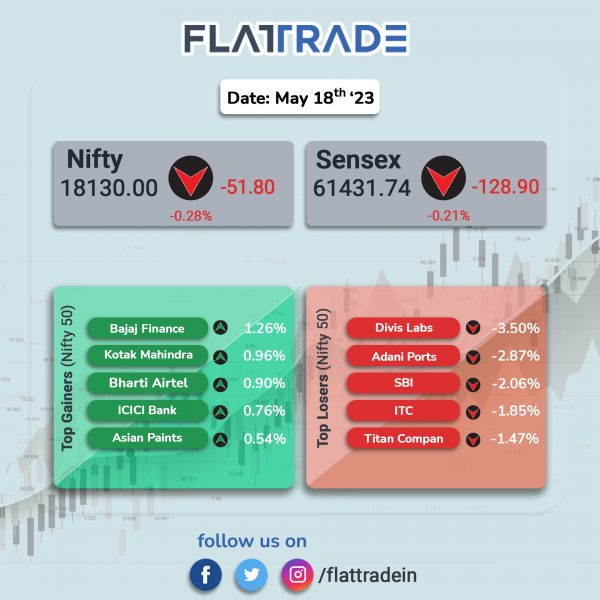

Sensex, Nifty ended in the red as losses in index heavyweights such SBI, ITC, HUL weighed on the markets and investors remained cautious due to the uncertainty over the US debt ceiling talks. The Sensex fell 0.21% and the Nifty 50 index was down 0.28%.

In broader markets, the Nifty Midcap 100 index dropped 0.59% and the BSE Smallcap declined 0.26%.

Top losers were Realty [-2.37%], PSU Bank [-1.9%], Pharma [-1.27%], Oil & Gas [-1.1%], and FMCG [-1.1%]. Top gainers were Private Bank [0.32%], Financial Services [0.32%], and Bank [0.12%].

Indian rupee fell 22 paise to 82.6 against the US dollar on Thursday.

Stock in News Today

State Bank of India (SBI): The country’s largest lender reported a net profit of Rs 16,694.5 crore in Q4FY23, up 83% from Rs 9,113.5 crore in Q4FY22. The net interest income (NII) during Q4FY23 increased 29.5% YoY to Rs 40,392 crore from Rs 31,197 crore. Its net interest margin (NIM) for Q4FY23 increased by 44 bps YoY to 3.84%. Operating profit during the quarter grew by 24.87% YoY to Rs 24,621 crore.

Net NPA fell 8.6% QoQ to Rs 21,466.6 crore from Rs 23,484 crore, while net NPA ratio decreased by 10 bps to 0.67% from 0.77%, QoQ. For FY23, SBI’s net profit stood at Rs 50,232 crore, witnessing a growth of 58.58% YoY. The bank’s board also recommended a dividend of Rs 11.30 per equity share for FY23. The dividend will be paid on June 14, 2023, the bank said.

ITC: The company’s consolidated net profit rose 23% year-on-year to Rs 5,175 crore in Q4FY23 from Rs 4,196 crore in the year-ago period. Revenue from operations during the March quarter surged 7% to Rs 19,058 crore as against Rs 17,754 crore in the year-ago quarter. Segment-wise, revenue from the cigarettes business rose 13% year-on-year to Rs 8,082 crore for the quarter under review compared with Rs 7,177 crore in the same quarter last year.

The board has recommended a final dividend of Rs 6.75 and a special dividend of Rs 2.75 per equity share.The dividend is expected to be paid between August 14 and 17 to all eligible members. The board has fixed May 30 as the record date to determine the eligibility of shareholders. Together with the interim dividend of Rs 6 per share, the total dividend for the financial year 2022-2023 would be Rs 15.50.

GAIL: The company reported a standalone net profit of Rs 603.52 crore in Q4FY23, down 77.5% from Rs 2,683.11 crore in the year-ago period. Its revenue from operations stood at Rs 32,858.20 crore, up 21.8% from Rs 26,968.21 crore in the year-ago period. The company’s Ebitda stood at Rs 307 crore, up 17.6% sequentially.

Zydus Lifesciences: The company’s net profit for Q4FY23 dropped 25.4% to Rs 296.6 crore from Rs 397.4 crore in the corresponding quarter of last fiscal. The decline in profit was attributed to a one-time loss of Rs 601.3 crore that includes impairment of goodwill relating to Sentynl Therapeutics and expenses incurred in connection with cessation of operations at one of the facilities of Zydus Wellness Ltd, the company said.

The company’s consolidated revenue from operations in Q4FY23 increased 29.7% YoY to Rs 5,010.6 crore from Rs 3,805.6 crore. Ebitda rose 75.1% to Rs 1,257 crore in the reported quarter from Rs 718 crore in the year-ago period. The company’s board of directors also recommended a final dividend of Rs 6 per equity share of Re 1 each, subject to approval of the shareholders. The record date for dividend has been fixed at July 28, 2023.

