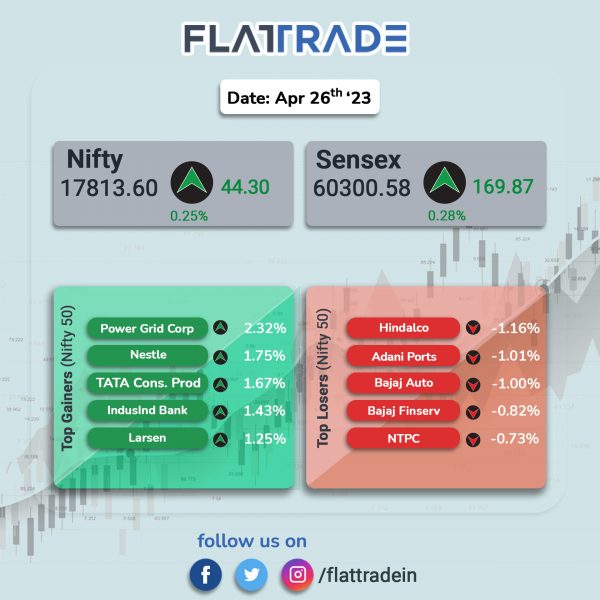

Benchmark equity indices closed higher, aided by gains in Realty, FMCG and Auto stocks. The Sensex gained 0.28% and the Nifty 50 index was up 0.25%.

In broader markets, the Nifty Midcap100 index was up 0.15% and the BSE Smallcap index rose 0.34%.

Top gainers were Realty [1.36%], FMCG [0.71%], Auto [0.53%], PSU Bank [0.52%] and Private Bank [0.46%]. Top losers were Metal [-0.44%], Energy [-0.09%] and Oil & Gas [-0.03%].

Indian rupee rose 15 paise to 81.76 against the US dollar on Wednesday.

Stock in News Today

Maruti Suzuki: The automaker said that its standalone net profit surged 42.67% YoY to Rs 2,623.6 crore. Its net sales rose 20.8% YoY to Rs 30,821.8 crore in Q4FY23. The operating profit for the reported quarter stood at Rs 2,611.1 crore, a rise of 46.7% YoY, on account of higher sales volume, improved realization from the market, and favourable forex movement. The company sold a total of 5,14,927 vehicles during the quarter, higher by 5.3% compared to the same period previous year.

On full year basis, the company’s net profit zoomed 113.72% to Rs 8,049.2 crore on 34.25% rise in net sales to Rs 1,12,500.8 crore in FY23 over FY22. The company sold a total of 1,966,164 vehicles during the fiscal 2023, up 19% from 1,652,653 vehiclec in FY22. The board has approved a dividend of Rs 90 per share for the financial year 2022-23.

KPIT Technologies: The IT firm said that its consolidated net profit rose 11.06% YoY to Rs 111.60 crore in Q4FY23. Revenue from operations increased 10.93% YoY to Rs 1,017.37 crore in Q4FY23. EBITDA stood at Rs 194.26 crore in Q4FY23, a growth of 60.02% YoY. EBITDA margin improved to 19.1% in Q4FY23 as against 18.5% in Q3FY23 and 18.6% posted in Q4 FY22.

Dalmia Cement: The company will acquire JP Super, after its pending arbritation with UltraTech, for Rs 1500-crore excluding additional costs and expenses of up to Rs 190 crore. The transaction also includes the acquisition of 74% stake in Bhilai Jaypee Cement for Rs 666 crore. The deal also entails a long-term lease agreement for seven years with Jaiprakash Power Ventures to acquire its Nigrie Cement Grinding Unit. The unit can be acquired during the lease period for Rs 250 crore.

Union Bank Of India: The lender plans to raise Rs 10,100 crore through equity and debt. The lender agreed to raise equity capital up to Rs 8,000 crore in tranches through either or a combination of public issue, rights issue and private placement. It also agreed to raise up to Rs 2,100 crore via Basel III compliant additional Tier 1, Tier 2 bonds.

