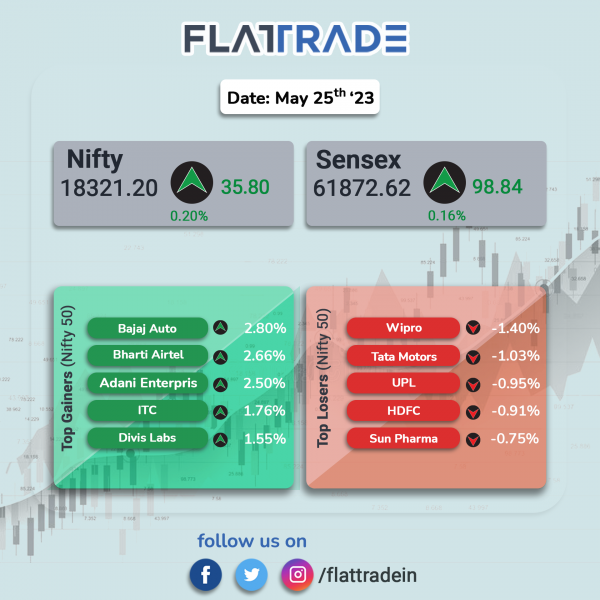

Benchmark equity indices ended higher in a volatile session, helped by gains in FMCG stocks and select index heavyweights amid uncertainty over raising the US debt ceiling. The Sensex rose 0.16% and the Nifty 50 index gained 0.20%.

In broader markets, the Nifty Midcap 100 index rose 0.38% and the BSE Smallcap index advanced 0.27%.

Top gainers were Realty [1.12%], FMCG [0.61%], Metal [0.30%], Auto [0.29%], and IT [0.13%]. Top losers were PSU Bank [-0.45%] and Oil & Gas [-0.11%].

Indian rupee fell 6 paise to 82.74 against the US dollar on Thursday.

Stock in News Today

Vedanta: The company has pledged 13.94 crore shares or 3.3% additional stake in its unit Hindustan Zinc to Axis Trustee Services, increasing the latter’s total pledge to 7.65%. Previously, Axis Trustee had acquired 4.34% stake in Hindustan Zinc on April 27. After the deal, Axis Trustee now holds 32.32 crore encumbered equity shares of Hindustan Zinc.

Phoenix Mills: The company reported a 142.5% jump in consolidated net profit at Rs 254.08 crore in Q4FY23 as compared with Rs 104.79 crore in Q4FY22. Revenue from operations increased 47.2% to Rs 729.04 crore in Q4 FY23 as against Rs 495.39 crore in corresponding quarter last year. Ebitda rose by 79% to Rs 430.7 crore in Q4FY23 from Rs 241.1 crore in Q4FY22. Meanwhile, the board has recommended a final dividend of Rs 5 per equity share for FY23.

Indian Energy Exchange (IEX): The company’s net profit was flat at Rs 88.3 crore in Q4FY23. Revenue was down 4.5% at Rs 107 crore in Q4FY23 as against Rs 112 crore in Q4FY22. EBITDA was down 1.8% YoY at Rs 93.1 crore in Q4FY23 as against Rs 94.8 crore in Q4FY22.

PTC Industries: Shares of the company rose 2.9% after the company’s subsidiary Aerolloy Technologies received Israel Aerospace Industries (IAI)’s approval to supply cast components for aerospace applications. This is the first time that IAI is sourcing such cast components from India. ATL is a manufacturer of strategic and critical materials and high-integrity metal components for various critical and super-critical applications in aerospace.

Suven Pharma: The company’s net profit was up 35.2% at Rs 124 crore in Q4FY23 as against Rs 91.7 crore in Q4FY22. Revenue rose 1.4% to Rs 369 crore in Q4FY23 from Rs 364 crore in Q4FY22. EBITDA rose 7% to Rs 168 crore in Q4FY23 as against Rs 157 crore in Q4FY22.

Titagarh Wagons: Shares of the company jumped jumped 8.7% after the company reported a consolidated net profit of Rs 48.24 crore in Q4FY23 as against a net loss of Rs 24.95 crore in Q4FY22. Net sales more than doubled to Rs 974.22 crore in the fourth quarter from Rs 422.19 crore recorded in the same period last year. Revenue from Freight Rail Systems was Rs 808.10 crore (up 124.9% YoY) while that from Passenger Rail Systems was Rs 166.11 crore (up 164.4% YoY) during the period under review.

Granules India: The company informed the exchanges about an IT security breach. It said the impacted IT assets have been isolated, and added that the company is investigating the matter and actions are being taken to address the incident.

Ingersoll-Rand (India): Shares of the company closed 5.3% higher after the company’s net profit soared 129.59% to Rs 67.11 crore on 37.25% increase in net sales to Rs 304.40 crore in Q4FY23 over FY22. The board has recommended a dividend of Rs 20 per share for FY23. For the full year, net profit surged 65.81% to Rs 182.64 crore on 26.47% increase in net sales to Rs 1150.79 crore in FY23 over FY22.

