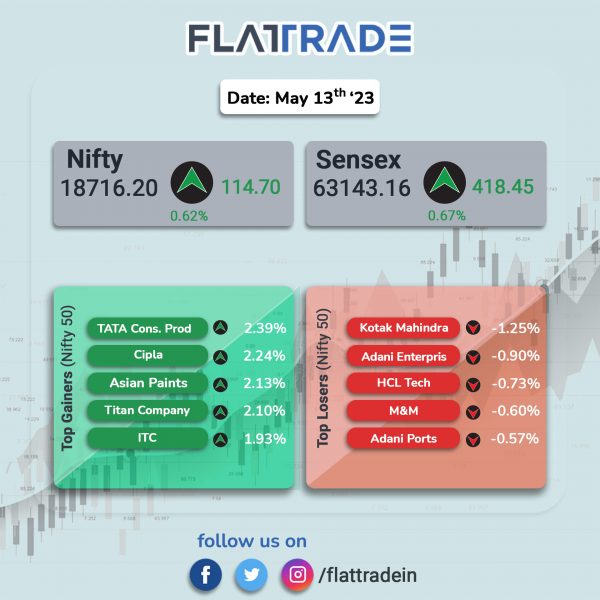

Dalal Street ended higher on Tuesday as investors were buoyed by positive macroeconomic data, which was released on Monday evening. The Sensex gained 0.67% and the Nifty rose 0.62%.

In broader markets, the Nifty Midcap 100 index jumped 1.22% and the BSE Smallcap advanced 0.82%.

Top gainers were Realty [3.01%], Media [1.78%], FMCG [1.38%], Pharma [1.07%], and Metal [0.85%]. Nifty Auto [-0.11%] was the sole loser.

Indian rupee appreciated by 6 paise to 82.38 against the US dollar on Tuesday.

On the macroeconomic front, India’s consumer price index (CPI) inflation eased sharply to 4.25 per cent in May hitting a 25-month low and coming under the Reserve Bank of India’s upper tolerance limit of 6% for the third straight month. The retail inflation in may 2023 declined from 4.7% recorded in April 2023 and 7.04% in May 2022. The consumer food price index (CFPI) eased to 2.91% in May from 3.84% in April. Rural inflation in May stood at 4.17% while urban inflation stood at 4.27%, according to data released by the Ministry of Statistics and Programme Implementation on June 12.

Further, India’s industrial output grew by 4.2% in April, data released by the Ministry of Statistics and Programme Implementation showed on June 12. The latest industrial growth figure as per the Index of Industrial Production (IIP) is significantly higher than that for March. IIP growth was 6.7 percent in April 2022.

Stock in News Today

ICICI Lombard General Insurance Company: The company informed the exchanges that IRDAI, the insurance regulator, has accorded its approval to SBI Mutual Funds for acquiring up to 10% of the total paid up equity share capital of the company. IRDAI has advised SBI Mutual Funds (SBI MF) to ensure that its total shareholding shall not exceed 10% percent of the total paid-up equity share capital of the company. Further, the approval of IRDAI is valid for a period of 1 year from the date of IRDAI approval letter.

Zee Entertainment Enterprises (ZEE): The promoters of the company approached the Securities Appellate Tribunal (SAT) to seek relief against the market regulator’s order banning Essel group Chairman Subhash Chandra and Zee MD & CEO Punit Goenka from holding key positions. SAT will take up the matter for admission on June 15. The promoters’ lawyer said that Sebi had not given a show cause notice before issuing the order, nor did it indicate any urgency for implementing a ban on them. The lawyer said that Sebi’s order had led to a steep fall in the stock prices. Shares of the company tanked 6.6% in intraday trading but recovered during the session to close 0.46% lower.

