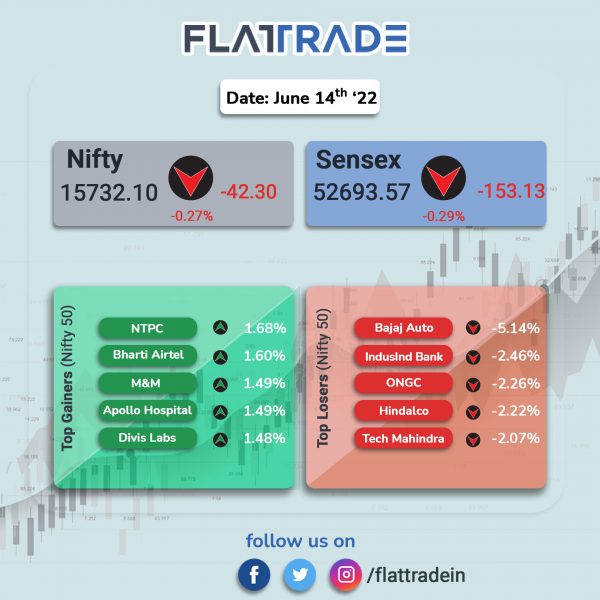

Benchmark stock indices fell for the third straight day after swinging between gains and losses for the most part of the session due to fears over aggressive tightening by global central banks and higher crude prices. The Sensex fell 0.29% and the Nifty ended 0.27% lower.

In broader markets, Nifty Midcap 100 lost 0.23% and BSE Smallcap was down 0.4%.

Top losers were Auto [0.55%], Energy [-0.55%], Private Bank [-0.45%], PSU Bank [-0.42%] and Financial Services [-0.42%]. Top gainers were Realty [0.81%], Metal [0.37%] and Pharma [0.22%].

Indian rupee rose 5 paise to 77.99 agains the US dollar on Tuesday.

WTI Crude rose to $121.8 per barrel and Brent Crude stood at $123.27 a barrel.

India’s annual wholesale price-based inflation rose to a record 15.88% in May, highest in the current series launched in 2012, government data showed on Tuesday.

Stock in News Today

Adani Enterprises: France-based TotalEnergies will acquire a 25% minority interest in Adani New Industries from Adani Enterprises. Shares of Adani Enterprises rose 5.61%.

Adani New Industries shall invest over $50 billion over the next 10 years in green hydrogen and associated ecosystem.

In the initial phase, Adani will develop green hydrogen production capacity of 1 million ton per annum before 2030.

Adani New Industries aims to be the largest fully integrated green hydrogen player in the world, with a presence from the manufacturing of renewables and green hydrogen equipment to downstream facilities.

Bharti Airtel: The telecom service provider launched India’s first multiplex on the Partynite Metaverse platform, according to an exchange filing. The Xstream multiplex is an extension of Airtel’s Xstream Premium offering, which recently crossed a 2-million subscriber milestone within 100 days of its launch.

Airtel’s Xstream multiplex will be a 20-screen platform with access to content portfolios from leading OTT partners available on the application.

Bajaj Auto: The two-wheeler said its board has decided that further deliberations are required in order to take a decision on the proposal of buyback and deferred the matter, according to its exchange filing. Shares of the company plunged 5.41%.

State Bank of India (SBI): The lender has hiked the interest rates on retail term deposits by 15-20 basis points on some tenors, with effect from June 14. It has also hiked interest rates on bulk term deposits by 50–75 basis points (bps) on certain tenors.

Oil Marketing companies: Shares of oil marketing companies such as IOCL, BPCL and HPCL fell between 1-6% amid concerns over elevated crude prices that could put pressure on the margin front.

Asian Paints: Shares of the company fell and hit 52-week low in intraday trading before recouping some losses. The share has been in a downtrend due to higher crude prices and intensifying competition as Grasim Industries announced doubling of capital expenditure to Rs 10,000 crore for its foray into the paints business.

Zydus Lifesciences: The company’s Chairman Pankaj R Patel has been appointed as part time non-official director in the Central Board of the Reserve Bank of India, the company said in an exchange filing. The Appointments Committee of the Cabinet (ACC) approved the appointment for a period of four years.

Kohinoor Foods: Shares of the company was locked in upper circuit after Food Secretary Sudhanshu Pandey said that the country has sufficient stocks of rice and there is no plan to consider any curb on rice exports.