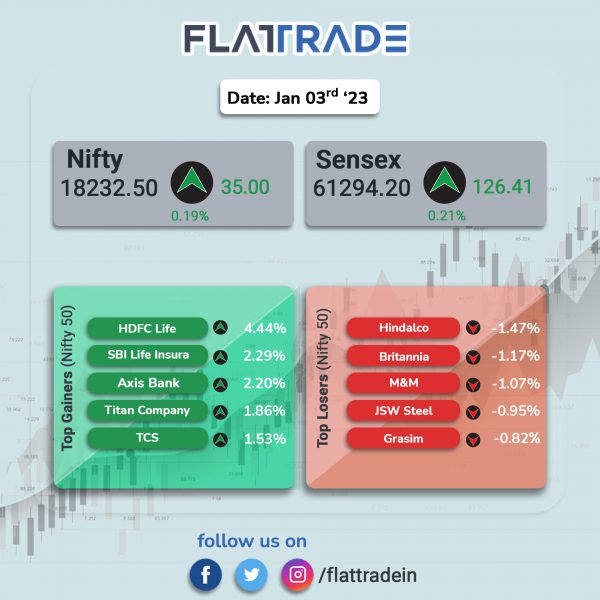

Dalal Street extended gains to close higher, aided by IT and financial services stocks. The Sensex closed 0.21% higher and the Nifty 50 index was up 0.19%.

In broader markets. Nifty Midcap 100 index ended 0.23% higher and BSE Smallcap index rose 0.18%.

Among Nifty sectoral indices, top gainers were IT [0.78%], PSU Bank [0.72%], Pharma [0.72%], Financial Services [0.64%] and Private Bank [0.63%]. Top losers were Media [-0.70%], Metal [-0.53%], Auto [-0.42%], FMCG [-0.41%] and Energy [-0.10%].

Indian rupee fell 14 paise to 82.89 against the US dollar on Tuesday.

Stock in News Today

State Bank of India (SBI): The lender’s board has approved raising infrastructure bonds aggregating up to Rs 10,000 crore in FY23. The fundraising will be done via public issue or private placement and the said amount will be raised in the current fiscal, the company said in an exchange filing.

Adani Enterprises: The company’s subsidiary, Adani Cement, has launched green concrete solution ‘ACC ECOMaxX’ in Mumbai with 30-50% lower embodied carbon content compared to standard OPC offering. The Mumbai Coastal Road Project has maximised its green impact with ACC ECOMaxX by saving 3,447 tonnes of CO2 emissions compared to conventional concrete.

Meanwhile, Adani Enterprises will make an additional payment for NDTV shares acquired via the open offer. The company will pay an extra Rs 48.65 per share over the Rs 294 it paid for NDTV shares in the open offer. This takes the cost per share to Rs 342.65, the same as the amount paid per share for the 27.6% stake acquired from promoter couple Roys.

Larsen & toubro (L&T): The company said that its construction arm has secured ‘major’ orders for its water & effluent treatment business. As per Larsen & Toubro’s (L&T) classification, the value of the significant project is Rs 5,000 crore to Rs 7,000 crore. The order entails executing two lift irrigation projects to irrigate 2,05,000 hectares of culturable command area covering more than five hundred villages of Dewas & Dhar districts in Madhya Pradesh on a turnkey basis. The micro irrigation projects will lift 60 cumecs of water from the Narmada River to irrigate the farmlands benefitting 3,00,000 farmers in the process.

Federal Bank: The lender said that its total deposits aggregated to Rs 2,01,425 crore at the end of Q3FY23, registering a growth of 14.8% as compared with Rs 1,75,432 crore in the year-ago period. Its CASA deposits stood at Rs 67,540 crore, up 7.2% YoY from Rs 64,343 crore in the same period a year ago. The bank’s gross advances grew by 19.1% to Rs 1,71,043 crore from Rs 1,43,638 crore as of December 31, 2021.

Welspun India: The company said that it has prepaid term loans of Rs 45.80 crore as on December 31, 2022, along with other installments which were due as the quarter end on standalone basis. The weighted average interest rate of the loans prepaid by the company was 8.30% per annum.

Bank of Maharashtra: The bank’s total deposits stood at Rs 2,08,436 crore as of December 31, 2022, recording a growth of 11.69% as against Rs 1,86,614 crore in the year-ago period. The public sector bank reported a 21.81% growth in gross advances to Rs 1,57,139 crore as of December 30, 2022 as against Rs 1,29,006 crore in the same period last year. CASA improved by 6.52% YoY to Rs 1,09,430 crore.

KIOCL: The company announced the execution of deed for grant of a mining lease between Karnataka Government & KIOCL for iron ore and manganese ore mining in Devadari Hill Range. The mining lease is for a period of 50 years and covers 388 hectares in Devadari Range, Sandur Taluk, Ballari District.

Zee Entertainment Enterprises (ZEEL): An operational creditor filed Rs 211.41 crore insolvency case against the company. The creditor has claimed a debt and default of Rs 211,41,82,521, towards royalty payable for utilization of “literary and musical works”. The creditor had has filed a petition against ZEEL under Section 9 of the Insolvency and Bankruptcy Code, 2016 before the National Company Law Tribunal (NCLT), Mumbai Bench.

Granules India: The company has entered into a strategic partnership with Greenko ZeroC to collaborate for Green Molecule Solutions and its wider applications in pharmaceuticals to build a leadership position in sustainability and circular economy initiatives and be a pioneer in the industry. Granules & Greenko ZeroC will develop and promote State-of-the-art Integrated Green Pharmaceutical Zones (GPZ) with first collaboration in Kakinada, Andhra Pradesh. The facility is spread across 100 acres and will be commissioned in a phase wise manner. The estimated cost of the project will be approximately Rs 2,000 crore over five years.

RateGain Travel Technologies: The company has announced that it has entered into a definitive agreement to acquire Adara Inc. through an asset purchase agreement. The acquisition is aligned to RateGain’s vision of building an integrated Revmax platform – focused on customer acquisition and wallet share expansion. It will help build one of the largest & most comprehensive source of travel intent data in the world that is permissioned and ethically sourced.

Marine Electricals: The company has secures order worth Rs 23.50 crore from AdaniConnex. The order entails design, manufacture, supply, installation, supervision of testing and commissioning at Noida DC from AdaniConnex. The delivery of the said goods shall be made over a period of six months.

Kamat Hotels: The company’s board has approved to sell Mumbai unit of the Company – VITS for Rs 125 crore. The final approval will be subject to members of the company.

Indian Energy Exchange (IEX): The company has achieved 8,452 MU overall volume in December 2022, a growth of 9% month-on-month. The electricity volume tood at 7,964, up 8% MoM and 4% YoY. Real time electricity market volume rose 17% YoY to 1,763 MU. Overall volume was up 5% QoQ at 24.2 BU in Q3FY23.