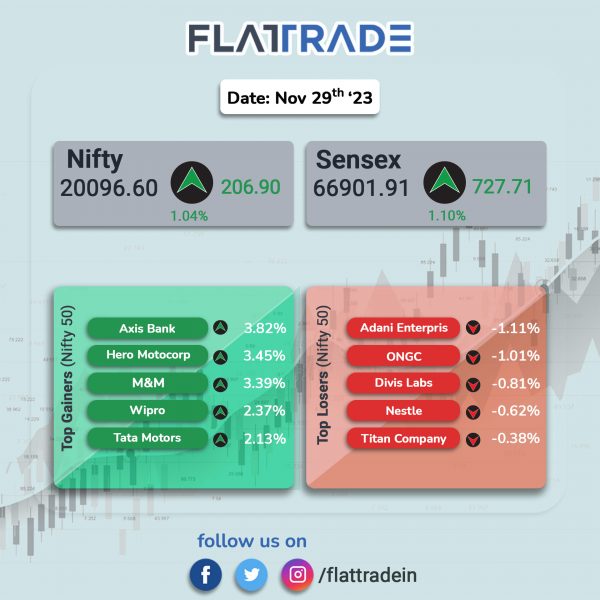

Benchmark equity indices closed higher as FIIs turned net buyers and investors’ optimism was boosted after Fed policymakers, Christopher Waller, signalled that interest rates were unlikely to rise and could be slashed if inflation continued to fall. The Sensex soared 1.09% and the Nifty surged 1.04%.

In broader markets, the Nifty Midcap 100 jumped 0.81% and the BSE Smallcap gained 0.4%.

Top gainers among Nifty sectoral indices were Auto [1.63%], Bank [1.56%], IT [1.53%], Financial Services [1.51%], and Private Bank [1.49%]. Top losers were Realty [-0.5%] and Media [-0.13%].

The Indian rupee closed flat at 83.33 against the US dollar on Wednesday.

Meanwhile, Indian stock market became the 5th in the world to surpass $4 trillion market-cap. Other markets include the US, China, Japan, and Hong Kong.

Stock in News Today

Infosys: The company said that Bank of Commerce (BankCom), an affiliate of San Miguel Corporation (SMC) group in Phillippines has decided to select Infosys Finacle Suite for its core banking transformation. The Infosys Finacle Suite of offerings, which includes Finacle Core Banking, Finacle Liquidity Management and Finacle Customer Data Hub solutions, will replace BankCom’s legacy platform and help the bank engage, innovate, and operate better to keep pace with evolving market expectations.

Bharat Petroleum Corporation (BPCL): The company announced its board has declared an interim dividend of Rs 21 per equity share for the financial year 2023-24. The board has fixed Tuesday, 12 December 2023, as record date to determine the eligibility of the shareholders to receive the said interim dividend. The above dividend would be paid on or before 28th December 2023.

Aurobindo Pharmaceuticals: The drug major announced that it has received final approval from US Food & Drug Administration (USFDA) to manufacture and market Darunavir tablets. The tablets is used for the treatment of human immunodeficiency virus (HIV-1) infection in adult and paediatric patients 3 years of age and older. The said drug is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Prezista Tablets of Janssen Products, L.P. According to IQVIA, the approved product has an estimated market size of $274.8 million for the twelve months ending October 2023.

Lemon Tree Hotels: The hospitality chain informed that Vikramjit Singh has resigned from his position as the president of the company to pursue an entrepreneurial role. The resignation of Vikramjit Singh shall be effective from the closure of working hours of 31 January 2024.

Capacite Infraprojects: The company has received work order from Tridhaatu Aranya Developers LLP for total contract value of Rs 101 crore for project – Aranya Phase-II at Chembur.

Shelter Pharma: The company secured a Rs 1 crore order from Sudan-based Taha Drugs & Chemicals. The order includes a bulk quantity of All vitamin Tablet Nutraceutical, totaling 60,000 boxes, and Joemega Capsule Nutraceutical, also amounting to 60,000 boxes. The order is expected to be fulfilled within four months.

Indostar Capital Finance: The company said that CARE Ratings has upgraded its long-term rating on the debt instruments of the company to “CARE AA- ; Stable” from “CARE A+; Stable”. CARE Ratings stated that the rating factors removal of audit qualifications, conclusion of control review exercise, changes in underwriting and internal control processes, demonstrated support of Brookfield in terms of management bandwidth and active involvement with stakeholders (including debt provider to ensure continued fund raise recently), distribution of bonds to large funds, beginning of flow of new lines from banking system, comfortable capitalisation and pick up in disbursements.

Munjal Auto: Shares of the company rose 4.34% after the IT Department rectified its previous order for AY2022-23 and reduced the demand from Rs 401.42 crore to Rs 69.74 lakh. The company is currently undergoing scrutiny assessment. Despite this, Munjal Auto Industries anticipates no financial repercussions from the ongoing process.

Yatharth Hospital & Trauma Care Services: The company shares dropped 11.9% after an order received from the Commissionerate of Sagar Sambhag, Madhya Pradesh, prevented the company from taking over the premises of Ramraja Hospital, citing government ownership. Ramraja Hospital, which was acquired by Yatharth Hospital, is facing a land dispute in Madhya Pradesh.

IREDA: The company had a strong stock market debut. Shares of the company opened at Rs 50 apiece as against an issue price of Rs 32 per share. The shares hit a high of Rs 60 and closed at the same price.