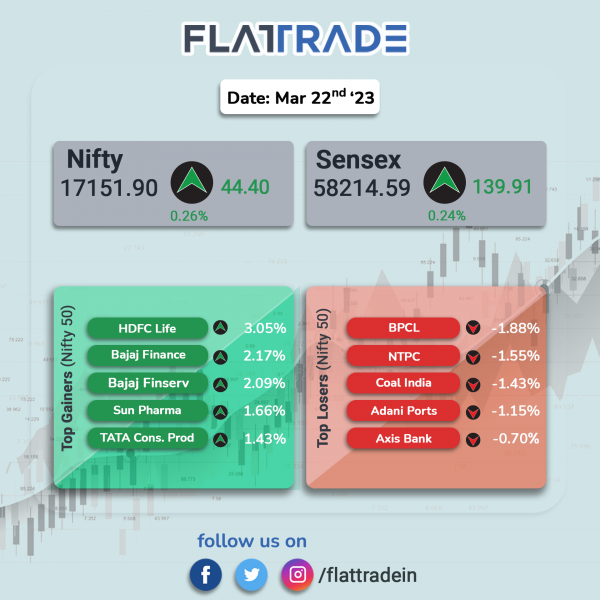

Benchmark indices ended higher ahead of the Fed’s monetary policy decision due later today. PSU banks and pharma stocks supported the indices. The Sensex rose 0.24% and the Nifty 50 index gained 0.26%.

In broader markets, Nifty Midcap 100 index rose 0.28% and the BSE Smallcap jumped 0.54%.

Top gainers were Pharma [1.04%], PSU Bank [0.83%], Auto [0.49%], FMCG [0.44%] and Private Bank [0.38%]. Top losers were Media [-0.32%] and Realty [-0.10%].

Indian rupee fell by 2 paise to close 82.66 against the US dollar on Wednesday.

Stock in News Today

Larsen & Toubro (L&T): The Construction arm of the company has secured orders for its Water & Effluent Treatment and Buildings & Factories Businesses. According to the company’s project classification, the orders are significant and range between Rs 1000 crore to Rs 2000 crore. The company has secured a repeat order from the Drinking Water & Sanitation Department, Government of Jharkhand to execute a Raw Water Transport System on turnkey basis from the proposed intake at Neghra, Rajmahal in Sahibganj district to Sundar Dam in Godda district. The project will provide bulk raw water to villages in Sahibganj, Godda and Dumka districts of Jharkhand.

JK Tyre & Industries: The company has received an investment of $30 million (Rs 240 crore) from International Finance Corporation (IFC) to part finance the expansion of manufacturing capacities and integrate advanced, resource-efficient technologies in the production of commercial and passenger car radial tyres which have better safety and longevity. IFC will hold 5.6 % stake in the manufacturer through issue of compulsorily convertible debentures (CCDs) on preferential basis.

Sula Vineyards: Shares of the company rose over 9% in intraday trading after a foreign broker CLSA initiated coverage on the stock on Tuesday with a ‘buy’ rating and a 12-month price target of Rs 475. According to the broker, the global consumer shift towards the low-alcohol beverage segment and a healthy operating margin plays in favour of Sula Vineyards.

The brokerage firm cited that Sula has strong backend capabilities and a pan Indian distribution market and its ability to invest in its own premium brand is a key for the long term. Over the next two years, brokerage expects Sula’s revenue to grow at a compounded annual growth rate (CAGR) of 17.5% and EPS growth of 18.5%. Change in wine incentives schemes remains a key regulatory risk, it added.

RailTel: The public sector enterprise announced that it has received work order from Madhya Pradesh State Electronics Development Corporation, aggregating to Rs 34.91 crore. The contract involves expansion of State Data Center (SOC) and establishment of Disaster Recovery (DR) Center with 5 years of maintenance.

Sobha: Shares of the company fell more than 16% in intradya trade after the real estate developer informed that the Income Tax (I-T) department is carrying out a search at its registered office and other premises. “We would like to inform you that a search by the Income Tax Department is being carried out at the registered office and other premises of Sobha Limited. Further, as a responsible company all the concerned employees/staff of the Company are extending their full cooperation to the Officials,” the realty firm said in a statement.

Kuantum Papers: The company announced that in view of better than envisaged business operations and healthy cash flows, the company had prepaid the entire FITL of Rs 36 crores in September 2022 which was otherwise repayable up to FY 2029-30 and had further prepaid term loans of Rs 105 crores in December 2022. The company has further prepaid an amount Rs 102 crore of the restructured term loans in the 3rd week of March 2023. This is in addition to the regular repayments due after the moratorium of 2 years ended on 31 August 2022.

Zydus Lifesciences: The company’s subsidiary, Zydus Pharmaceuticals (USA) Inc., has received final approval and tentative approval from the USFDA for Tofacitinib tablets. According to IQVIA MAT December 2022, Tofacitinib Tablets had annual sales of $900 million in the United States. Tofacitinib is indicated for the treatment of adult patients with moderately to severely active rheumatoid arthritis and for the treatment of adult patients with active psoriatic arthritis.

Patel Engineering: The company announced that the company along with its JV Partner has received letter of acceptance for Tumkur Branch Canal (Package V) micro irrigation project from Visvesvaraya Jala Nigama (VJNL), which was declared as L1 earlier. The value of the contract is Rs 551.11 crore. The company being 51% partner in the JV, its share in the project is Rs 281.07 crore.

Asian Energy Services: The company received letter of award (LoA) from Svetah Energy Infrastructure FZE, UAE, for operations and maintenance works (O&M) of Svetah Venetia, a floating production storage and offloading system. The estimated value of LoA is around $20 million or Rs 165 crore. The primary term is proposed to be 5 years commencing from the date of readiness of Svetha Venetia to receive hydrocarbons from PY_3 field.

Emami: Share price surged over 8% in intraday trade after the company announced that its board will meet on Friday, 24 March 2023, to consider a share buyback. As on 31 December 2022, the promoters held 54.27% stake in Emami.

Bandhan Bank: The lender’s board has appointed Ratan Kumar Kesh as Executive Director (ED) of the bank and the Reserve Bank of India (RBI) has also approved the appointment. Further, on March 21, the bank informed exchanges that it has received binding bids of Rs 369.20 crore for a written-off portfolio worth Rs 2,614.03 crore; and Rs 370.62 crore for non-performing assets (NPA) originating from banking units worth Rs 2,316.32 crore, on security receipt consideration basis for transferring loans to asset reconstruction company.

VST Tillers Tractors: The company announced that it had crossed a production milestone of 500,000 power tillers from its state-of-the-art manufacturing plant at Malur – Benguluru in Karnataka. The company said that the milestone is a testimony to the customer’s confidence in the VST power tillers.

Gensol Engineering: The company will 100% stake in Scorpius Trackers for 135 crore via bank transfer, shares swap and capital infusion directly in the target company. The company is planning to complete the the acquisition by June 30, 2023. With this acquisition Gensol Engineering will be able to offer to its clients an end-to-end EPC solution.

Mastek: The company announced that Ashank Desai will relinquish his role as Vice Chairman and Managing Director and become Chairman and Managing Director from April 1.