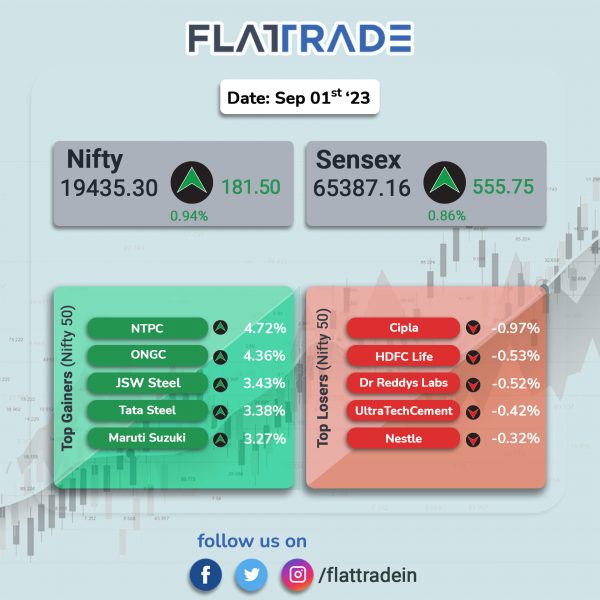

Dalal Street ended higher as market participants were buoyed by strong GDP numbers. Metal, IT, Auto, and Bank stocks were top gainers. The Sensex rose 0.85% and the Nifty jumped 0.94%.

In broader markets, the Nifty Midcap 100 index surged 0.84% and the BSE Smallcap gained 0.75%.

Top gainers were Metal [2.88%], Auto [1.65%], PSU Bank [1.6%], Oil & Gas [1.56%], IT [1.12%]. Nifty Pharma [-0.56%] was sole loser.

The Indian rupee rose 8 paise to 82.71 against the US dollar on Friday.

Stock in News Today

Maruti Suzuki India: The company said its total sales in August 2023 grew 14.48% to 1,89,082 units as compared with 1,65,173 units sold in the same period last year. The sales of passenger vehicles increased 16.36% to 1,56,114 units, while sales of light commercial vehicles slipped 23.94% to 2,564 units in August 2023 as compared with August 2022. While the company’s total domestic sales rose by 14.46% to 164,468 units while exports grew by 14.58% to 24,614 units in August 2023 over August 2022.

Tata Motors: The company’s domestic and international sales for August 2023 stood at 78,010 vehicles, down 1.06% compared to 78,843 units sold in August 2022. The company’s total domestic sales dropped 0.29% to 76,261 units sold in August 2023 from 76,479 units sold in the same period last year. Total commercial sales rose 1.9% YoY to 32,077 units sold in August 2023.

Oil and Natural Gas Corporation (ONGC): Global rating agency Fitch Ratings affirmed the company’s long-term foreign-currency issuer default rating (IDR) at ‘BBB-‘ with ‘stable’ outlook. The rating agency has maintained ONGC’s standalone credit profile (SCP) at ‘bbb+’, which reflects ONGC’s scale as the largest oil and gas (O&G) producer in India, its significant reserves and production, and its vertically integrated and geographically diversified business model, which are comparable with that of peers rated in the ‘A’ category by Fitch.

Mahindra Logistics: The company announced its collaboration with Flipkart for integrated line haul solutions that will enhance operational efficiency and consistency. Mahindra Logistics will provide a dedicated fleet of Heavy Commercial Vehicles, assistance in route management and network operations, and advanced analytics for Flipkart’s pan India operations. The fleet deployed by Mahindra Logistics will primarily facilitate Flipkart’s e-commerce parcel movements through hub-to-hub operations.

Coal India: The state-owned coal miner’s production in August 2023 saw a jump of 13.2% at 52.3 Million Tonnes over last year’s 46.2 MT, the company announced on Friday. Further, Coal India’s sales in August 2023 increased by 15.3 per cent to 59 MT in comparison to 51.2 MT in August 2022.

Ashok Leyland: The company announced that total vehicle sales jumped by 10% to 15,576 units in August 2023 from 14,121 units in August 2022. Medium & Heavy Commercial Vehicles (M&HCV) sales increased 17% YoY to 9,763 units, total Light Commercial Vehicles (LCV) sales rose 1% to 5,813 last month. The company’s domestic sales of commercial vehicles during the period under review aggregated to 14,545 units, higher by 9% compared with the same period last year.

NMDC: The state-owned company’s ore production jumped 37.5% to 3.41 million tonnes (MT) in August 2023 as against 2.48 MT in August 2022. Iron ore sales in the month of August 2023 stood at 3.54 MT, a growth of 25.09% as compared with 2.83 MT recorded in the same period previous year. Sequentially, the PSU minor’s iron ore production climbed 39.75% and iron ore sales increased by 16.83% in August 2023 over July 2023.

Atul Auto: The company announced said that its total sales jumped 34% in August 2023 to 2,610 units from 1,950 units sold in August 2022. During the April to August 2023 period, the company’s total sales aggregated to 7,803 units, a decline of 13.83% from 9,055 units sold in the same period a year ago.

