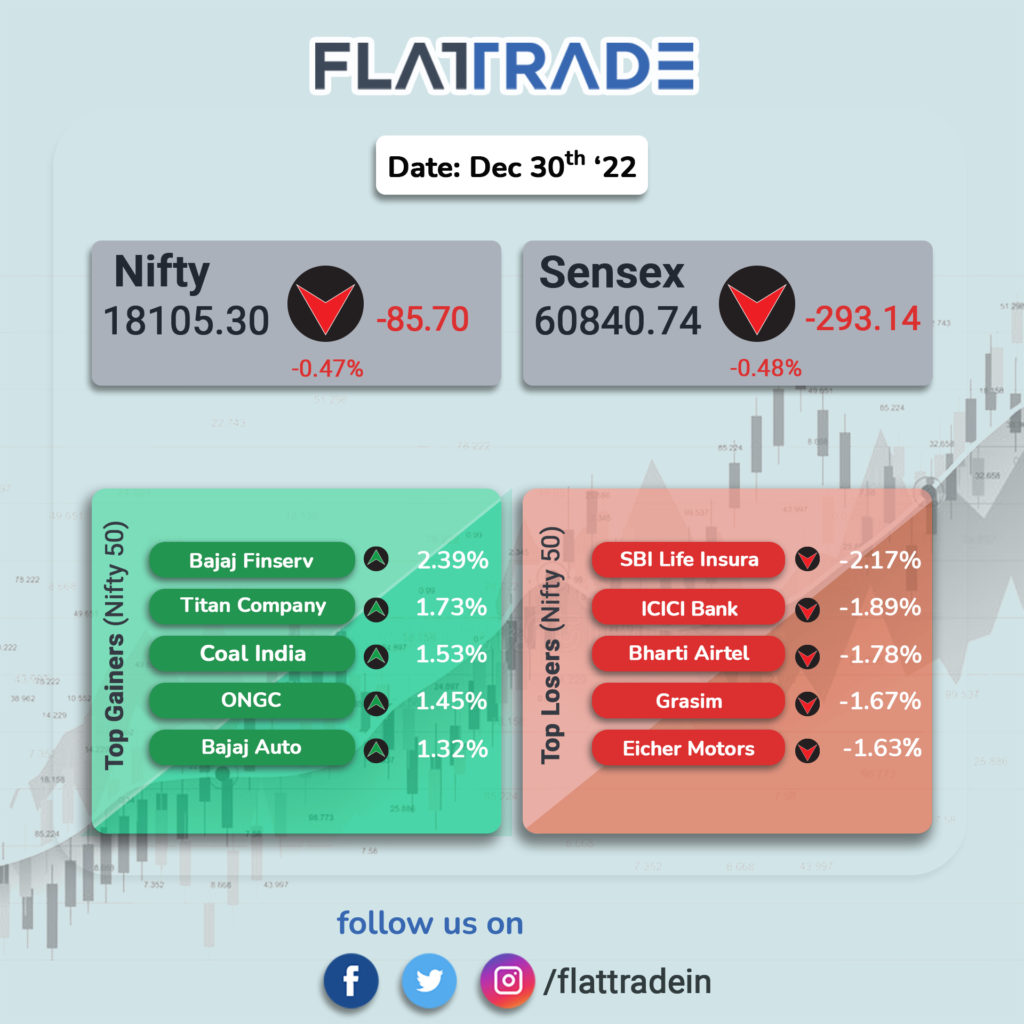

Domestic equity indices ended a downtrend on the last trading day of the year 2022. The Sensex was down by -0.48% and the Nifty 50 index plummeted by -0.47% to end above 18100, PSU banks outperformed.

In broader markets, Nifty Bank was down by -0.61% and the BSE FMCG was down -0.59%, BSE SmallCap was up by 0.76%, and BSE MidCap was up by 0.37%.

Top losers among Nifty sectoral indices are metal, realty, and PSU Bank indices up 0.5-1 percent, while power, bank, and FMCG indices are down 0.5 percent each.

The Indian rupee fell 8 paise to 82.72 against the US dollar on Friday.

Stock in News Today

Lotus Chocolate: Reliance Retail Ventures subsidiary Reliance Consumer Products will acquire a 51% controlling stake in Lotus Chocolate Company, for Rs 74 crore, and make an open offer to acquire up to 26%. The capital infusion by Reliance Consumer Products will help drive the growth and expansion of Lotus into a comprehensive confectionery, cocoa, chocolate derivatives, and related products manufacturer.

Tata Power: The company has raised Rs 1,000 crore via allotment of 10,000 non-convertible debentures. These NCDs will be listed on the WDM segment of BSE.

Marine Electricals: The company bags an order worth Rs 14.07 cr from Larsen & Toubro Limited for the supply of a Power Distribution Board and Bus Bar Type for the data center at Kanchipuram amounting to Rs 9.65 crore. The delivery shall be completed over a period of 2 months and Garden Reach Shipbuilders & Engineers for the supply of Electrical Package for NG Electric Ferry project amounting to Rs 4.42 crore. The delivery shall be completed over a period of 6 months.

Welspun Enterprises: The company has today decided in a meeting, subject to shareholders’ approval, to undertake a buyback of 1,17,50,000 equity shares of Rs 10 each at the buyback price of Rs 200 per equity share, for an aggregate amount of Rs 235 crore, representing 14.22% and 15.74% of the total paid-up equity share capital and free reserves.

Kalpataru Power: Kalpataru Power Transmission & its international subsidiaries have secured new orders/notification of awards of Rs 1,247 crore in India and overseas markets in the T&D business.

HPL Electric and Power: The electric manufacturer has received a significant order, worth Rs 161.59 crore, for the supply of smart meters to serve a leading private DISCOM player. This win underscores the Company’s dominant market position in the smart metering space and fortifies its reputation as a strong advanced meter solutions company. This new order has expanded the Company’s metering order book to exceed Rs. 600 crores as of 29th December 2022.

Elin Electronics: The last listing for this calendar year failed to create sparks on Dalal Street as the shares opened at a 1.5 percent discount to issue a price of Rs 243.