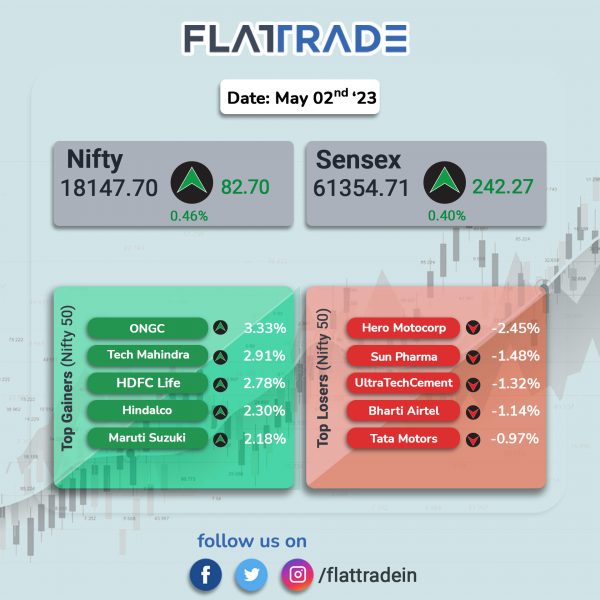

Dalal Street made steady gains on Tuesday as investor sentiments were boosted after companies reported strong earnings. The Sensex rose 0.4% and the Nifty 50 index advanced 0.46%.

In broader markets, the Nifty Midcap 100 index jumped 0.97% and the Smallcap rose 0.63%.

Top gainers were Metal [1.42%], Energy [1.32%], Oil & Gas [1.16%], IT [1.14%], and Auto [0.71%]. Top losers were Pharma [-0.19%], FMCG [-0.13%] and Realty [-0.03%].

Indian rupee fell 5 paise to 81.88 against the US dollar on Tuesday.

Stock in News Today

Adani Total Gas: The company said its net profit was up 21% YoY at Rs 98 crore in Q4FY23 as against Rs 81 crore in the year-ago period. Revenue was up 10.2% YoY at Rs 1,114.8 crore as against Rs 1,012 crore in the year-ago period. EBITDA jumped 48.8% YoY to Rs 195.2 crore as against Rs 131.2 crore in the year-ago period.

Varun Beverages: The bottling company said its consolidated net profit surged 61.8% to Rs 438.57 crore in Q1CY23 and revenue from operations rose 37.7% YoY to Rs 3,892.98 crore in the reported quarter. The increase in profit after tax was driven by high growth in revenue from operations, improvement in margins, and transition to a lower tax rate in India. During Q1CY23, total sales volumes grew by 24.7% YoY to 224.1 million cases from 179.7 million cases in Q1CY22, driven by strong demand across regions in India. EBITDA stood at Rs 798.04 crore, recording a growth of 50.3% YoY, while EBITDA margins improved by 172 bps to 20.5% in Q1CY23.

ONGC: The company shares jumped 3.37% after the government slashed windfall tax on crude output to Rs 4,100 per tonne from Rs 6,400 per tonne, effective Tuesday. It had raised the windfall gain tax on crude output from nil to Rs 6,400 per tonne on April 19, 2023.

Maruti Suzuki India: Total sales in the month of April 2023 stood at 160,529 units, higher by 7% from 150,661 units sold in the same period last year. The company’s total domestic sales rose 9% to 143,558 units, while exports fell 8% to 16,971 units in April 2023 over April 2022. “The shortage of electronic components had some impact on the production of vehicles. The Company took all possible measures to minimise the impact,” the auto maker said in a statement.

Ashok Leyland: The commercial vehicles maker reported 10% rise in total vehicle sales to 12,974 units in April 2023 from 11,847 units in April 2022. While medium & heavy commercial vehicles (M&HCV) sales increased 3% YoY to 7,933 units, total light commercial vehicles (LCV) sales grew 21% YoY to 5,041 last month. The domestic sales of commercial vehicles during the period under review aggregated to 12,366 units, higher by 10% compared with the same period last year.