GIC Housing Finance: The company reported 6.8% rise in consolidated net profit to Rs 52.33 crore despite a 0.9% decline in total income to Rs 287.40 crore in Q4FY23 over Q4FY22. Interest outgo increased by 7.6% YoY to Rs 178.19 crore in Q4FY23. Operating profit before provisions & contingencies was Rs 74.20 crore in Q4FY23, down 22.4% YoY. The board approved the re-validation of board resolution for raising of funds by issue of redeemable non-convertible debentures (NCDs)/bonds through private placement basis up to Rs 2,500 crore. The board also recommended a dividend of Rs 4.50 per equity share for FY23. It approved the appointment of Darshit Sheth as chief compliance officer.

Wheels India: The auto ancillary firm said that net profit was down 9% YoY at Rs 24.3 crore as against Rs 27 crore in the year-ago period. Revenue was up 5.4% YoY at Rs 1,251.9 crore as against Rs 1,187.7 crore in the year-ago period. EBITDA slipped 0.4% YoY to Rs 71.7 crore in Q4FY23 as against Rs 72 crore in Q4FY22.

Arvind: The textile company said its net profit was up 12.4% YoY at Rs 97 crore in Q4FY23 as against Rs 86 crore in Q4Fy22. Revenue was down 14.4% YoY at Rs 1,880.8 crore in Q4FY23 as against Rs 2,197 crore in Q4FY22. EBITDA fell 19.7% YoY at Rs 190.9 crore in Q4FY23 as against Rs 237.8 crore in Q4FY22.

JK Tyre & Industries: The company’s net profit stood at Rs 108.4 crore in Q4FY23 as against Rs 40 crore in Q4FY22. Revenue was up 9.7% YoY at Rs 3,632.5 crore in Q4FY23 as against Rs 3,311.8 crore in Q4FY22. EBITDA was up 65% YoY at Rs 376.2 crore in Q4FY23 as against Rs 227.9 crore Q4FY22.

Railtel Corporation Of India: The company said net profit was up 40% YoY at Rs 76 crore in Q4FY23 as against Rs 54 crore in Q4FY22. Revenue was up 51% YoY at Rs 703.6 crore in Q4FY23 as against Rs 465.5 crore in Q4FY22. EBITDA was up 2% YoY at Rs 98.2 crore in Q4FY23 as against Rs 96.4 crore in Q4FY22.

Clean Science and Technology: The company’s net profit was up 29% YoY at Rs 80.5 crore in Q4FY23 from Rs 62.3 crore in Q4FY22. Revenue was up 6% YoY at Rs 216.9 crore in Q4FY23 as against Rs 204.6 crore in Q4FY22. Ebitda was up 25.4% YoY at Rs 105 crore in Q4FY23 as against Rs 83.7 crore in Q4FY22.

PSP Projects: The company reported a net profit of Rs 45.9 crore in Q4FY23, down 16.8% YoY from Rs 55 crore. Revenue was up 31.6% YoY at Rs 729.6 crore in Q4FY23 from Rs 554.6 crore in Q4FY22. Ebitda was down 8.2% YoY at Rs 81 crore in Q4FY23 from Rs 88.2 crore in Q4FY22.

Shalby: The company said its net profit was down 8.5% YoY at Rs 14 crore in Q4FY23 from Rs 15.3 crore in Q4FY22. Revenue fell 1.7% YoY to Rs 199 crore in Q4FY23 from Rs 202.5 crore in Q4FY22. Ebitda was down 24.5% YoY at Rs 25.6 crore in Q4FY23 from Rs 33.9 crore in Q4FY22.

Surya Roshni: The company announced that it has bagged an orders worth Rs 105.92 crore from Indraprastha Gas, Indian Oil Corporation and Maharashtra Natural Gas. Surya Roshni is one of the largest GI steel pipe manufacturer and it is also in the business of lighting products and manufacturing.

Mtar Technologies: The company’s consolidated net profit rose to Rs 31.07 crore in Q4FY23 from Rs 19.80 crore in Q4FY22. Revenue from operations surged 99.2% to Rs 196.40 crore in Q4FY23 from Rs 98.58 crore in Q4FY22. Ebitda stood at Rs 49.1 crore in Q4FY23 from Rs 27.7 crore in Q4FY22, registering the growth of 77.1%. Meanwhile, the board has approved the reappointment of P Srinivas Reddy as a managing director of the company for a period of 5 years with effect from 01 September 2023.

Orient Paper: The company net profit at Rs 50 crore in Q4FY23 as against a net loss of Rs 2.2 crore in the year-ago period. Revenue jumped 35.3% YoY to Rs 258.5 crore in Q4FY23 as against Rs 191.1 crore in Q4FY22. Ebitda stood at Rs 68.4 crore in Q4FY23 as against Rs 4.5 crore in Q4FY22.