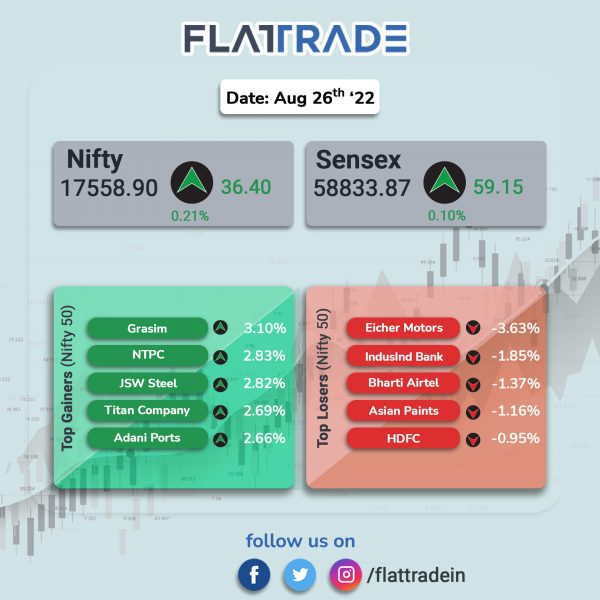

Benchmark indices ended higher led by gains in metal and PSU Bank stocks amid investors awaiting the US Fed chief Jerome Powell’s address at the Jackson Hole Symposium later tonight. The Sensex rose 0.1% and the Nifty 50 index gained 0.21%.

Broader markets outperformed headline indices. The Nifty Midcap 100 rose 0.55% and the BSE SmallCap was up 0.35%.

Top Nifty sectoral gainers were Metal [1.77%], PSU Bank [0.98%], Energy [0.76%] Oil & Gas [0.58%] and Auto [0.4%]. Top losers were Media [-0.66%], Realty [-0.37%], Private Bank [-0.28%], FMCG [-0.14%] and Pharma [-0.1%]

The Indian rupee rose 2 paise to 79.86 against the US dollar on Friday.

Stock in News Today

IDBI Bank: The lender’s chief executive officer said that the bank is likely to recoup 195 billion rupees ($2.4 billion) on soured debt in his pitch to potential buyers amid India’s planned auction of the firm, Bloomberg reported. “We are sitting on about 780 billion rupees of fully provided for bad loans, including written-off loans, and around 25 per cent is likely to be recovered,” Rakesh Sharma said in an interview. “This hidden asset is not reflected in our current valuation and will directly boost the bottom line,” he added.

Adani Group: The Group has launched its Rs 31,000-crore open offer to acquire 26% additional stake from the public shareholders of Swiss firm Holcim’s two Indian listed entities ACC Ltd and Ambuja Cements. In two separate regulatory filings, Ambuja Cements and ACC have submitted their letter of offers, launched by the Adani family group’s Mauritius-based firm Endeavour Trade and Investment.

Mining companies: Shares of mining companies rose after the country’s apex court partially relaxed ceiling limit on iron ore mining. The mining limit for Bellary is raised to 25 MMT and for Chitradurga and Tumkur to 15 MMT. The Supreme Court was hearing applications requesting the lifting of the ceiling limits for production of iron ore for mining leases in districts of Bellary, Chitradurga and Tumkur.

Insurance companies: Shares of insurance companies rose after the insurance regulator’s new proposal. The Insurance Regulatory and Development Authority of India (IRDAI) has recently proposed a 20 percent cap on the agents’ commission for insurance companies and also released a draft consultation paper on the commission limit. The limit on agents’ commission, remuneration and reward has been proposed for general insurers and standalone health insurers.

New Delhi Television Ltd (NDTV): Shares of the media company extended gains to hit upper circuit limit for the third straight day in the opening trade on Friday. The company’s shares have been on an uptrend after Adani group’s hostile takeover bid with the announcement of an open offer on Tuesday to acquire an additional 26% stake.

