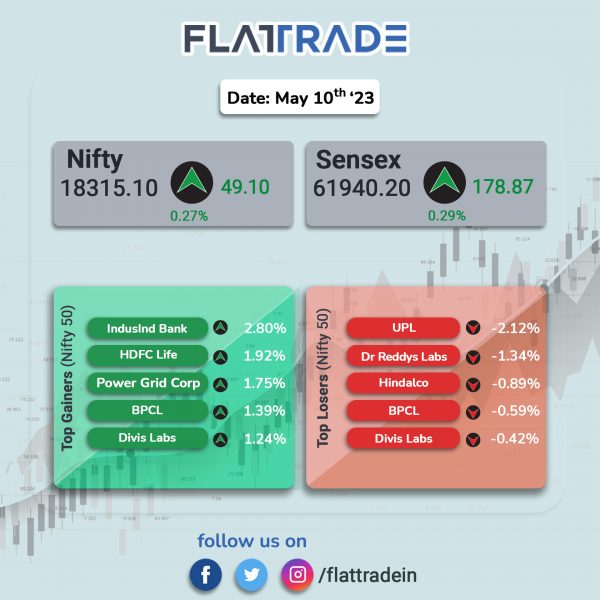

Sensex, Nifty closed higher with modest gains as energy, auto, and FMCG stocks rose amid investors bracing for the US inflation data due later today. The Sensex rose 0.29% and the Nifty gained 0.27%.

In broader markets the Nifty Midcap 100 index inched up 0.05% and the BSE Smallcap index rose 0.33%.

Top gainers among Nifty sectoral indices were Media [1.36%], Realty [0.86%], Oil & Gas [0.8%], Auto [0.75%], and Energy [0.7%]. Top losers were PSU Bank [-1.06%], Metal [-0.25%], and IT [-0.12%].

Indian rupee appreciated by 5 paise to 81.99 against the US dollar on Wednesday.

Stock in News Today

Sanofi India: The pharma company reported 20.13% decline in net profit at Rs 190.4 crore despite of 4.17% increase in revenue from operations to Rs 736.5 crore in Q1FY23 over Q1FY22. Profit before exceptional items and tax jumped 18.35% to Rs 245.7 crore in Q1FY23 as compared with Rs 207.6 crore in corresponding quarter last year. Exceptional items stood at Rs 178 crore in Q1 FY23. Sanofi India will demerge its consumer healthcare business and the company will be called Sanofi Consumer Healthcare.The shareholders of the demerged company, will be issued equity in the ratio of 1:1.

BASF India: The company’s net profit dropped 45.02% to Rs 82.39 crore in Q4FY23 as against Rs 149.85 crore in Q4FY22. Its company’s revenue from operations declined 3.26% to Rs 3,249.95 crore in the quarter ended March 2023. The company reported an exceptional profit of Rs 15.31 crore in Q4FY23 due to sale of non-core assets – residential properties. The company’s net profit decreased 32.27% to Rs 402.89 crore on a 4.23% rise in revenue from operations to Rs 13,518.79 crore in FY23 over FY22. Meanwhile, the board recommended a dividend of Rs 8 per equity share for FY23, subject to the approval of the shareholders and the dividend is payable on or after 8 August 2023.

Cera Sanitaryware: The company reported 11.64% YoY jump in net profit of Rs 62.93 crore and its revenue from operations rose 20.9% YoY to Rs 530.38 crore in Q4FY23. EBITDA (excluding other income) stood at Rs 851 crore, a growth of 3.3% as compared with Rs 824 crore posted in corresponding quarter last year. On full year basis, the company’s net profit jumped 40.37% to Rs 209.65 crore on 24.58% rise in revenue from operations to Rs 1,796.19 crore in FY23 over FY22.

Hatsun Agro: The dairy product manufacturer reported 39.06% decline in net profit to Rs 24.99 crore despite of 10% increase in revenue from operations to Rs 1,789.46 crore in Q4FY23 over Q4FY22.On full year basis, the company’s net profit (from continuing operations) slipped 33.19% to Rs 165.86 crore on 13.76% rise in net sales to Rs 7,246.97 crore in FY 23 over FY22.

Kolte-Patil: The company has acquired land at Wagholi and NIBM Road, Pune, with an estimated saleable area of 1.9 million square feet and a potential revenue of Rs 1,300 crore. While the five acres of land parcel at Wagholi is a direct purchase, the company entered into a JV for the project at NIBM Road.

Krishna Defence and Allied Industries: Shares of the company hit an all-time high after it secured a Rs 63.48 crore order from the Ministry of Defence. The order entails supply of Special Heating Equipment to be used by armed forces at sub-zero temperatures and it is expected to be executed over the next 12 months, according to its exchange filing.

Tinna Rubber and Infrastructure: The company bagged a contract worth Rs 107 crore from Indian Oil Corporation for the supply of Crumb Rubber Modifier (CRM) at their Mathura and Haldia plants. Tinna Rubber & Infrastructure recycles end-of-life tires into valuable rubber and steel materials. These materials have various applications such as new tires, conveyor belts, rubber molded products, and roads.

JBM Auto: Shares tanked over 10% after the company’s consolidated net profit slumped 67.22% to Rs 28.07 crore on 5.8% decline in revenue from operations to Rs 1,010.06 crore in Q4FY23 over Q4FY22. On a full year basis, the company’s consolidated net profit slipped 20.36% YoY to Rs 124.39 crore on 20.81% YoY jump in revenue to Rs 3,857.38 crore in FY23. Meanwhile, the firm’s board has recommended a final dividend of Rs 1.30 per equity share for FY23.