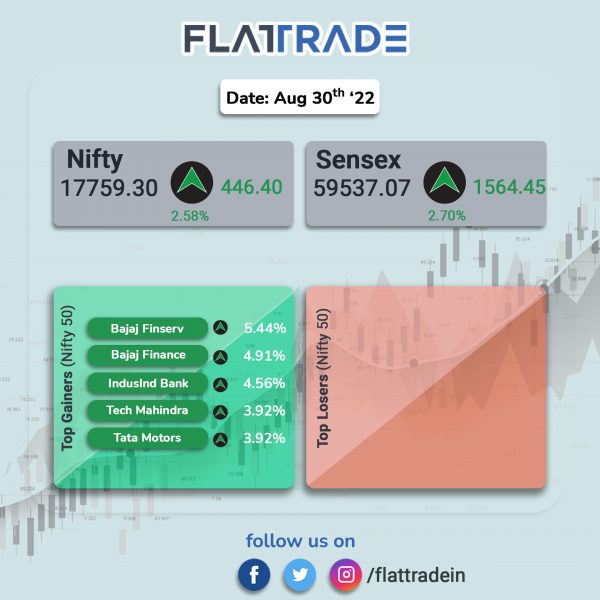

Dalal Street soared on broad-based rally as well as helped by gains in financial, IT and realty stocks. The Sensex surged 2.7% and the Nifty 50 index zoomed 2.58%.

Broader markets also jumped with the Nifty Midcap 100 index rising 2.03% and the BSE SmallCap advancing 1.4%.

Top Nifty sectoral gainers Realty [3.49%], Financial Services [3.42%], Bank [3.29%], IT [2.63%] and Auto [2.57%]. All Nifty sectoral indices ended in the green.

The Indian rupee strengthened by 51 paise to 79.45 against the US dollar on Tuesday.

Stock in News Today

Bajaj Finserv: Shares of the company rose 8% in two days after the board of directors of the company fixed a record date for bonus share issue and stock split. The company’s board has fixed 14th September 2022 for the purpose of finalising eligible shareholders for bonus share and stock split benefit. The ex-date will be 13th September 2022. The NBFC has announced bonus share issue in 1:1 ratio and stock subdivision in 5:1 ratio.

Central Bank of India (CBI): The lender has entered into a strategic co-lending partnership with Shapoorji Pallonji Finance to offer loans to MSME borrowers at competitive rates. Under the arrangement, Shapoorji Pallonji Finance will originate and process MSME proposals under priority sector as per jointly formulated credit parameters and eligibility criteria. Central Bank of India will take into its books 80% of the MSME priority sector loans under mutually agreed terms.

Nazara Technologies: The gaming media company has acquired 100% of the US-based children’s interactive entertainment company WildWorks for about Rs 83 crore. “Wildworks will enables us to solidify our leadership position in the gamified learning space for kids,” said Nitish Mittersain, Founder and MD of Nazara Technologies. Two of the founders, CEO Clark Stacey and COO Jeff Amis, will remain with the company in their current positions and lead its next phase of growth as part of the “Friends of Nazara” network, according to the company’s exchange filing.

Piramal Enterprises (PEL): Shares of the company rose 2.52%, trading ex-demerger on Tuesday. The stock opened at Rs 1050 and hit a high of Rs 1141.75 so far during the day.

PEL demerged its pharmaceutical business, Piramal Pharma (PPL), into a separate entity. PPL will list on the bourses as a separate entity by the end of the third quarter of this fiscal year. Investors will get four PPL shares for each PEL share held. The record date for the demerger has been set as 1 September 2022.

Ramkrishna Forgings: The company has announced that it has won an order wirth Rs 20.5 crore from a “market leader in rubber tracks for farm equipment and snowmobiles, as well as in solid and bias tyres for material handling equipment.” The company said that the new order has a potential to become an annual business of Rs 80 crore.

TD Power Systems: Shares of the company gained 9.3% in intraday trading after the company’s board approved the share split of one share of face value of Rs 10 each into five each of face value of Rs 2. The share split is subject to the approval of shareholders of the company and regulators/statutory approvals. The record date is yet to be fixed.

Eicher Motors: Shares of the company jumped over 3% in intraday trading after BofA Securities reiterated its ‘buy’ rating and raised its target price for the automaker as it sees growth “finally coming back” at Royal Enfield. The brokerage new Royal Enfield Hunter is performing well and this momentum is “being further topped up by Eicher via targeted influencer led marketing and aggressive financing push for other models too.”

Granules India: The company has received an approval from the USFDA for Loperamide Hydrochloride and Simethicone Tablets. In an exchange filing, the company said the drug is the bioequivalent to the drug product, Imodium, which is made by Johnson & Johnson Consumer.

Hindustan Oil Exploration: Shares of the company gained after the board approved a proposal to raised funds of up to Rs 250 crores by issuance of equity shares/other securities in accordance with SEBI regulations. The company also approved an increase in the borrowing limits of the board up to a sum of Rs 500 crore. Both the proposals are subject to approval from the shareholders at the upcoming annual general meeting and other regulatory authorities.

Shipping Corporation of India (SCI): The government is likely to invite financial bids for privatisation of state-owned company in the March quarter, an official said. “The demerger of non-core and land assets of Shipping Corporation is at an advanced stage. The process is expected to be over in about three months’ time, after which financial bids will be invited,” the official told PTI news agency.

EaseMyTrip: The company and magicpin, a platform for local shopping, have joined hands to bring new customer experiences for their users. As part of the partnership, EaseMyTrip and magicpin are launching a suite of products and services that will bring travel and shopping experiences across both the platforms.

Panchsheel Organics: The company has revised the record date from 30 August 2022 to 10 September 2022 for determining the eligibility of the shareholders entitled for Interim Dividend of 10% amounting to Rs. 1.00 per equity share on face value of Rs. 10/- each declared by the board at its meeting.