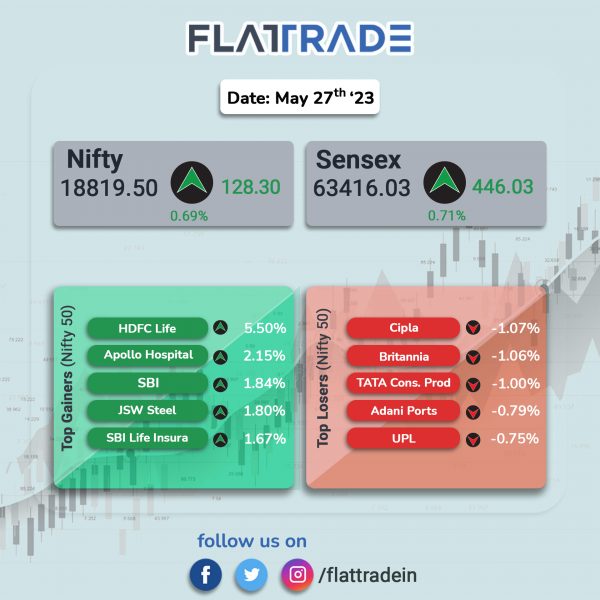

Benchmark indices closed higher, aided by gains in HDFC twins and financial services stocks. The Sensex jumped 0.71% and the Nifty 50 index gained 0.68%.

In broader markets, the Nifty Midcap 100 index rose 0.5% and the BSE Smallcap advanced 0.61%.

Top gainers were Financial Services [1.37%], Realty [1.24%], Private Bank [1.11%], Bank [1.1%], and PSU Bank [1.02%]. Nifty FMCG declined 0.07%.

Indian rupee inched up 1 paise to 82.03 against the US dollar on Tuesday.

Stock in News Today

HDFC Bank, HDFC: The merger of HDFC and private lender HDFC Bank will be effective from July 1, said HDFC Chairman Deepak Parekh. The boards of both the companies will meet on June 30 post-market hours to clear and approve the merger, Parekh told reporters. Meanwhile, HDFC will be delisted from exchanges with effect from July 13.

Hindustan Aeronautics (HAL): The company said that its board has approved the sub-division of existing one equity share of face value of Rs 10 each into two equity shares of Rs 5 each. The record date for the purpose of sub-division of equity shares is 29 September 2023. Further, the company’s board has approved a final dividend of Rs 15 per equity share for FY23.

IIFL Securities: Shares of the company rose over 9% in intraday trade after media reports suggested that the Securities Appellate Tribunal (SAT) has stayed the order passed by the Securities and Exchange Board of India (SEBI) against the company. The aforementioned order issued by SEBI had barred the company from on-boarding any new clients for two years.

IDFC First Bank: The lender announced that its board has approved the allotment of Rs 1,500 crore of Tier-2 bonds in domestic Indian Bonds market. These privately placed bonds are issued as unsecured, subordinated, rated, listed, nonconvertible, fully paid-up, taxable, redeemable Basel III compliant tier-2 bonds, in nature of debentures at a face value of Rs 1 crore each. The bonds were raised for a tenor of 10 years with a call option at the end of five years and have a coupon rate of 8.4%.

Zee Entertainment Enterprise; The Securities Appellate Tribunal (SAT) reserved appeals by Zee’s Punit Goenka and Subhash Chandra against SEBI. The Securities and Exchange Board of India on June 12, through an interim order had barred Zee’s Punit Goenka, Subhash Chandra from holding directorial positions for allegedly misappropriating Zee’s funds for the benefit of associate companies. Goenka and Chandra had appealed against the order on June 13.

InterGlobe Aviation (IndiGo): Shares of the company rose 2.6% after investment firm UBS Group AG raised the price target of the company from Rs 2,690 to Rs 3,300, on the back of underlying demand, higher yields and lower fuel cost. The brokerage also maintained its ‘buy’ rating for the company.

RateGain Travel Technologies: The company announced an agreement with North America-basedVirgin Voyages to provide comprehensive cruise rate intelligence data. RateGain’s product for the Cruise Data sector will allow Virgin Voyages to gain access to real-time price intelligence solutions, enabling them to align their pricing strategy with the latest market trends and competitor rates. Concurrently, RateGain’s data analytics platform will empower Virgin Voyages to track rates across multiple channels, bolstering their global visibility and facilitating the delivery of unique booking experiences to their customers.

Sonata Software: The company has announced that it has extended the partnership with TUI Group to create digital hub in India. TUI Group is a leading global tourism group and operates worldwide. Roshan Shetty, chief revenue officer, Sonata Software, said, “Establishing TUI’s Digital Hub in India is a testament to our shared vision of excellence and will unlock new opportunities to enhance operational efficiency, elevate customer experiences, and achieve sustained business growth for TUI Group.”

CreditAccess Grameen: The microfinance company announced the signing of a syndicated social loan facility of up to $200 million, qualifying as ECB (external commercial borrowing) under the automatic route of the RBI. The company has received $160 million in commitments to date, along with a green-shoe option to raise an additional $40 million, exercisable over 120 days from the date of signing of the facility agreement.

HBL Power Systems (HBL): The company said that it has entered into contract with Ashoka Buildcon (ABL) for supply of the kavach part of an EPC contract won by ABL in September 2022. The contract is worth Rs 135 crore that includes the supply and commissioning of all equipment involved in the kavach system requiring RDSO approval. The delivery and commissioning is to be completed in 18 months.

Hindustan Unilever (HUL): The company has announced the resignations of two of its board members – outgoing CEO & MD Sanjiv Mehta and independent director of the company, Dr Ashish Gupta. Following his retirement from the company, Sanjiv Mehta stepped down as the chief executive officer & managing director with effect from close of business hours on 26 June 2023. In March this year, HUL had named Rohit Jawa as the new managing director and chief executive of the company, succeeding Sanjiv Mehta.

Sterlite Technologies (STL): The company announced that it has installed Neox Unified Communications solution (Neox) which enabled a seamless communication system for the water metro in Kochi, Kerala, India. Neox Unified Communications solution is equipped with IP telephony, Contact Centre, Automatic Call Distribution (ACD), IVRs and Centralized Voice Recording (CVR) module.

Manappuram Finance: The NBFC announced that its board may consider raising funds through debt securities during July 2023. The NBFC said that it is considering various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore / offshore securities market by public issue, on private placement basis or through issuing commercial papers.