MRF: Shares of the tyre company crossed the Rs 1 lakh mark on Tuesday (June 13) and it became the first stock in India to breach the Rs 1 lakh mark per share. On the NSE, the share price touched a high of Rs 1,00,439.95 apiece (up 1.5% to Monday’s closing) and lost some of the gains to close 1.03% higher at Rs 99,992.85 per share to Monday’s closing.

Tata Motors: Brokerage firm Jefferies has maintained a ‘buy’ rating and upgraded the price target to Rs 700 per share from Rs 666 per share. JLR at its investor day resolved to focus on strengthening its four brands, viz., Range Rover, Discovery, Defender and Jaguar. It plans to launch battery electric vehicles version for all models by 2030. Brokerage firm expects both JLR and India businesses to perform well in FY24, driving strong earnings growth and deleveraging. The luxury arm, JLR, aims to clock a revenue of £28 billion by FY24 and reduce the net debt to zero by FY25.

InterGlobe Aviation (IndiGo): The company said in an exchange filing that it has not received any information from co-founder Rakesh Gangwal of his intention to sell the stake worth Rs 7,493 crore.

Larsen and Toubro (L&T): The infrastructure conglomerate said that its hydrocarbon business, L&T Energy Hydrocarbon (LTEH), has secured an offshore project from an overseas client. As per L&T’s classification, the value of the orders lies between Rs 1,000 crore to Rs 2,500 crore. The scope of work comprises engineering, procurement, construction & installation for new offshore structures.

JSW Steel: The steel major said that its consolidated crude steel production in May 2023 stood at 21.78 lakh tonnes, up 7% YoY. JSW Steel achieved combined production of 22.30 lakh tonnes, up 8% YoY from 20.71 lakh tonnes recorded in the same period last year. The company’s Indian operations increased by 6% to 20.93 lakh tonnes in May 2023 as against 19.82 lakh tonnes reported in May 2022.

Zydus Lifesciences: The company announced that it has received final approval from the United States Food and Drug Administration (USFDA) to manufacture and market Varenicline tablets. The said tablets are indicated to treat smoking addiction. The drug will be manufactured at the group’s formulation manufacturing facility at Ahmedabad SEZ, India . According to IQVIA MAT March 2023, Varenicline tablets had annual sales of $501 million in the United States.

Ramco Systems: The company said that it will implement its aviation suite for Skytek Pty Ltd, an independent maintenance, repair, and overhaul (MRO) services provider, specialising in fixed wing and rotary wing maintenance. Ramco’s Aviation Suite will integrate and automate various operations at Skytek, empowering them with a modern solution to support their business growth. The solution will also help Skytek optimize their turnaround times for quotations, order processing and customer engagements as well as improve productivity and enhance process efficiencies.

Granules India: The pharma company said that it has received US drug regulator’s approval for its abbreviated new drug application (ANDA) for Metoprolol Succinate extended-release tablets USP. The tablets are indicated for the treatment of hypertension in order to lower blood pressure. The current annual U.S. market for Metoprolol Succinate ER Tablets is approximately $321 million, according to MAT Mar 2023, IQVIA/IMS Health.

Can Fin Homes: The company said that its board will meet on June 19 to consider a proposal of fund raising by way of issuance of equity shares. The housing finance company said that the proposal of issue of equity shares is subject to approvals, as may be required. Further, the board of directors may also consider borrowing or raising funds by issue of secured and/or unsecured non-convertible debentures and/or non-convertible subordinated debt Tier-II debentures.

Mahindra & Mahindra (M&M): The company said that the total production in the month of May 2023 was 59,385 units, up by 17.35% from 50,606 units produced in the same period last year. The auto major’s total sales rose 13.74% to 58,799 units in May 2023 as against 51,698 units sold in the same period a year ago. Meanwhile, exports for the period under review jumped 29% YoY to 2,616 units.

Signet Industries: The company said that it has secured orders worth Rs 120 crore from various EPC contractors. These order are for pipes in water supply project in state of Madhya Pradesh, Uttar Pradesh, Orissa, Rajasthan, Maharashtra.