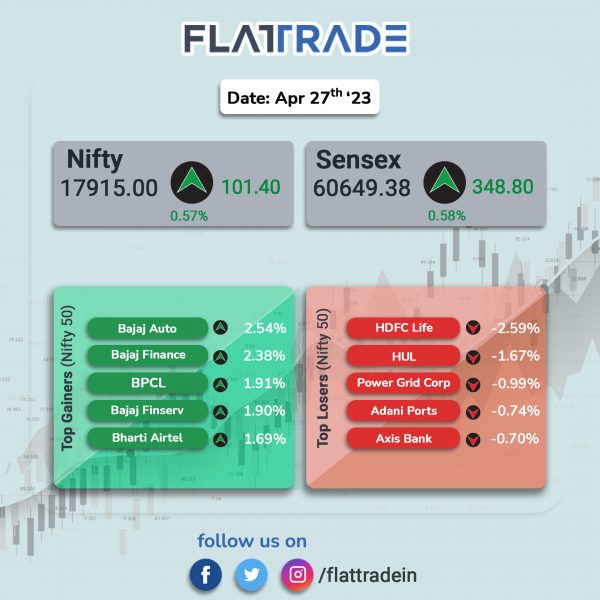

Dalal Street closed higher on broad-based buying and overall investor optimism. The Sensex rose 0.58% and the Nifty gained 0.57%.

In broader markets, the Nifty Midcap 100 index rose 0.56% and the BSE Smallcap advanced 0.62%.

Top gainers were Realty [1.53%], IT [1.07%], Auto [0.76%], Metal [0.71%], and Healthcare [0.7%]. Top loser was FMCG [0.06%].

Indian rupee fell 7 paise to 81.84 against the US dollar on Thursday.

Stock in News Today

Hindustan Unilever (HUL): The FMCG major reported 9.67% YoY rise in standalone net profit to Rs 2,552 crore on 10.98% YoY increase in revenue to Rs 14,638 crore in Q4FY23. EBITDA for the quarter stood at Rs 3,471 crore, up 7% YoY. EBITDA margin reduced to 23.7%, down 90 bps YoY in Q4FY23. Meanwhile, the company’s board has recommended a final dividend of Rs 22 per equity share for the financial year ended 31 March 2023. For the fiscal 2023, HUL’s net profit jumped nearly 13% YoY to Rs 9,962 crore on 15.53% YoY rise in turnover to Rs 58,154 crore.

Godrej Consumer: The company announced that it will acquire FMCG business of Raymond Care for Rs 2825 crore. Along with the FMCG business, Godrej Consumer is also acquiring the trademarks of Park Avenue, KS, KamaSutra, and Premium, through a slump sale.

Coforge: The IT services company said its consolidated revenue from operations increased to Rs 2,170 crore in Q4FY23 from Rs 1,742.9 crore in the year-ago period. The net profit fell to Rs 116.7 crore in Q4FY23 from Rs 224.8 crore in Q4FY22. In Q4FY23, the company’s order intake was $301 million. Total order book executable over the next 12 months at $869 million. The firm has upgrade its financial year 2024 annual growth guidance of 13%-16% in constant currency terms, expects a gross margin increase of about 50 bps and adjusted EBITDA margin to be at similar levels as FY23. Meanwhile, the board has recommended an interim dividend of Rs 19 per share and the record date for this payout will be 9 May 2023.

Bajaj Finserv: The financial services firm said that consolidated revenue was up 25% YoY at Rs 23,625 crore in Q4FY23 from Rs 18,862 crore in Q4FY22. Consolidated net profit rose 31% YoY to Rs 1,768 crore in Q4FY23 from Rs 1,346 crore in Q4FY22. EBITDA jumped 31% to Rs 4,719 crore in Q4FY23 from Rs 3612 crore in Q4FY22. The board announced a dividend of Rs 0.80 per share.

Laurus Labs: The company said its consolidated revenue dropped 3% YoY to Rs 1,381 crore in Q4FY23 from Rs 1,425 crore in the year-ago period. Consolidated net profit fell 55% YoY to Rs 103 crore from Rs 231 crore in the year-ago period. EBITDA fell 28% YoY to Rs 286 crore in Q4FY23 from Rs 397 crore in the corresponding quarter last fiscal.

Oracle Financial Services Software (OFSS): The company reported a consolidated net income to Rs 479.3 crore in Q4FY23, which is higher by 10% from Rs 4,373 in Q3FY23. Total revenue increased by 1% QoQ to Rs 1,470.5 crore in the fourth quarter. Operating income improved by 8% to Rs 624.5 crore in Q4FY23 from Rs 579 crore in Q3FY23. Operating income margin was at 43% in Q4 Y23 as against 40% in Q3FY23. The board of directors of the company declared an interim dividend of Rs 225 per equity share for the financial year 2022-23.

