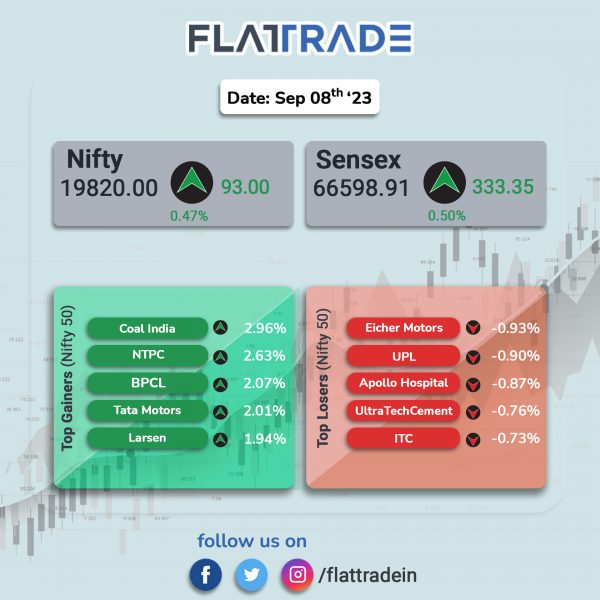

Benchmark indices continued their rally to end higher for the sixth day in a row as risk appetite improved. The Sensex rose 0.5% and the Nifty ended 0.49% higher.

In broader markets, the Nifty Midcap 100 jumped 0.95% and the BSE Smallcap gained 0.43%.

Top gainers among Nifty sectoral indices were Realty [2.12%], Energy [1.39%], Oil & Gas [1.12%], Financial Services [0.89%], Auto [0.67%]. Top losers were Media [-0.97%], Pharma [-0.36%], FMCG [-0.14%], IT [-0.1%], and Metal [-0.05%].

The Indian rupee rose by 28 paise to 82.94 against the US dollar on Friday.

Stock in News Today

Reliance Industries Limited (RIL): The company’s telecom arm Jio Infocomm and chip maker Nvidia announced that they will develop artificial intelligence-based applications for India. Both the companies will work together to develop India’s own foundation large language model (LLM) trained on India’s languages and tailored for generative artificial intelligence (AI) applications in the country. “We are delighted to partner with Reliance to build state-of-the-art AI supercomputers in India,” said Jensen Huang, founder and chief executive officer (CEO) of Nvidia.

JSW Steel: The company said that its consolidated crude steel production in August 2023 grew by 19% YoY to 22.86 lakh tonnes from 19.22 lakh tonnes. The company’s domestic production jumped 17% to 22.15 lakh tonnes. Production at JSW Steel USA-Ohio surged 214% to 0.71 lakh tonnes in August 2023 as compared with August 2022.

Natco Pharma: The company said that it has been named one of the defendants in an antitrust lawsuit by Bayou State’s largest health insurer Louisiana Health Service and Indemnity Company. The company along with Celgene Corporation, Bristol Myers Squibb and Breckenridge Pharmaceutical Inc. has been named defendants in an antitrust lawsuit in the US by Louisiana Health Service & Indemnity Company and HMO Louisiana Inc. regarding Pomalidomide (POMALYST). Natco said it believes that this matter is without merit.

Kotak Mahindra Bank: The Reserve Bank of India (RBI) has approved the appointment of Dipak Gupta as the interim managing director & CEO of the bank, for a period of two months, with effect from 2 September 2023.

PB Fintech (Policybazaar): The company is planning to enter the insurance manufacturing market, and it would start with business-to-business sector, focusing on reinsurance, CNBC-TV18 reported citing sources.

Zydus Lifesciences: The drug maker announced that it has incorporated a wholly owned subsidiary, Zydus Pharmaceuticals (Canada) Inc., on September 6, 2023 in Canada. Zydus Pharmaceuticals (Canada) Inc. is incorporated in Canada under the Canada Business Corporations Act and is yet to commence its business operations.

Gulf Oil Lubricants India: The company said that ICRA has reaffirmed the credit ratings assigned to the long-term/short-term, fund-based/ non-fund-based credit facilities of the company. The credit rating agency has affirmed the company’s long-term rating at ‘[ICRA] AA (Stable)’ and the short-term rating at ‘[ICRA] A1+’. The ratings were attributed to the company’s strong financial profile, characterised by healthy profitability levels, return indicators and a comfortable capital structure.

Spandana Sphoorty Financial: The company’s board has approved and allotted non-convertible debentures (NCDs) aggregating to Rs 100 crore on private placement basis. The microfinance institution allotted 10,000 listed, rated, senior, secured, transferable, redeemable NCDs having a face value of Rs 1 lakh each. Spandana Sphoorty Financial is a rural-focused non-banking financial company and a microfinance lender.

Kirloskar Ferrous Industries: The company said that commercial operations of the ‘Mini Blast Furnace – I’ of the company at Koppal, Karnataka have resumed with effect from September 7. The company said that replacement of top equipment with a bell less top as well as other allied maintenance activities will result in improved operating efficiency of ‘Mini Blast Furnace – I’.