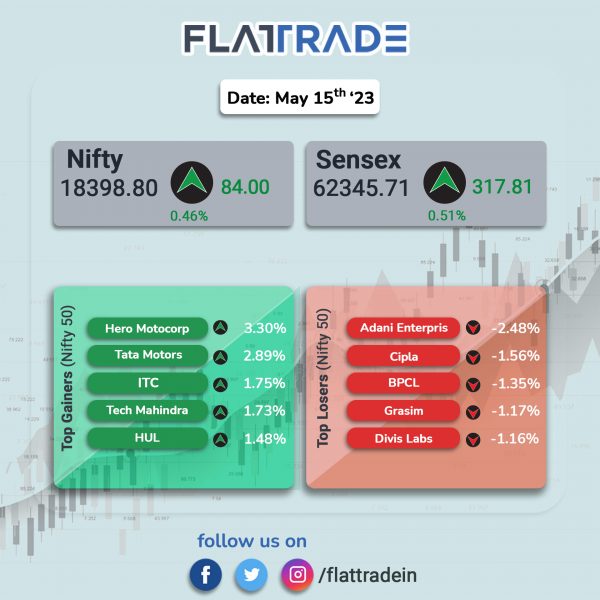

Sensex, Nifty ended higher on broad-based buying amid positive global cues and softening inflation in India. The Sensex rose 0.51% and the Nifty gained 0.46%.

In broader markets, the Nifty Midcap 100 index rose 0.74% and the BSE Smallcap advanced 0.49%.

Top gainers were Realty [4.32%], Media [2.06%], FMCG [1.14%], PSU Bank [1.13%], and Private Bank [-0.77%]. Oil & Gas and Energy indices ended flat.

Indian rupee fell 13 paise to 82.30 against the US dollar on Monday.

The CPI inflation fell to an 18-month low of 4.7% in April, while the Wholesale Price Index (WPI)-based inflation in India turned negative in April and was recorded at -0.92% , data released by the Ministry of Commerce and Industry said. In March, the WPI inflation was 1.34%.

Stock in News Today

Kalyan Jewellers: The company’s net profit fell 1.6% to Rs 71 crore in Q4FY23 as against Rs 72 crore in Q4FY22. Revenue rose 18.4% YoY to Rs 3,381.8 crore in Q4FY23. Ebitda fell 17.5% YoY to Rs 256.7 crore in Q4FY23. The company’s board has also recommended a final dividend of ₹0.50 per equity share, aggregating to 5% of face value of Rs 10 each, for the financial year ended March, 31, 2023, subject to the approval of shareholders.

Rainbow Children’s Medicare: The hospital chin said that net profit stood at Rs 53.9 crore in Q4FY23 as against Rs 12.3 crore in Q4FY22. Revenue was up 49.2% YoY at Rs 317 crore in Q4FY23 as against Rs 212.4 crore in Q4FY22. Ebitda stood at Rs 97.9 crore in Q4FY23 as against Rs 48.1 crore in Q4FY22.

Data Patterns (India): The company’s net profit declined 10.16% to Rs 55.36 crore on 8.54% increase in net sales to Rs 185.10 crore in Q4FY23 over Q4FY22. Ebidta declined 16.13% YoY to Rs 73.35 crore during the quarter. For the full year, net profit rose 31.96% YoY to Rs 124 crore in the year ended March 2023, and net sales rose 45.87% to Rs 453.45 crore. The company’s order book stood at Rs 924 crore at the end of FY23, reflecting a 3x increase compared to order inflow in FY22. With orders finalised in April and May, the current order book is Rs 1,008 crore.

