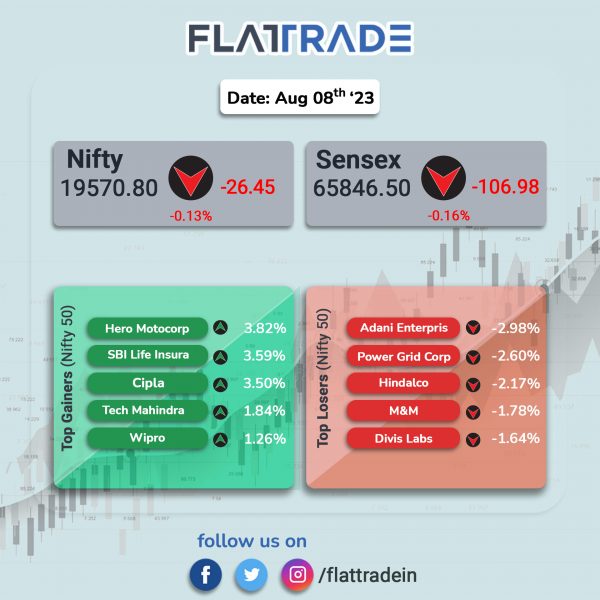

Sensex, Nifty ended lower due to weak global cues as investors’ sentiments were dented after data showed China’s exports plunging and economic growth slowing down. The Sensex fell 0.16% and the Nifty 50 index dropped 0.13%.

In broader markets, the Nifty Midcap 100 index rose 0.23% and the BSE Smallcap gained 0.25%.

Top gainers were PSU Bank [3.37%], Media [0.74%], Pharma [0.64%], Financial Services [0.32%], and Bank [0.28%]. Top losers were Metal [-1.17%], Energy [-0.35%], Auto [-0.31%], FMCG [-0.28%], and Realty [-0.18%].

The Indian rupee fell 7 paise to 82.83 against the US dollar on Tuesday.

Stock in News Today

Adani Ports and SEZ: The company reported a 82.57% rise in consolidated net profit at Rs 2,114.72 crore in Q1FY24 from Rs 1,158.28 crore reported in the year-ago period. Revenue from operations jumped 23.51% to Rs 6,247.6 crore in the quarter under review from Rs 5,058.09 crore in the year-ago period. EBITDA soared 80% YoY to Rs 3,765 crore. Cargo volume grew 12% YoY to over 101 MMT, supported by 15% containers growth.

Hindalco Industries: The aluminium producer said its standalone net profit for the quarter ended June 2023 plunged 58.6% to Rs 600 crore from Rs 1,448 crore in the year-ago quarter. The company’s standalone revenue from operations rose 2% to Rs 19904 crore in Q1FY24 from Rs 19,518 crore in Q1FY23. EBITDA during the quarter declined 46.7% to Rs 1,561 crore from Rs 2,927 crore. On a consolidated basis, Hindalco Industries’ net profit fell 40.4% YoY to ₹2,454 crore, while revenue from operations declined nearly 9% YoY to Rs 52,991 crore.

Hero Motocorp: The two-wheeler manufacturer said that it has received 25,597 bookings for the Harley-Davidson X440, since opening the bookings on the 4 July 2023 and further said that the booking window has now been closed, and the new booking window will be announced in due course. Production of the Harley-Davidson X440 will start in September 2023 and customer deliveries will commence from October onwards. The introductory ex-showroom prices have now been revised and the new prices for the Denim is Rs 2,39,500, Vivid is Rs 2,59,500, and S variants is Rs 2,79,500.

Tata Power: The company has signed Rs 13,000 crore MoU with Maharashtra Government for pumped hydro storage projects Signs Rs 13,000 crore MoU with the Government of Maharashtra for 2800 MW of pumped hydro storage projects 1800 MW projects will be built in Shirawata, Pune 1000 MW projects will be built in Bhivpuri, Raigad Source:

Borosil Renewables: The company has reported a net loss of Rs 11.53 crore in Q1FY24 compared to a net profit of Rs 30.11 crore in Q1FY23. Revenue from operations stood at Rs 354.49 crore in the quarter ended June 2023, a growth of 108.56% YoY. Total expenses rose 178% YoY to Rs 369.46 crore during the period under review.