Rail Vikas Nigam Limited (RVNL) : The company and its JV partner emerged as the lowest bidder for construction works related to an irrigation project in Rajasthan. The project costs Rs 2248.95 crore and is divided between RVNL and SCC, with RVNL owning 51% of the project and SCC owning 49%. The order comprises planning, design and construction of main canal and structures to provide irrigation facility to an area of 41,903 hectares and 10 years of operation and maintenance.

Tata Motors: The company’s overall sales stood at 69,599 vehicles in April 2023, down 3.69% from 72,468 units in April 2022. Total commercial sales declined 27% to 22,492 units while passenger vehicle sales (including EV) jumped 13% to 47,107 units in April 2023 over April 2022. Total sales of Medium and Heavy Intermediate Commercial Vehicles (MH & ICV) domestic & international business in April 2023, including trucks and buses declined 25.23% to 9,364 units as compared with 12,524 units in April 2022.

Hero MotoCorp: The company’s total sales declined by 5% to 3,96,107 units in April 2023 from 4,18,622 units in April 2022. Total domestic sales fell by 3% to 386,184 units, while exports declined by 51% to 9,923 units in April 2023 as compared with April 2022. Motorcycle sales stood at 368,830 units (down 6% YoY) and scooter sales amounted to 27,277 units (up 5% YoY) during the period under review.

TVS Motor Company: The company said its total sales in the month of April 2023 were 306,224 units, from 295,308 units in April 2022. Total two-wheeler sales rose by 5% to 294,786 units in April 2023 from 280,022 units in April 2022. Motorcycle sales aggregated to 152,365 units (up 10% YoY) and scooter sales added up to 107,496 units (up 5% YoY) in April 2023. TVS iQube has recorded a sales milestone of 1,00,000 units. Three-wheeler sales of the company declined by 25% to 11,438 units in April 2023 from 15,286 units April 2022. Total exports registered sales of 71,663 units in April 2023 as against 113,427 units April 2022, down 37% on YoY basis.

Bajaj Auto: The company’s total auto sales increased by 7% to 3,31,278 units in April 2023 from 3,10,774 units sold in April 2022. Total domestic sales more than doubled during the month to 2,13,172 units, up from 1,02,177 units sold in the same period last year. Exports in April 2023 aggregated to 1,18,106 units (down 43% YoY). While the company’s 2-wheeler sales rose by 2% to 2,87,985 units, sales of commercial vehicles jumped by 49% to 43,293 units in April 2023 as compared with April 2022.

New Delhi Television: The media company said its revenue from operations for the full year remained flat at Rs 385.8 crore on a consolidated basis. Consolidated profit for the year was impacted by exceptional items and stood at Rs 52.94 crore. Exceptional expenses to the tune of Rs 11.76 crore, which included employee severance cost of Rs 3.54 crore, the company disclosed.

Cyient: The technology company announced that a case brought by the US Department of Justice against a Cyient executive on grounds of violation of Sherman act for alleged ‘No-Poach’ agreement, has been dismissed mid-trial by a federal court on 28 April 2023. The case was initiated in December 2021 for alleged illegal suppression of competition and wages by restricting hiring and recruiting of engineers in violation of the Sherman act by six aerospace executives. Meanwhile, the associated civil class action lawsuit naming Cyient Inc as a co-defendant continues. Cyient strongly denies all allegations and is taking all necessary steps for its defense. It believes that this matter will have no materially adverse effect on the company’s operations, finances, or liquidity.

Coal India: The company said production grew 7.7% to 57.6 MT from 53.5 MT last year. Coal supplies increased 8.6% to 62.3 MT in April, compared to 57.4 MT last year. Coal inventory rose 13% year-on-year to 64.6 MT.