VST Tillers Tractors: The company’s net profit jumped 81.7% YoY to Rs 40.15 crore in Q4FY23 as compared with Rs 22.10 crore in Q4FY22. Net sales increased 47.7% YoY to Rs 322.61 crore in Q4FY23. On full year basis, the company’s net profit fell 7% to Rs 92.37 crore despite of 17.9% rise in net sales to Rs 1,006.43 crore in FY23 over FY22. Meanwhile, the board has recommended a dividend of Rs 25 per equity share for FY23. Further, the board has approved the appointment of Nitin Agrawal as chief financial officer with effect from 12 May 2023.

Karur Vysya Bank: The lender said its net profit was up 58.3% YoY at Rs 338 crore in Q4FY23 as against Rs 214 crore in Q4FY22. Net Interest Income rose 25.7% YoY at Rs 892.6 crore in Q4FY23 as against Rs 710 crore in Q4FY22. Net NPA ratio stood at 0.74% in Q4FY23 as against 0.90% in the preceding quarter.

Patel Engineering: The net profit stood at Rs 83 crore in Q4FY23 as against Rs 34 crore in Q4FY22. Revenue rose 16.3% YoY to Rs 1,298 crore in Q4FY23 from Rs 1,116 crore in Q4FY22. Ebitda climbed 13.5% to Rs 180.5 crore in Q4FY23 as against Rs 159.1 crore in Q4FY22.

Good Luck India: The company’s net profit was up 15.2% YoY at Rs 28 crore in Q4FY23 as against Rs 24.3 crore in Q4FY22. Revenue rose 10.4% YoY at Rs 764.5 crore in Q4FY23 as against Rs 692.3 crore in Q4FY22. Ebitda rose 32.2% YoY at Rs 57.9 crore in Q4FY23 as against Rs 43.8 crore in Q4FY22.

Century Plyboards: The company’s net profit jumped 29.5% YoY at Rs 114.7 crore in Q4FY23 as against Rs 88.5 crore in Q4FY22. Revenue gained 7.1% YoY at Rs 965.4 crore in Q4FY23 as against Rs 901.1 crore in Q4FY22. Ebitda edged up 2% to Rs 163.8 crore in Q4FY23 as against Rs 160.7 crore Q4FY22. The board of directors approved a dividend of Re 1 per share.

Navin Fluorine International: The company’ s net profit was up 81.4% YoY at Rs 136.4 crore in Q4FY23 as against Rs 75.2 crore in Q3FY22. Revenue rose 70.5% YoY to Rs 697.1 crore in Q4FY23 as against Rs 408.9 crore in Q4FY22. Ebitda stood at Rs 201.8 crore in the quarter under review as against Rs 94.2 crore in the year-ago period.

Hikal: The company announced that it had concluded a recently conducted US FDA audit at its Gujarat-based facility with ‘zero’ observations from the American drug regulator.

Great Eastern Shipping Company (GE Ship): The company’s consolidated net profit surged 282.04% to Rs 721.94 crore on 58.92% increase in net sales to Rs 1455.98 crore in Q4 March 2023 over Q4 March 2022. The company’s Ebitda jumped 129.98% year-over-year (YoY) to Rs 936 crore in Q4 FY23. For the full year, net profit soared 308.94% to Rs 2,575.01 crore in FY23, while sales increased by 62.17% over last year to Rs 5690.46 crore. The board has declared 4th interim dividend of Rs 9 per share for the financial year ended 31 March 2023. The record date is fixed on 24 May 2023.

Subex: The company reported a consolidated net loss of Rs 47.18 crore in Q4FY23 as compared with net profit of Rs 0.61 crore in Q4FY22. Net sales declined 40.01% to Rs 47.27 crore in Q4FY23 as against Rs 78.80 crore in Q4FY22. Ebitda stood at Rs 36.8 crore in Q4FY23, steeply higher from Rs 5.1 crore posted in Q4FY22. On full year basis, the company reported net loss of Rs 52.11 crore in FY23 as compared with net profit of Rs 20.99 crore in FY23 over FY22. Meanwhile, the company’s board has appointed Nisha Dutt as Chief executive officer (CEO) with effect from 2 May 2023.