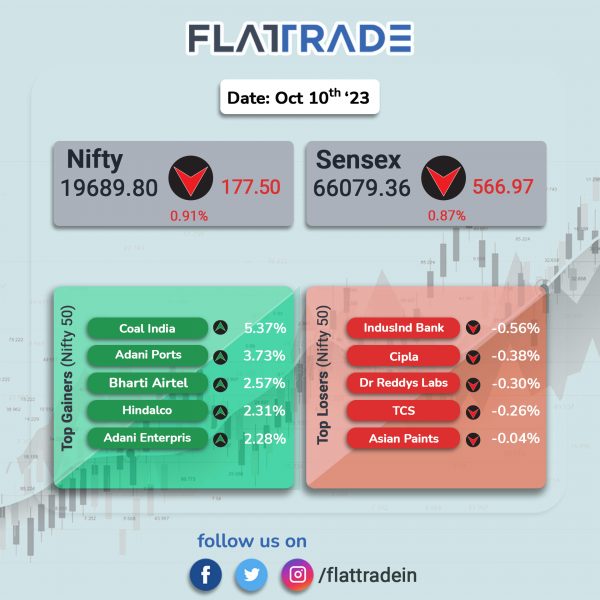

Dalal Street ended higher as investors’ risk appetite improved after bond yields eased following dovish comments from the Fed officials on interest rates. The Sensex rose 0.86% and the Nifty gained 0.91%.

In broader markets, the Nifty Midcap 100 jumped 1.36% and the BSE Smallcap advanced 1.25%.

Top gainers were Realty [4.01%], PSU Bank [2.08%], Metal [2.05%], Auto [1.24%], and Financial Services [1.23%]. All indices closed in the green.

The India rupee appreciated by 3 paise to 83.25 against the US dollar on Tuesday.

Stock in News Today

JSW Steel: The company reported a consolidated crude steel production of 6.41 million tonnes in Q2FY24, up 13% YoY. On a quarterly basis, production was marginally lower by 3% due to scheduled shutdowns undertaken at Indian operations and lower capacity utilisation at USA-Ohio due to market conditions.

LTIMindtree: The IT services company announced that it has been selected as a strategic partner for SAP services by Infineon Technologies AG, a global semiconductor leader in power systems and IoT. Through this partnership, LTIMindtree supports Infineon to modernise its SAP application landscape, enrich the user experience, streamline business processes, and deliver contemporary digital operations across both SAP S/4HANA and SAP Cloud Solutions.

HDFC Bank: The lender has raised MCLR based lending rates by up to 10 basis points on select tenors. While the overnight rate has been increased to 8.6%, the one-year MCLR was increased by five basis points. The bank’s one-month MCLR was also raised by 10 basis points to 8.65%.

Puravankara: Shares of the company soared 14.31% on the NSE in intraday trading after the company said its sales value rose 102% to Rs 1,600 crore in Q2FY24 from Rs 791 crore recorded in Q2FY23. Volumes jumped by 89% YoY to 2.01 million sft and realization rose by 7% YoY to Rs 7,947 per square feet (sft) in Q2FY24. Customer collections from the real estate business increased to Rs 879 crore in Q2 FY24 compared to Rs 518 crore in same quarter last year, a 70% YoY rise.

Ajmera Realty & Infra: The company registered strong growth in Q2FY24, with a 51% YoY increase in sales area to 1,20,787 sq.ft, and a 52% YoY growth in sales value to Rs 252 crore. The collection stood at Rs 111 crore, up 8% YoY. The company acquired three projects with Gross Development Value of about Rs 800 crore and sales potential of 4.4 lakh sft.

KPI Green Energy: The company’s net profit rose 64.22% to Rs 34.75 crore in the quarter ended September 2023 as against Rs 21.16 crore during the quarter ended September 2022. Sales rose 34.55% to Rs 215.07 crore in the quarter ended September 2023 as against Rs 159.84 crore during the previous quarter ended September 2022.

Jash Engineering: Shares of the company rose over 3% after the company said that it had bagged orders worth Rs 44 crore in September 2023. Out of this, orders worth Rs 19 crore are from domestic market and orders worth Rs 25 crore are from international market. As on 1 October 2023, the total consolidated order book position of the company is Rs 837 crore.

Satin Creditcare Network: The company along with its subsidiaries has crossed the major milestone of Rs 10,000 crore Assets Under Management on consolidated basis as on September 30, 2023.

Sterlite Technologies: The company said its wholly owned subsidiary, STL Digital Limited, has launched AInnovTM, a solutioning fabric of powerful Generative AI Services, frameworks, methodologies and solutions designed for enterprises to accelerate Generative AI-led innovation and adoption. AInnov enables development of embedded AI applications for multi stakeholder experiences.

GMDC: Shares of the company soared 20% to hit a lifetime high Rs 383.45 apiece. Shares of the company opened at Rs 324 and closed Rs 382.35 per share.

Shyam Metalics and Energy: The company said steel sales volume stood at 5,08,771 tonnes in Q2FY24, up 8.26% YoY and down 1.8% QoQ. The company’s sponge iron sales volume was at 1,77,373 tonnes, up 13.6% QoQ and up 3.07% YoY.

Vascon Engineers: The company has received Letter of Acceptance amounting to Rs 352.91 crore from Jharkhand State Building Construction Corporation Limited, for construction of medical college and upgradation of district hospital at Koderma. The work is expected to be completed within 30 months from the date of letter of acceptance.