Mahindra & Mahindra (M&M): The automaker said that its overall auto sales for the month of August 2023 stood at 70,350 vehicles, registering a growth of 19.14% as against 59,049 vehicles sold in August 2022. On a sequential basis, M&M’s total auto sales rose 6.39% in August 2023 as against 66,124 units sold in July 2023. In the Utility Vehicles segment, Mahindra sold 37,270 vehicles in July 2023, up 25% YoY. Meanwhile, its total tractor sales (domestic + exports) rose 1% YoY to 21,676 units in August 2023 from 21,520 units sold in August 2022.

Aeroflex Industries: The company announced that it has repaid the entire outstanding Kotak Mahindra Bank loan amounting to Rs 32.49 crore from the proceeds of initial public offer and internal accruals. Shares of the company closed at Rs 166.2, up 1.8% to Thursday’s closing price.

Balaji Amines: The company announced that its consolidated net profit declined 57.1% to Rs 52.73 crore in Q1FY24 from Rs 122 crore posted in Q1FY23. Revenue from operations slumped 30.8% to Rs 463.67 crore in Q1FY24 from Rs 670.17 crore in Q1FY23. EBITDA dropped 52.76% to Rs 103.69 crore in Q1FY24 from Rs 219.48 crore in Q1FY23. EBIDTA margin stood at 22.09% in Q1FY24 as compared with 35.52% in Q1FY23.

Escorts Kubota: The company’s agri machinery segment sold 5,593 tractors in August 2023, up 8.5% as compared with 6,111 tractors sold in August 2022. Domestic tractor sales in August 2023 were at 5,198 tractors as against 5,308 tractors sold in August 2022. The deficient monsoon in some regions during the month of August along with shifting of key festive season to the third quarter of this fiscal impacted tractor sales this month.

Greaves Cotton: The company said that AutoEVmart, a multi-brand EV retail store by Greaves Retail, which is the retail and distribution unit of the company, entered into a strategic partnership with Enigma Automobiles. The partnership aims to accelerate the sales and distribution of Enigma’s electric two-wheeler range nationwide through AutoEVmart’s retail network.

Steel Strips Wheels: The company announced that it has achieved a net revenue of Rs 389.77 crore in August 2023, a growth of 10.44% YoY. The firm’s net revenue in the same period last year was Rs 352.93 crore. In volume terms, the exports segment recorded the highest growth (up 271% YoY), followed by Truck segment (up 43% YoY) and Passenger Car – Steel segment (up 25% YoY).

TVS Motor Company: The company posted a sales growth of 4%, rising from 3,33,787 units in August 2022 to 3,45,848 units in August 2023. Total two-wheelers sales increased by 5% to 332,110 units in August 2023 from 315,539 units sold in August 2022. Domestic two-wheeler sales stood at 256,619 units in August 2023, registering a growth of 7% as compared to 239,325 units sold in the same period last year. The company’s total exports declined 6.01% to 87,515 units in August 2023 as against 93,111 units in August 2022.

Eicher Motors: The automaker’s subsidiary, VE Commercial Vehicles (VECV), has reported 29.4% YoY jump in commercial vehicles (CV) sales to 6,476 units in August 2023. The total domestic sales of Eicher trucks and buses surged 30.4% to 5,907 units while total exports slipped 8.5% to 332 units in August 2023 over August 2022.

Optiemus Infracom: The company and Corning International, one of the world’s leading innovators in glass and glass-ceramic materials for mobile consumer electronics applications, announced a joint venture to set up India’s first manufacturing facility for producing high-quality finished cover glass parts for the mobile consumer electronics industry. As a part of the joint venture, the companies aim to set up a world-class manufacturing facility in India, powered by cutting-edge technologies and processes.

Sumitomo Chemical India: The company has executed a definitive agreements for acquiring 85% equity shares and controlling stake on fully diluted basis in Barrix Agro Sciences, a Bangaluru-based company engaged in the business of developing and providing to farmers pheromone traps and chromatic sheets. It is also engaged in the business of bio-products and micronutrients. The transaction is subject to customary closing conditions and approvals.

VST Tillers: The tractor manufacturer’s total sales increased 12.08% to 4,037 units in August 2023 from 3,602 units sold in August 2022. Sequentially, the company’s total sales tumbled 26.68% in August 2023 from 5,506 units sold in July 2023. The company’s power tillers sales grew 20.56% to 3,616 units in August 2023 from 3,002 units in August 2022. On the other hand, total tractor sales dropped 29.83% to 421 units during the month as against 600 units sold in August 2022.

Shiva Texyarn: The yarn and technical textiles manufacturer announced that it has received an order for supply of 16,000 units of NBC Haversack MK-II from Air Officer Commanding, Pune. The value of the contract is Rs 5.44 crore and the delivery period for the supply of items would be 180 days against placement of purchase order.