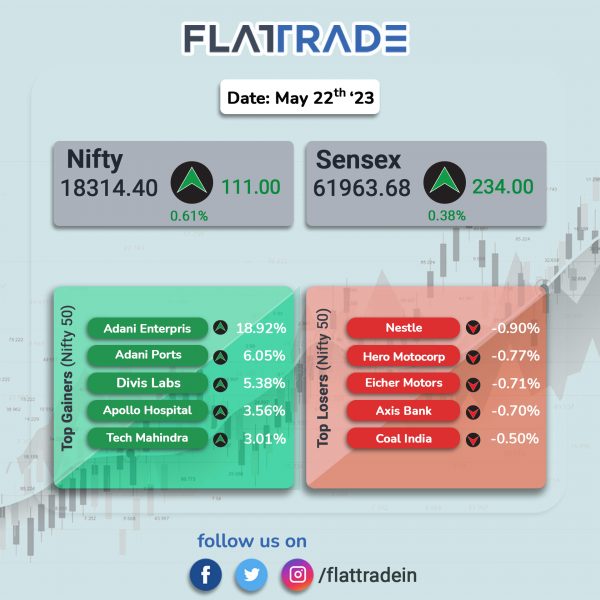

Benchmark equity indices closed higher after metal, IT, and pharma stocks made significant gains. The Sensex closed 0.38% higher and the Nifty 50 index rose 0.61%.

In broader markets, the Nifty Midcap 100 index advanced 0.63% and the BSE Smallcap gained 0.41%.

Top gainers were Metal [3.19%], IT [2.49%], Pharma [0.99%], Oil & Gas [0.78%], Energy [0.74%], and Realty [0.71%] . Top losers were Private Bank [-0.23%], Bank [-0.19%], and Financial Services [-0.18%].

Indian rupee declined by 17 paise to close at 82.83 against the US dollar on Monday.

Stock in News Today

Tata Consultancy Services (TCS): A consortium led by TCS has received advance purchase order worth Rs 15,000 crore from BSNL for 4G network deployment across India. Tejas Networks, a subsidiary of Tata Group, is a part of the consortium and will supply and service the radio access network (RAN) equipment.

Separately, TCS has launched TCS Generative AI in partnership with Google Cloud. TCS Generative AI will leverage Google Cloud’s AI services to design and deploy business solutions for clients. TCS has over 50,000 associates trained in AI, with plans to earn 40,000 skill badges on Google Cloud Generative AI within the year, to support the anticipated demand for its new offering. TCS is currently working with clients in multiple sectors to explore how generative AI can be used to deliver value in their specific business contexts.

Aditya Birla Fashion and Retail (ABFRL): The retailer reported a consolidated net loss of Rs 187 crore for the quarter ended March 2023. The company reported a net profit of Rs 43.59 crore in the year-ago period. Its consolidated revenue from operation rose by 26.14% to Rs 2,880 crore for the reported quarter as compared to Rs 2,283 crore in the year-ago period.

Larsen & Toubro (L&T): The infrastructure company said that the Power Transmission & Distribution (PT&D) Business of L&T Construction has secured ‘large’ EPC orders in India and overseas. As per L&T’s classification, the value of the said contract lies between Rs 2,500 crore to 5,000 crore. In the Kingdom of Saudi Arabia (KSA), the business secured two orders to establish 380 kilovolt overhead power transmission lines connecting prominent cities situated on the Red Sea coast. Subsequently, another order has been secured to design, supply, and construct a 380 kilovolt substation in the central region of KSA. Further, in the domestic market, the company secured fresh orders from a prominent Gujarat discom.

Som Distilleries: The company has tied-up with Carlsberg India for an Odisha plant. The company’s Odisha plant will be partly used by Carlsberg India to produce a range of beverages and popular brands from the former’s portfolio, according to its regulatory filing. The company expects this tie-up will lead to better capacity utilisation of the expanded capacity of the Odisha plant which is expected to be completed by June 2023.

Divis Laboratories: The pharmaceutical company’s net profit slumped 63.9% YoY to Rs 318.79 crore on 23.52% YoY decline in revenue from operations to Rs 1,908.17 crore in Q4FY23 over Q4FY22. On full year basis, the company’s net profit declined 38.68% to Rs 1808.15 crore on 14.13% fall in revenue to Rs 7,625.30 crore in FY23 over FY22. Meanwhile, the board has recommended a dividend of Rs 30 per equity share for FY23. Shares jumped 5.4% on Monday.