Kolte-Patil Developers: The company’s net profit stood at Rs 116.9 crore in Q4FY23 as against Rs 26.8 crore in Q4FY22. Revenue was at Rs 797 crore in Q4FY23 as against Rs 376 crore in Q4FY22. EBITDA stood at Rs 173.4 crore in Q4FY23 as against Rs 40.4 crore in Q4FY22.

TTK Prestige: The company’s net profit was down 25.7% at Rs 59.4 crore in Q4FY23 as against Rs 80 crore in Q4FY22. Revenue was down 12.4% at Rs 611 crore in Q4FY23 as against Rs 697.5 crore in Q4FY22. EBITDA was down 26.4% at Rs 80.4 crore in Q4FY23 as against Rs 109.2 crore in Q4FY22.

Piramal Pharma: The company’s net profit was down 75.4% at Rs 50.1 crore in Q4FY23 as against Rs 204 crore in Q4FY22. Revenue was up 1.5% at Rs 2,163.6 crore in Q4FY23 as against Rs 2,131.4 crore in Q4FY22. EBITDA was down 11.7% at Rs 351.3 crore in Q4FY23 as against Rs 398 crore in Q4FY22.

Ganesha Ecosphere: The company’s net profit was down 65.1% at Rs 15.4 crore in Q4FY23 as against Rs 44.1 crore in Q4FY22. Revenue was up 5% Rs 301.5 crore in Q4FY23 as against Rs 287.1 crore in Q4FY22. EBITDA was up 2.4% at Rs 33.6 crore in Q4FY23 as against Rs 32.8 crore in Q4FY22.

Infibeam Avenues: The company’s net profit was up 36.5% at Rs 39.3 crore in Q4FY23 as against Rs 29 crore in Q4FY22. Revenue was up 76.7% at Rs 652.6 crore in Q4FY23 as against Rs 369.4 crore in Q4FY22. EBITDA was up 11% at Rs 49.4 crore in Q4FY23 as against Rs 44.5 crore in Q4FY22.

Cheviot Company: The company’s net profit was down 9.3% at Rs 13.7 crore in Q4FY23 as against Rs 15.1 crore in Q4FY22. Revenue was down 17.6% at Rs 134.8 crore in Q4FY23 as against Rs 163.5 crore in Q4FY22. EBITDA was down 1.5% at Rs 17.4 crore in Q4FY23 as against Rs 17.7 crore in Q4FY22.

Saksoft: The company’s net profit was up 42.3% at Rs 25 crore in Q4FY23 as against Rs 17.6 crore in Q4FY22. Revenue jumped 30.9% to Rs 182.1 crore in Q4FY23 as against Rs 139 crore in Q4FY22. EBITDA was up 48.1% at Rs 32.5 crore in Q4FY23 as against Rs 21.9 crore in Q4FY22.

Sandhar Technologies: The company’s net profit was up 39% at Rs 24.3 crore in Q4FY23 as against Rs 17.5 crore in Q4FY22. Revenue was up 12% at Rs 765 crore in Q4FY23 as against Rs 683.6 crore in Q4FY22. EBITDA was up 7.7% at Rs 67.5 crore in Q4FY23 as against Rs 62.7 crore in Q4FY22.

Strides Pharma Science: The company’s net loss stood at Rs 9.5 crore in Q4FY23 as against a net profit of Rs 29.2 crore in Q4FY22. Revenue was up 14% Rs 986.3 crore in Q4FY23 as against Rs 866 crore in Q4FY22. EBITDA rose to Rs 155.6 crore in Q4FY23 as against Rs 42 crore in Q4FY22.

Dhanuka Agritech: The company’s consolidated net profit jumped 20.04% to Rs 65.30 crore in Q4FY23 as compared with Rs 54.40 crore in Q4FY22. Revenue from operations increased 16.63% YoY to Rs 371.22 crore in Q4FY23. On full year basis, the company’s net profit jumped 11.78% to Rs 233.50 crore on 15.04% rise in revenue from operations to Rs 1,700 crore in FY23 over FY22. Meanwhile, the company’s board recommended a dividend of Rs 2 per equity share having face value of Rs 2 per share.

Fine Organic Industries: The company reported 22.7% rise in consolidated net profit at Rs 149.15 crore in Q4FY23 as compared with Rs 121.85 crore in Q4FY22. Revenue from operation fell 3.3% YoY to Rs 596.63 crore in Q4 FY23. Ebitda stood at Rs 201.7 crore in Q4FY23, registering a growth of 26% from Rs 159.5 crore in the corresponding quarter last year. Meanwhile, the board has recommended a final dividend of Rs 9 per equity share for FY23.

Shyam Metalics and Energy: The company registered 40% drop in consolidated net profit to Rs 258.9 crore on a 22% increase in revenue from operations to Rs 3,380.1 crore in Q4FY23 over Q4FY22. Ebitda declined by 38% YoY to Rs 413.5 crore during the quarter under review.