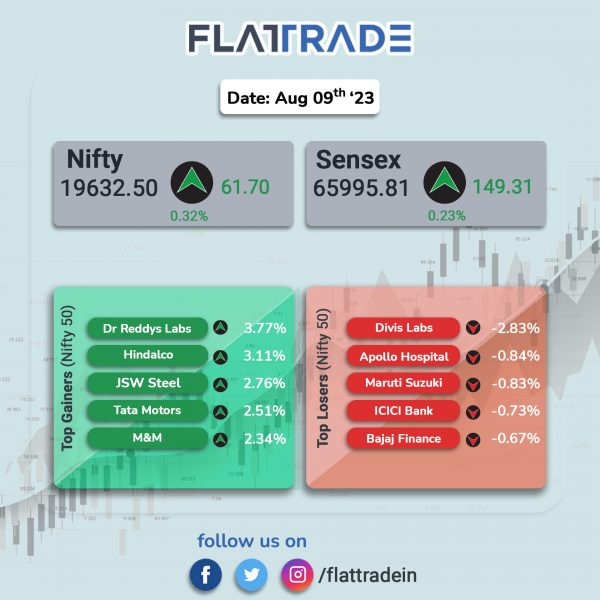

Dalal Street ended higher with modest gains ahead of the RBI’s monetary policy decision tomorrow. Gains were capped by losses in banks, financial services stocks, and realty. The Sensex rose 0.23% and the Nifty gained 0.32%.

In broader markets, the Nifty Midcap 100 jumped 0.33% and the BSE Smallcap rose 0.57%.

Top gainers were Media [2.1%], Metal [2.03%], Oil & Gas [1.01%], Auto [0.93%], and Consumer Durables [0.83%]. Top losers were Realty [-1.24%], Financial Services [-0.21%], Bank [-0.19%], Private Bank [-0.16%], and PSU Bank [-0.1%].

The Indian rupee rose 2 paise to 82.82 against the US dollar on Wednesday.

Stock in News Today

Bharat Forge: The company’s standalone net profit jumped 27.84% to Rs 311.50 crore in Q1FY24 as against Rs 243.66 crore in Q1FY23. Revenue from operations grew by 20.91% YoY to Rs 2,127.29 crore in the quarter ended June 2023. Shipment Tonnage rose by 17% YoY, domestic revenue was higher by 33.6% YoY, while export revenue declined 11.15% YoY. EBITDA grew 20.3% YoY in the reported quarter to Rs 553.3 crore. The board has approved an investment of up to Rs 150 crore in Kalyani Powertrain in one or more tranches.

Kalyan Jewellers: The jewellery retailer said that its net profit rose 33.3% at Rs 144 crore in Q1FY24 as against Rs 108 crore in Q1FY23. Revenue was up 31.3% at Rs 4,375.7 crore in Q1FY24 as against Rs 3,332.6 crore in Q1FY23. EBITDA gained 22.2% to Rs 322.8 crore in the reported quarter compared with Rs 264.2 crore in Q1FY23. Total revenue from the Middle East operations during Q1 FY24 stood at Rs 700 crore as against Rs 574 crore in Q1 FY23, reporting a growth of 22%. The e-commerce division, Candere, recorded a revenue of Rs 34 crore for the quarter, sliding 22.73% from Rs 44 crore reported in the same period a year ago.

Trent: The clothing retailer reported a consolidated net profit at Rs 166.67 crore in Q1FY24, up 45% from a ner profit of Rs 114.93 crore in the same quarter of last fiscal. Total revenue of the company rose to Rs 2,628.37 crore, a rise of 45.7% from Rs 1,803.15 crore in the year-ago quarter. EBIDTA grew by 26% YoY to Rs 367.4 crore in the reported quarter.

ICICI Lombard General Insurance Company: The company said that it has received a Goods and Services Tax (GST) show cause notice for Rs 273.44 crore by the Directorate General of GST Intelligence (DGGI). The general insurer said that the matter largely relates to an industry wide issue on applicability of GST on salvage adjusted and ineligible input tax credit, on motor claims settled. The company has deposited an amount of Rs 104.13 crore under protest, without accepting any liability in this regard.

Uno Minda: The company said its net profit was up 24.4% at Rs 172.8 crore in Q1FY24 as against Rs 138.8 crore in Q1FY23. Revenue rose 21% to Rs 3,092.7 crore in Q1FY24 from Rs 2,555.2 crore in Q1FY23. EBITDA grew 24.1% at Rs 330.1 crore in Q1FY24 from Rs 265.9 crore in Q1FY23. The company’s board has approved raising up to Rs 400 crore via NCDs in one or more tranches.

Happiest Minds Technologies: The company reported a 1.16% rise in consolidated net profit at Rs 58.33 crore and a 3.41% increase in net sales to Rs 390.87 crore in Q1FY24 over Q4FY23. Its EBITDA rose 17.4% YoY to Rs 102.99 crore in Q1FY24. EBITDA margin stood at 25.5% in Q1FY24 from 26.6% in Q1 FY23. In dollar terms, the company’s operating revenue stood at $47.56 million during the quarter, rising 12.7% YoY. Happiest Minds added 18 new clients in the quarter ended 30 June 2022 taking the tally to 243 total clients.

Bajaj Consumer Care: The company reported a 36.37% rise in consolidated net profit to Rs 46.22 crore in Q1FY24 as against a consolidated net profit of Rs 33.89 crore in the same quarter of the last fiscal. Its consolidated revenue from operations during the quarter under review stood at Rs 265.68 crore as against Rs 246.51 crore in the corresponding quarter last fiscal. The company’s international business on a consolidated basis grew by 42% year-on-year.