Elgi Equipments: The company’s consolidated net profit stood at Rs 170.10 crore in Q4FY23, up from Rs 73.06 crore in Q4FY22. Consolidated net sales jumped 14.9% to Rs 835.74 crore in Q4 FY23 as compared with Rs 727.61 crore in Q4 FY22. The board has recommended a dividend of Rs 2 per equity share for FY23, subject to approval of shareholders. The dividend will be paid to shareholders on or before September 3, 2023. Shares of the company surged 18.06% on Monday.

Bharat Electronics: The company posted a net profit of Rs 1,382 crore in Q4FY23, up 19.7% from Rs 1,154 crore in Q4FY22. Revenue was up 2.2% YoY at Rs 6,479.1 crore in Q4FY23 as against Rs 6,339.8 crore in Q4FY22. EBITDA was up 16.1% YoY at Rs 1,831.8 crore in Q4FY23 as against Rs 1,577.5 crore in Q4FY22.

Nilkamal: The furniture maker said its net profit was at Rs 48.21 crore in Q4FY23 as against Rs 20 crore in Q4FY22. Revenue was up 11.7% YoY at Rs 829 crore in Q4FY23 as against Rs 742 crore in Q4FY22. EBITDA stood at Rs 100.66 crore in Q4FY23, up 70.99% from Rs 58.87 crore in Q4FY22. Shares of the company soared 14.25% in intraday trade on Monday.

Suzlon Energy: The company has bagged an order for 68 wind turbines from Serentica Renewables, a decarbonization platform that seeks to accelerate the energy transition for energy‐intensive industries. The project is expected to commission by early 2024. A project of this size can provide electricity to about 1.68 thousand households and curb about 6.63 lakh tonnes of CO2 emissions per year, the company said in an exchange filing. Shares rose 8.82% on Monday.

Tourism Finance Corporation Of India: The company posted a net profit of Rs 24.8 crore in Q4FY23, up 10.7% YoY from Rs 22 crore in Q4FY22. Revenue fell 1.2% to Rs 60 crore in Q4FY23 from Rs 60.8 crore in Q4FY22.

Dodla Dairy: The company said its net profit was down 44.3% YoY at Rs 22.5 crore in Q4FY23 as against Rs 40 crore in Q4FY22. Revenue was up 22.8% YoY at Rs 724.2 crore in Q4FY23 as against Rs 589.7 crore in Q4FY22. EBITDA fell 28% YoY at Rs 33.7 crore in Q4FY23 as against Rs 46.8 crore in Q4FY22.

Balaji Amines: The company’s net profit was down 56.4% at Rs 47.4 crore in Q4FY23 as against Rs 109 crore in Q4FY22. Revenue was down 39.6% YoY at Rs 471.4 crore in Q4FY23 as against Rs 780.4 crore in Q4FY22. EBITDA was down 52.5% at Rs 33.1 crore in Q4FY23 as against Rs 196.1 crore in Q4FY22. Shares of the company slumped over 6% on Monday.

VRL Logistics: The company’s net profit jumped 16.6% to Rs 60.98 crore in Q4FY23 as compared with Rs 52.30 crore in Q4FY22. Revenue was up 17.6% at Rs 698.2 crore in Q4FY23 as against Rs 594 crore in Q4FY22. EBITDA was down 0.7% YoY at Rs 114.1 crore in Q4FY23 as against Rs 114.9 crore in Q4FY22.

SPARC: The company reported a net loss of Rs 82 crore in Q4FY23 as against Rs 71 crore in Q4FY22. Revenue was up 89.3% YoY at Rs 47.7 crore in Q4FY23 as against Rs 25.2 crore in Q4FY22. EBITDA loss stood at Rs 89.6 crore in Q4FY23 as against an EBITDA loss of Rs 66.6 crore in Q4FY22. The board has approved fundraising of up to Rs 1,800 crore via equity and convertible warrants.

Ramco Industries: The company’s net profit was up 26.1% YoY at Rs 58.4 crore in Q4FY23 as against Rs 46.3 crore in Q4FY22. Revenue fell 10.4% to Rs 350 crore in Q4FY23 from Rs 390.7 crore in Q4FY22. EBITDA was down 4.6% YoY at Rs 33.7 crore in Q4FY23 as against Rs 35.3 crore in Q4FY22.

Multi Commodity Exchange Of India: The company said its net profit was down 85.1% YoY at Rs 5.5 crore as against Rs 37 crore in the year-ago period. Revenue was up 25.6% YoY at Rs 133.8 crore in Q4FY23 as against Rs 106.5 crore in the same period last fiscal. The board has recommended a final dividend of Rs 19.09 per share.