Ramkrishna Forgings: The profit after tax (PAT) was 23% lower at Rs 68.45 crore in Q4FY23 on account of higher expenses, from Rs 83.93 crore in the year-ago period. For the whole FY23, the company’s PAT rose to Rs 248.10 crore from Rs 198.02 crore during FY22. Its total income, however, increased to Rs 893.43 crore from Rs 718.72 crore in the year-ago quarter.

Meghmani Organics: The company’s net profit slumped 57.9% YoY to Rs 45.08 crore on 30.6% YoY decline in net sales to Rs 564.63 crore in Q4FY23. EBITDA dropped 38.9% to Rs 84 crore in Q4FY23 from Rs 137 crore in Q4FY22. On a full year basis, the company’s net profit declined 18.7% to Rs 250 crore in FY23 as compared with Rs 308 crore in FY22. Net sales fell 2.5% year on year to Rs 2,557 crore in FY23 over FY22.

NBCC (India): The EPC company received a project aggregating to Rs 749.28 crore, Ministry of Housing & Urban Affairs. The scope of the project entails providing project management consultancy (PMC) and marketing consultancy services for redevelopment/ modernization of Government of India presses at Mayapuri, Rashtrapati Bhawan, (Delhi), Nashik and Kolkata.

Mahindra & Mahindra (M&M): The automaker announced that its overall auto sales for the month of April 2023 stood at 62,294 vehicles, up by 36% from 45,640 vehicles sold in the same period last year. In the Utility Vehicles segment, Mahindra sold 34,694 vehicles (up 57% YoY), passenger vehicles segment witnessed sales of 34,698 vehicles (up 54% YoY) in April 2023. In the Commercial Vehicles segment, Mahindra sold 20,231 vehicles (up 16% YoY) in April 2023. Exports for the month were at 1,813 vehicles (down 33% YoY).

Eicher Motors: The company’s total motorcycles sales increased by 18% to 73,136 units in April 2023 from 62,155 units in April 2022. International Business sales in April 2023 aggregated to 4,255 units, down by 49% from 8,303 units in April 2022. Separately, Eicher Motors announced that VE Commercial Vehicles (VECV) had recorded 18.85% growth in total commercial vehicles (CV) sales for the month of April 2023. VECV’s total sales for the period under consideration aggregated to 6,567 units as against 5,525 units in April 2022.

Blue Star: The air-conditioning company said its board will consider a bonus share issue on 4th May 2023. The board will also consider Q4 results and final dividend on the same day.

Escorts Kubota: The company said that its agri machinery business had sold 7,565 tractors in April 2023 as against 8,325 tractors sold in April 2022, a 9.1% YoY decline. Domestic tractor sales during the month fell by 5.5% to 7,252 units from 7,676 units sold in April 2022. Tractor exports in April 2023 added up to 313 units, down by 51.8% from 649 units exported in April 2022.

Ashoka Buildcon: The infrastructure company said NHAI withdrew letter of award, dated January 25, for an engineering, procurement and construction project in Bihar as the company was debarred by NHAI and couldn’t sign the contract. The debarment expired on April 15 and the company is now eligible to participate in all bids by various authorities including NHAI.

NCC: The company has received six orders worth Rs 3,344 crore from state and central government agencies in April. Of these, it secured three orders worth Rs 2,506 crore pertaining to buildings division; two orders worth Rs 538 crore from electrical division; and one Rs 300- crore order from water division. Company needs to execute contracts within 15 to 27 months from the date of award.

Welspun India: Shares of the company jumped 16.8% in intraday trade after the company’s board had approved buyback proposal at Rs 120 per share via tender offer. The board approved a proposal for purchase of 16.25 million equity shares worth Rs 195 crore through a tender offer. The company has fixed May 10, 2023 as the record date. For Q4FY23, its consolidated net profit more-than-doubled to Rs 125.4 crore, as against Rs 52.2 crore in Q4FY22. Ebitda margin improved 361 bps to 14.6%from 11% in the year-ago quarter. Total income declined 2.3% YoY at Rs 2,196 crore in the reported quarter.