Brigade Enterprises: Shares of the company fell 3.8% after the company’s net profit fell 65% YoY in the April-June quarter. Brigade Enterprises’ consolidated net profit stood at Rs 38.5 crore for Q1FY24. The Company’s revenue also fell 21% YoY to Rs 685 crore in Q1FY24. Its net sales from commercial projects dropped to Rs 4.3 crore in Q1FY24 from Rs 71 crore in Q1FY23. The company’s net sales from residential projects rose 33% YoY to Rs 991 crore in the same period. Brigade Enterprises said it expects conferences, trade shows, events planned in the coming days to boost growth in occupancies.

Ipca Laboratories: The company has got SEBI’s nod for acquiring additional 26% stake in Unichem Laboratories, according to its exchange filing.

Sandhar Technologies: The company’s net profit was up 68.5% at Rs 21.4 crore in Q1FY24 from Rs 12.7 crore in Q1FY23. Revenue rose 22.8% to Rs 828.9 crore in Q1FY24 from Rs 675.1 crore Q1FY23. EBITDA jumped 33.6% to Rs 72.8 crore in Q1FY24 as against Rs 54.5 crore in Q1FY23.

Gensol Engineering: The company announced that it has secured an letter of intent (LoI) from Odisha Renewable Energy Development Agency (OREDA) to provide 300 electric vehicles on operational lease with fleet management services for a 5 year period. The cumulative billing value of this tender is Rs 115 crore.

CFF Fluid Control: The company announced that it has received the contract for annual maintenance of TWA MCA 62.5 System of Indian Navy Submarines totaling to approximately Rs 23.44 crore. The said contract is for a period of three years till August 2026. CFF Fluid Control is engaged in business of manufacturing and servicing of shipboard machinery, critical component systems and test facilities for submarines & surface ships for defence sector.

Delhivery: The company announced that it has won the contract to design, build, and operate the factory-to-customer supply chain for Havells India in western India. Covering Havells’ product portfolio of electrical and consumer goods, Delhivery will deploy its technology-led integrated warehousing and transportation solutions to deliver speed, precision, and faster complete end-to-end visibility.

Talbros Automotive Component: The company’s board approved the splitting of the existing equity shares from one equity share into five equity shares. Currently, shares of Talbros Automotive bear a face value of Rs 10 each. Post the split, the shares will have a face value of Rs 2 each.

Shankara Building Products: The company reported a net profit of Rs 17.3 crore in Q1FY24, up 44.2% from Rs 12 crore in Q1FY23. Revenue jumped 36% to Rs 1,132.1 crore in Q1FY24 from Rs 832.5 crore in Q1FY23. EBITDA was up 30.8% at Rs 34 crore in Q1FY24 as against Rs 26 crore in Q1FY23.

V-Guard Industries: The voltage stabilizer manufacturer said that its net profit jumped 20.2% to Rs 64.2 crore in Q1FY24 from Rs 53.4 crore in Q1FY23. Revenue was up 19.3% at Rs 1,214.8 crore in Q1FY24 as against Rs 1,018.3 crore in Q1FY23. EBITDA rose 27.9% to Rs 104.9 crore in Q1FY24 from Rs 82 crore in Q1FY23.

Sandhar Technologies: The company’s net profit soared 68.5% to Rs 21.4 crore in Q1FY24 as against Rs 12.7 crore in Q1FY23. Revenue jumped 22.8% to Rs 828.9 crore in Q1FY24 from Rs 675.1 crore in Q1FY23. EBITDA was up 33.6% at Rs 72.8 crore in Q1FY24 as against Rs 54.5 crore in Q1FY23.

The Phoenix Mills: The company’s consolidated net profit tumbled 66.5% to Rs 240.50 crore in Q1FY24 as compared with Rs 718.70 crore in Q1FY23. Revenue from operations stood at Rs 810.63 crore, a rise of 41.1% YoY. EBITDA jumped 52% to Rs 492.3 crore in Q1FY24 from Rs 322.9 crore in Q1FY23. Total consumption in Q1FY24 stood at Rs 2,573.8 crore, 18% YoY growth. It achieved a gross leasing of approximately 1.76 lakh sq.ft. during Q1FY24, of which around 0.88 lakh sq.ft. is new leasing and approximately 0.87 lakh sq.ft. is renewal leasing.

Utkarsh Small Finance Bank: The lender reported a 20% increase in net profit to Rs 107 crore in Q1FY24 from Rs 89 crore in Q1FY23. Net interest income (NII) rose by 21% to Rs 422 crore in Q1FY24 from Rs 349 crore recorded in the same period last year. The bank’s net interest margin stood at 9.2% in Q1FY24 as against 9.7% in Q1 FY23. Operating profit rose by 4% to Rs 221 crore in Q1FY24 from Rs 213 crore in Q1FY23. Total provisions for the period under review amounted to Rs 77 crore (down 16% YoY). Net NPA ratio was 0.3% as on 30 June 2023 as against 1.7% as on 30 June 2022 and 0.4% as on 31 March 2023.

Dish TV India: The DTH firm reported a 15.07% increase in its consolidated net profit at Rs 20.54 crore in Q1FY24 compared to Rs 17.85 crore in the year-ago period. The company’s revenue from the operation declined 17.82% to Rs 500.16 crore during the quarter under review as against Rs 608.63 crore in the corresponding quarter of last fiscal. In the June quarter, Dish TV’s subscription revenues were 27.12% lower at Rs 397.4 crore as against Rs 545.3 crore in the year-ago period. The company also announced the appointment of Manoj Dobhal as CEO with effect from August 23, 2023, after receiving an approval from the Ministry of Information and Broadcasting.