Meanwhile, Adani Enterprises said that news broadcaster NDTV does not need the Securities and Exchange Board of India’s (Sebi’s) approval to transfer the shares of its promoter entity, RRPR Holdings, to VCPL, according to a letter to the stock exchanges.

GAIL India: The Indian government is in talks with Russia to resume gas supplies under the long-term import deal between Gazprom and GAIL (India), Reuters reported. “There are some immediate issues which we are trying to tackle both at the company level and also at G2G (government to government) level,” GAIL Chairman Manoj Jain said at an annual shareholder meeting.

Marico: The FMCG firm will continue to expand its health care brand Saffola as it aspires to build an Rs 850-1,000 crore business from its food portfolio by FY24, its Managing Director and CEO Saugata Gupta said. “We will continue to launch a significant aggressive innovation programme under the brand Saffola in line with our aspiration to create Rs 850-1,000 crore food portfolio by FY24,” Gupta told the company’s shareholders during the AGM.

Mahindra Lifespace Developers: Mahindra Group Chairman Anand Mahindra said the market capitalisation of its realty firm Mahindra Lifespace has crossed $1 billion, proving sceptics wrong that the company could not survive without transacting in black money. The milestone has vindicated the Group’s entry into the real estate sector, he said.

Indian Hotels: The Tata group hospitality company said that it is on track to achieve its targetted portfolio of a total of 300 hotels by 2025. At present, the company has 242 hotels, including 61 under development, across its brands such as the Taj, SeleQtions, Vivanta and Ginger. Over the last 24 months, the company has rapidly expanded with two hotel signings each month, the company’s Managing Director and CEO Puneet Chhatwal said.

Lupin: The pharma company said that its UK subsidiary, Lupin Healthcare (UK) Limited has received approval from the Medicines and Healthcare products Regulatory Agency (MHRA) to market a generic version of Spiriva. The drug named Lutio, also known as Tiotropium bromide inhalation powder, is used to relieve wheezing, shortness of breath, coughing and chest tightness in patients with chronic obstructive pulmonary disease.

EaseMyTrip: The company will be the official co-powered sponsor of the Asia Cup Cricket 2022. The partnership will give immense visibility to the brand participating in the cricket match having an estimated collective reach of more than 4.94 billion. The brand’s logo will be displayed in multiple places like the area behind the wicket pitch mat, trophy table, etc.

Granules India: The company’s wholly-owned US subsidiary located in Chantilly, Virginia, USA, was classified as Voluntary Action Indicated (VAI). VAI means the USFDA has accepted the company’s response to its observations.The USFDA had issued form 483 with 6 observations at this facility in July 2022.

Gensol Engineering: The company has bagged purchase orders from reputed clients for the development of solar power projects aggregating to a capacity of around 58.8 MWp in the states of J&K, Gujarat, Punjab, Rajasthan, Tamil Nadu and Telangana. The total order value of these projects is estimated at over Rs. 153.15 crore.

Zuari Agro Chemicals: Shares of the company ended nearly 10% higher after CNBC-TV18 reported that the company sought to sell its stake in Mangalore Chemicals, citing sources. According to the report, the company plans to offload Mangalore Chemicals stake to Chambal Fertilisers. Chambal Fertilisers closed 6.32% higher.

Syrma SGS Technologies (Syrma): The company had a strong stock market debut on Friday. Shares of the company surged to toush a high of Rs 312 apiece as against its issue price of Rs 220 per share. The stock ended at Rs 310.5 per equity share.

Zomato: The online food delivery company said that Sequoia has reduced its stake in the company to 4.40% from 6.41%. Earlier, ride-hailing company Uber had exited Zomato, while Tiger Global reduced its stake to 50%.

Delhivery: The logistics firm announced that its plans to hire over 75,000 staff for seasonal jobs over the next one-and-a-half month and expand its parcel sortation capacity by 1.5 million shipments per day. Of these, over 10,000 people will be off-roll employees across Delhivery’s gateways, warehouses, and last-mile delivery, the company said.