides Pharma Global Pte. Limited, Singapore, has received an approval for Mycophenolate Mofetil for oral suspension from the United States Food & Drug Administration (USFDA). Mycophenolate Mofetil for oral suspension belongs to a group of medicines called immunosuppressants. The Mycophenolate Mofetil for Oral Suspension has a market size of $41 million, as per IQVIA.

Ramkrishna Forgings: The company said that it has been awarded a substantial business contract worth 8.25 million euros (approximately Rs 73.65 crore) by a prominent European OEM & Tier 1 supplier. Under the terms of this agreement, the company will be supplying front and rear axle components for the next five years. The said order would help the company to expand its footprint into the South American market.

Axis Bank: The private sector bank announced the launch of a new savings account variant – ‘Infinity Savings Account’ – to cater to digitally savvy customers who are frequent adopters of subscription-based models. Customers will get exclusive privileges such as waived Average Monthly Balance (AMB) requirement, complimentary debit cards, and waiver of all the domestic charges against a small monthly recurring fee of Rs 150 or annual fee of Rs 1650.

Spandana Sphoorty Financial: The company’s board has approved a proposal to raise funds worth Rs 30 crore through non convertible debentures (NCDs) on private placement basis. The company will issue 3,000 senior, secured, rated, listed, redeemable NCDs having face value of Rs 1 lakh each aggregating to Rs 30 crore. NCDs will be allotted on 4 September 2023 and get matured on 4 September 2026. The instrument has an interest rate of 10.75% p.a. The tenure of the instruments will be 36 months from the deemed date of allotment.

Further, the company will issue 20,000 senior, secured, rated, listed, redeemable non-convertible debentures having face value of Rs 1 Lakh each aggregating up to Rs 200 crore, which includes a green shoe option of up to Rs 100 crore. NCDs will be allotted on 7 September 2023 and get matured on 7 March 2025. The NCDS has an interest rate of 10.43% p.a. The tenure of the instruments will be 18 months from the deemed date of allotment. The NCDs are to be listed on Bombay stock Exchange (BSE).

Newgen Software Technologies: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL A1’ rating on the bank loan facilities of the company. CRISIL said that the rating reflects strong business and financial risk profiles of the company with continued growth of 15-20% in last three fiscals ending FY23 driven by continuous in-house research and development (R&D), new service offerings, penetration in new geographies and regular addition of customers.