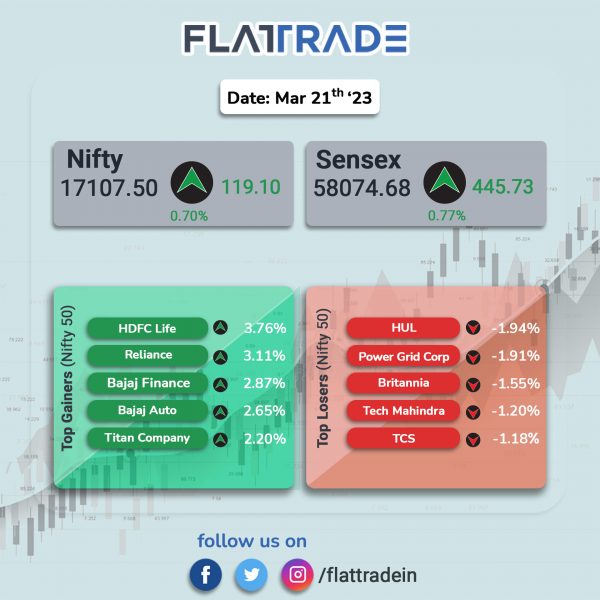

Benchmark indices ended higher, led by gains in banking and energy stocks amid investors remaining cautious over the stress in the financial system. The Sensex gained 0.775 and the Nifty 50 index rose 0.7%.

In broader markets, Nifty Midcap 100 rose 0.595 and the BSE Smallcap advanced 0.5%.

Top gainers were Nifty PSU Bank [1.65%], Financial Services [1.46%], Private Bank [1.44%], Bank [1.35%], and Oil & Gas [1.27%]. Top losers were IT [-0.98%], FMCG [-0.66%], and Pharma [-0.25%].

Indian rupee fell 2 paise to 82.65 against the US dollar on Tuesday.

Stock in News Today

Reliance Industries (RIL): Shares of the company gained 3.11% after institutional brokerage CLSA reiterated ‘buy’ rating on the back of a slew of positive triggers. “The ramp-up of its FMCG business, launch of Airfiber to catapult wireless broadband penetration and a new affordable 5G smartphone to monetise its pan-India standalone 5G network by end-2023 along with an IPO of Jio and/or retail are all possible large triggers in 2HFY24,” the report added.

Larsen and Toubro (L&T): The company’s hydrocarbon business, L&T Energy Hydrocarbon (LTEH), has secured major orders from an overseas client. As per L&T’s classification, the value of the orders lies between Rs 5,000 crore to Rs 7,000 crore. The scope of work comprises engineering, procurement, construction & installation of offshore structures and upgradation of existing facilities.

UTI Asset Management Company (UTI AMC): The company rose 8.18% in intraday trade after PPFAS Mutual Fund bought 0.88% stake in the company through a block deal. As per the NSE bulk deal data, PPFAS Mutual Fund bought 11,22,643 equity shares, or 0.88% equity, at Rs 636 per share in UTI AMC, aggregating to Rs 71.40 crore.

NMDC: The state-owned iron ore miner has increases prices of lump ore and fines, effective from 21 March 2023. The prices of lump ore have been increased by Rs 100 or 2.27%, to Rs 4,500 per ton compared with Rs 4,400 per ton fixed on 28 January 2023. The prices of iron ore fines have been raised by Rs 200 or 5.12%, to Rs 4,110 per ton from Rs 3,910 per ton set on 28 January 2023.

RattanIndia Enterprises: The company’s Revolt Motors has appointed Pankaj Sharma as chief business officer. Sharma has earlier worked as India Head of Ola Electric with responsibilities including sales, service, distribution, customer experience and Go To Market for the company. Pankaj Sharma is a veteran of auto industry in India with nearly three decades of experience having worked in leadership positions across top auto companies in two wheeler, four wheeler and commercial vehicle segments.

PVR: The company shares rose 2.52% in intraday on the NSE after ICICI Prudential Mutual Fund, SBI Mutual Fund, and Societe Generale picked shares worth Rs 380.37 crore in the multiplex chain operator via bulk deals. As per the bulk deals data on the BSE, ICICI Prudential Mutual Fund acquired 6.41 lakh shares, SBI Mutual Fund purchased 14.69 lakh shares and Societe Generale – ODI bought 3.28 lakh shares in PVR. In total, they bought 24.39 lakh equity shares of PVR at an average price of Rs 1,559.35 per share.

Rail Vikas Nigam (RVNL): The company announced the formation of a joint venture with Jakson Green for global clean energy engineering, procurement, and construction (EPC) projects. The partnership aims at enabling India’s decarbonizing push and it is expected to bring synergies in designing, executing and delivering EPC projects globally by both partners.

Zydus Lifesciences: The company announced that the USFDA has granted ‘Orphan Drug Designation’ (ODD) to ZYIL1, for treatment of patients with Cryopyrin Associated Periodic Syndrome (CAPS). ZYIL1 is a novel oral small molecule NLRP3 inhibitor which has demonstrated CSF penetration in non-human primates.

Blue Star: The company has secured Railway Electrification orders totalling Rs 575 crore, thereby, successfully expanding its presence in the Railways segment and marking its foray into the Railway Electrification space. The company has bagged four railway electrification orders from various prestigious customers including the West Central Railway (Kota Division), Central Organization for Railway Electrification (CORE), and Metro Railway, Kolkata.

PNC Infratech: The company has secured orders from Haryana Rail Infrastructure Development Corporation (HRIDC) for Rs 771.46 crore project. The project involves design and construction of civil works and its connectivity to Indian Railways network from New Patli to Patli Station and New Patli to Sultanpur Station including modifications/civil works at Sultanpur Station in connection with laying of new BG double railway line of Haryana Orbital Rail Corridor (HORC) Proiect in Haryana.

PTC India Financial Services: The company has appointed S. Siva Kumar as the Executive Director (Credit) in a slew of new appointments aimed at pushing the company towards its aim of decent growth and value to its stakeholders.

RateGain Travel Technologies: The company announced that it has been awarded as the ‘SaaS Startup of the Year’ at the recently concluded SaaSBOOMi Awards. SaaSBOOMi is a close-knit community of B2B SaaS founders from India, founded in 2018 by some of the leading SaaS founders from the country.

Intellect Design Arena: Intellect Global Consumer Banking (iGCB), the consumer banking arm of Intellect Design Arena, announced that Faisal Islamic Bank of Egypt has chosen its CBX Retail (CBX-R) platform to power its Digital Banking. The bank will be offering contextual experience to more than a million Retail and Business customers across Egypt.

H. G. Infra Engineering: The company announced that it has received completion certificate for an EPC project in Rajasthan worth Rs 880.11 crore awarded under Bharatmala Pariyojna. The scope of project involves construction of eight lane access controlled expressway starting from road over bridge (RoD) near Baonli- Jhalai road of Delhi- Vadodara green field alignment in Rajasthan.