Multi Commodity Exchange of India (MCX): Shares of the company tumbled over 6% after Shashank Sathe, chief technology officer (CTO) of the company tendered his resignation on account of personal reasons and for better prospects. Meanwhile, Dr. N. Rajendran, chief digital officer of the company has been advised to look after the portfolio of the CTO, said MCX.

KEC International: The company announced that it has secured new orders of Rs 1,017 crore across its various businesses. Vimal Kejriwal, MD & CEO, KEC International, said that the civil business continues to be on a high growth trajectory and widens its presence by securing orders in the composite space.

Tata Steel Long Products: The company reported a standalone net loss of Rs 184.11 crore in Q4FY23 as against a net profit of Rs 59.62 crore in Q4FY22. Net sales declined by 1.9% YoY to Rs 1,765.47 crore during the quarter under review. The company reported a standalone net loss of Rs 1,085.49 crore in FY23 as against a net profit of Rs 629.87 crore in FY22. Net sales increased by 10% YoY to Rs 7,464.07 crore in FY23.

Dhampur Bio Organics: The company’s consolidated net profit rose 13% YoY to Rs 80.20 crore and net sales jumped 58.8% YoY to Rs 803.23 crore in Q4FY23. On full year basis, the company’s consolidated net profit rose 8.6% to Rs 111.10 crore on 53.9% jump in net sales to Rs 2,407.53 crore in FY23 over FY22.

The board has approved for expansion of sugar units capacity by 4000 tonnes crushing per day (TCD). With the proposed expansion, the total capacity of the company will be augmented to 26,000 TCD from 22000 TCD. The board has recommended a dividend of Rs 3.5 per equity share for FY23, subject to approval of shareholders. The record date for the same is fixed on 23 June 2023.

VST Industries: The company reported 21.2% decline in net profit to Rs 68.70 crore in Q4FY23 from Rs 87.19 crore in Q4FY22. Revenue from operations fell marginally to Rs 300.86 crore in Q4FY23 from Rs 302.07 crore posted in same quarter last year. The board has recommended a final dividend of Rs 150 per equity share, the dividend will be paid within 30 days of the approval of shareholders.

Rallis India: The company’s net loss widened to Rs 69.13 crore in Q4FY23 as against a net loss of Rs 14.13 crore posted in Q4FY22. Revenue from operations rose 3% YoY to Rs 522.62 crore in the quarter ended March 2023 from Rs 507.54 crore in Q4 FY22. Rallis India reported 44.3% decline in net profit to Rs 91.49 crore despite of 13.9% rise in net sales to Rs 2,966.97 crore in FY23 over FY22.

GMR Airports Infrastructure: The company announced that its step-down subsidiary GMR Goa International Airport (GGIAL) has received a sum of Rs 631.24 crore from NIIF towards subscription of 63,124 compulsory convertible debentures (CCDs) of GGIAL. In December 2022, GMR Airports (GAL) and National Investment and Infrastructure Fund (NIIF) had announced a financial partnership for NIIF to invest in the equity capital of three airport projects.

Nippon Life India Asset Management: The company’s net profit rose by 13% YoY to Rs 197.7 crore on a 3% YoY increase in revenue from operations to Rs 348.3 crore in Q4FY23. Its operating profit remained flat at Rs 199.5 crore on a yearly basis. As on 31 March 2023, NAM India’s assets under management (AUM) was Rs 3,62,981 crore (US$ 44.2 billion).

Gujarat State PSUs: Shares of seven PSUs in Gujarat rallied after the state government announced a policy for minimum levels of dividend distribution and bonus shares for state PSUs. The State Government of Gujarat has mandated a minimum of 30% of profit after tax or 5% of net worth, whichever is higher to be a minimum level of dividend declared for shareholders.

Patel Engineering: The company’s consortium received letter of awards (LOAs) for Krishna Marathwada Irrigation Project from Water Resources Department, Government of Maharashtra. The project is expected to be completed within a period of 36 months.