Krishna Institute of Medical Sciences (KIMS): The company reported a 15.52% YoY rise in consolidated net profit at Rs 80.82 crore and revenue from operations rose 22.3% YoY to Rs 606.03 crore in Q1FY24. EBITDA grew by 12.4% YoY to Rs 160.2 crore in the quarter ended June 2023, while EBITDA margin reduced to 25.5% in Q1FY24 from 26.5% in Q1FY23. Average revenue per operating bed (ARPOB) stood at Rs 31,697 (up 5% YoY) and average revenue per patient (ARPP) rose 5% YoY to Rs 1,31,363 for the quarter ended June 2023.

HLE Glascoat: The company’s consolidated net profit declined 39.60% YoY to Rs 9.29 crore and net sales fell 3.54% YoY to Rs 197.19 crore in Q1FY24. Meanwhile, HLE Glascoat has signed agreements to buy 70% stake in Kinam Engineering Industries. The acquisition will be carried out in phases, with Kinam maintaining its brand identity and operating as a separate business entity.

Monte Carlo Fashions: The clothing retailer has reported a net loss of Rs 11.60 crore in Q1FY24 as against a net loss of Rs 3.92 crore in Q1FY23. Revenue from operations jumped 22.95% to Rs 138.77 crore during the reported quarter compared with Rs 138.77 crore in Q1FY23. The company reported an EBITDA loss of Rs 41 crore in Q1FY24 compared with an EBITDA gain of Rs 44 crore posted in corresponding quarter last year.

Olectra Greentech: The company’s consolidated net profit increased 8.7% to Rs 18.08 crore in Q1FY24 from Rs 16.63 crore in Q1FY23. Revenue from operations tumbled 23.1% YoY to Rs 216.02 crore in the quarter ended June 2023. During the quarter, the company’s revenue from e-bus division stood at 182.32 crore (up 33.39% YoY) and insulator division stood at Rs 29.65 crore (up 17.38% YoY).

Genus Power Infrastructures: The company said that its wholly owned subsidiary has received a letter of award (LoA) of Rs 2,209.84 crore for appointment of Advanced Metering Infrastructure Service Provider (AMISP). The contract involves design of AMI system with supply, installation and commissioning of 21.77 lakh smart prepaid meters, on DBFOOT (design, build, finance, own, operate, transfer) basis under Revamped Distribution Sector Scheme (RDSS). After this new order, the company’s total order book stood at over Rs 8,200 crore.

ITD Cementation India: The company’s consolidated net profit jumped 73.66% YoY to Rs 52.20 crore in Q1FY24 and posted a 66.93% YoY increase in net sales to Rs 1,832.57 crore in Q1FY24. EBITDA stood at Rs 174 crore, up 73% YoY, while EBITDA margin was at 9.5% during the quarter. Consolidated orderbook stood at Rs. 18,517 crore at the end of June 2023 quarter.

IRCON International: The public sector construction company recorded a 35.78% increase in net profit to Rs 27.17 crore in Q1FY24 as against Rs 20 crore in Q1FY23. Revenue from operations rose 29.6% to Rs 187.36 crore during the reported quarter from Rs 144.57 crore in the corresponding quarter last fiscal. The company’s revenue from overseas customers jumped 51.67% YoY to Rs 113.45 crore, while revenue from domestic customers rose 35.11% YoY in Q1FY24.

J Kumar Infraprojects: The company posted a revenue of Rs 1131 crore in Q1FY24, up 14% from Rs 994 crore in the year-ago period. Net profit rose 18% to Rs 73 crore in the quarter under review from Rs 62 crore in the year-ago period. EBITDA rose 15% to Rs 161 crore in Q1FY24 as against Rs 140 crore in the year-ago period.

Jain Irrigation: The company’s net profit stood at Rs 35.4 crore in Q1FY24 as against a net loss of Rs 9.6 crore in Q1FY23. Revenue was up 20.1% YoY at Rs 1,701 crore in Q1FY24 from Rs 1,416.2 crore in Q1FY23. EBITDA grew 14.8% to Rs 218.5 crore compared with Rs 190.4 crore in Q1FY23.

Subros: The company posted a 16.2% rise in net profit at Rs 13.6 crore in Q1FY24 as against Rs 11.7 crore in Q1FY23. Revenue fell 2.2% YoY to Rs 693 crore in the quarter under review from Rs 708.5 crore in the year-ago period. EBITDA rose 9% to Rs 47.2 crore in Q1FY24 as against Rs 43.3 crore in the year-ago period.