On a consolidated basis, revenue for fiscal year 2023 was Rs 5,698 crore, up 9% compared to fiscal year 2022. Net Income for fiscal year 2023 was Rs. 1,806 Crore, down 4% compared to fiscal year 2022.

HDFC Bank: The lender’s board has approved appointment of Kaizad Bharucha as Deputy Managing Director and Bhavesh Zaveri as Executive Directo for 3 years, effective April 19.

Welspun India: The company’s consolidated revenue fell 3% YoY to Rs 2,153.90 crore in Q4FY23 from Rs 2,227.09 crore. Consolidated net profit jumped 152% YoY to Rs 128.99 crore in Q4FY23 from Rs 51.25 crore in the year-ago period. Ebitda rose 9% YoY to Rs 663.23 crore in Q4FY23 as against Rs 605.79 crore in the year-ago period. The company’s board announced a dividend of Rs 0.10 per share and also approved buyback of Rs 120 per share aggregating to Rs 195 crore via tender offer.

Embassy Office Parks REIT: The company said its consolidated revenue was up 16% YoY to Rs 867.6 crore in Q4FY23 as against Rs 748.8 crore in Q4FY22. Consolidated net profit slumped 87% YoY to Rs 35.45 crore in Q4FY23 from Rs 279.18 crore in Q4FY22. Ebitda was up 27% YoY to Rs 1,168.7 crore in Q4FY23 as against Rs 920.25 crore in Q4FY22. The company’s board appointed Aravind Maiya as the CEO following Vikaash Khdloya’s resignation.

Suzlon Energy: The company said that it has received a 39 megawatt (MW) order for their 3 MW product series from a thermax group company, First Energy 5. This order is part of a 100 MW wind‐solar hybrid project by First Energy 5. Suzlon will install 13 wind turbine generators (WTGs) with a hybrid lattice tubular (HLT) tower and a rated capacity of 3 MW each. The project to be located at Thalaikattupuram, Tuticorin in Tamil Nadu and is expected to be commissioned in 2024. A project of this size can provide electricity to approximately 32,000 households and curb around 1.26 lakh tonnes of CO2 emissions per year.

Ipca Laboratories: The company announced that the USFDA had issued form 483 with three observations post the inspection of its formulations manufacturing unit situated at Piparia. The inspection was conducted from 18th to 26th of April 2023. “The company will submit its comprehensive response on these observations to the US FDA within the stipulated time and shall work closely with the agency to resolve these issues at the earliest,” the company said.

UTI AMC: The company reported 58.7% jump in consolidated net profit to Rs 85.70 crore in Q4FY23 from Rs 53.99 crore posted in Q4FY22. Total revenue from operations declined marginally year-on-year to Rs 300.69 crore during the quarter ended March 2023 from Rs 301.09 in the year-ago period. For the full year, the company reported 18.1% decline in consolidated net profit to Rs 437.36 crore on 4% fall in total income to Rs 1,266.86 crore in the FY23 over FY22. The board recommended a final dividend of Rs 22 per equity share of face value of Rs 10 each for the FY23, subject to the approval from the shareholders.

Chennai Petroleum Corporation (CPCL): The company’s standalone net profit increased marginally to Rs 1,004.19 crore in Q4FY23 from Rs 994.42 crore recorded in Q4FY22. Net sales grew by 9.72% to Rs 18,008.89 crore in the quarter ended March 2023 from Rs 16,413.57 crore recorded in the corresponding quarter previous year. Meanwhile, the company’s board has recommended a final equity dividend of Rs 27 per equity share for FY23. Further, the board has also recommended a preference dividend of 6.65% on the outstanding preference shares amounting to Rs 33.25 crore for the year FY2023.

Surya Roshni: The company said its net profit rose 87.9% YoY to Rs 155.6 crore in Q4FY23 from Rs 82.8 crore in the year-ago period. Revenue fell 6.5% YoY to Rs 2,151.3 crore in the quarter under review as against Rs 2,301.4 crore in the year-ago period. EBITDA rose 66% YoY to Rs 252.5 crore in the reported quarter.

Swaraj Engines: The company’s consolidated net profit jumped 59.9% to Rs 34.96 crore in Q4FY23 as compared with Rs 21.86 crore in Q4FY22. Revenue from operations stood at Rs 359.79 crore in Q4FY23, a growth of 48.5% from Rs 242.35 crore posted in corresponding quarter last year. The board has given its approval to further enhance the engine capacity to 1,95,000 units per annum. The total projected outlay for the same would be financed through internal generations /surplus available, the company said. The board has recommended a dividend of Rs 92 per share for FY23.

For financial year 2023, the company’s consolidated net profit advanced 22.1% to Rs 133.61 crore on 24.9% jump in net sales to Rs 1,421.82 crore in FY23 over FY22.

Rail Vikas Nigam Limited (RVNL): The company has received a Letter of Acceptance for a project worth Rs 121 crore from Jhansi division of North Central Railway. The exact cost of project is Rs 121,05,77,446 and it is expected to be completed within 545 days or 1.49 years.