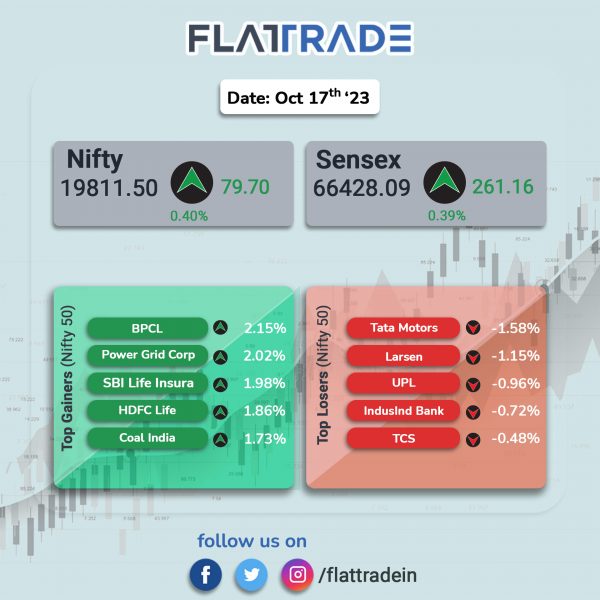

Benchmark equity indices closed higher as investors’ confidence improved on upbeat earnings from corporate India. The Sensex rose 0.39% and the Nifty ended 0.4% higher.

In broader markets, the Nifty Midcap 100 index gained 0.35% and the BSE Smallcap jumped 0.75.

Top gainers were Oil & Gas [0.72%], Financial Services [0.65%], PSU Bank [0.54%], FMCG [0.5%], and Bank [0.42%]. All Nifty sectoral indices closed in the green.

The Indian rupee rose by 2 paise to close at 83.26 against the US dollar on Tuesday.

Stock in News Today

Bajaj Finance: The NBFC has signed an agreement for acquisition of up to 26% equity stake in Pennant Technologies for a cash consideration of Rs 267.50 crore. The acquisition would be completed by December 30, 2023. Pennant Technologies is engaged in providing business-driven technology services and software products for the banking and financial services industry.

Titan: The company’s board has approved the proposal for raising of funds through issuance of rated, listed, redeemable, unsecured Non-Convertible Debentures (NCDs) on private placement basis, for an amount up to Rs 2,500 crore. The board has also approved availing long-term borrowings in the form of long-term unsecured loans up to a limit of Rs 1,000 crore from banks and financial Institutions.

Newgen Software Technologies: The company’s consolidated net profit jumped 59% YoY to Rs 47.78 crore in Q2FY24 due to strong growth in the banking and financial services segment. The company’s revenue from operations grew 29.7% to Rs 293.23 crore in Q2FY24 as against Rs 226.11 crore in the year-ago quarter. The company said that it has secured an order worth Rs 68 crore from a leading public sector bank in India for the development and management of their complete Digital Business Platform.

Tata Motors: The automaker launched the new facelifted version of Harrier in India with the price ranging between Rs 15.49 lakh and Rs 24.49 lakh (ex-showroom). The pricing of automatic transmission variants starts from Rs 19.99 lakh (ex-showroom). Bookings for the SUV have already been opened. The new Tata Harrier SUV comes with a Global NCAP rating of five stars for both adult and child safety.

VA Tech WABAG: The company has partnered with Pani Energy Inc. to implement applied AI for treatment plants. The new category of digital technology is called Operational Intelligence (OI) and delivered through their product Pani ZEDTM, in the plant operations. The partnership aims to leverage Pani’s platform to optimize on operational expenditure in the plants by reducing downtime, energy consumption, and chemical usage.

Tata Metaliks: The company announced that its net profit rose to Rs 44.16 crore in Q2FY24 from Rs 14.29 crore in the year-ago period. The rise was attributed to lower raw material costs. Revenue from operations fell 13.9% YoY to Rs 754.71 crore during the reported quarter from Rs 876.98 crore in the same period last year. The company Ebitda stood at Rs 90.1 crore and Ebitda margin was at 11.9%.

Ajmera Realty & Infra India: The company announced that it has bagged a residential redevelopment project in Versova, Mumbai, and the target sale value is estimated at Rs 360 crore. The redevelopment will primarily comprise 3 BHK residential apartments with an estimated carpet area of approximately 90,700 square feet. The company said it is focused on premium developments in luxury and mid-luxury projects in the residential segment.

JKumar Infraprojects: The company said that it has received Letter of Acceptance (LOA) for the project: Provn of Tech Accn and Allied Infra for Command Hospital, Lucknow on EPC Mode for Rs 509 crore. The project has to be executed within a period of 30 months for Phase I (Construction) & 60 months for Phase II (Maintenance).

Bajaj Housing Finance: The company’s standalone net profit grew 47.43% to Rs 451.11 crore in the quarter ended September 2023 as against Rs 305.98 crore during the quarter year ago. Its standalone revenue jumped 42.67% to Rs 1907.37 crore in the quarter ended September 2023 as against Rs 1336.90 crore during the same period last fiscal.

PCBL: The company reported a 8.7% decline in its revenue at Rs 1,486.70 crore for the quarter ended September 2023 as against Rs 1,627.8 crore in the same period last year. The company’s net profit rose 5.3% YoY to Rs 122.60 crore in Q2FY24 from Rs 116 crore reported during the same quarter last fiscal. Ebitda jumped 26.3% to Rs 238 crore in Q2FY24 from Rs 189 crore in Q2FY23.

Dalmia Bharat: The company said its board has declared an interim dividend of Rs 4 per equity share of Rs 2 each for the financial year 2024. The record date fixed for payment of the said interim dividend is October 21, 2023.

TCI Express: The company’s standalone revenue from operation stood at Rs 319.98 crore in Q2FY24 as against Rs 309.9 crore in Q2FY23. The net profit came in at Rs 35.58 crore for the quarter ended September 2023 as against Rs 37.79 crore in the year-ago period. The company informed that its board of directors has declared an interim dividend for FY24 at Rs 3 per equity share of face value of Rs 2 each. The record date for the payment of dividend is fixed on October 26 (Thursday).

TVS Motor Company: The two-wheeler announced the launch of all new TVS Jupiter 125 enabled with SmartXonnectTM. The price of the new vehicle starts from Rs. 96,855 (ex-showroom, Delhi), and it is available across the country.

Man Infraconstruction: The company has increased its equity ownership in its associate company, Atmosphere Realty Private Limited (ARPL), by buying an additional 12.5% stake for a cash consideration of Rs 12.5 crore. With this acquisition, the company has increased its equity holding in ARPL from 17.5% to 30%.

Eimco Elecon: The company’s consolidated net profit soared 77% YoY to Rs 10.80 crore and the company’s net sales rose 38.6% YoY to Rs 51.12 crore in Q2FY24. Total expenses rose 25.1% to Rs 38.31 crore in Q2 FY24 over Q2 FY23. Net cash flow from operating activities stood at Rs 7.11 crore in Q2FY24, down from Rs 12.04 crore in the year-ago period.

Shilpa Medicare: The company’s finished dosage form manufacturing facility, Unit IV, at Telangana has successfully received a good manufacturing practice (GMP) Inspection from (TGA), Australia. The facility is involved in manufacturing, packaging, labelling, testing and release of finished dosage forms (sterile injections and non-sterile oral solids) for the treatment of various forms of cancer and adjuvant therapy.

Maithon Power: The company’s net profit rose 10.55% to Rs 90.20 crore in the quarter ended September 2023 as against Rs 81.59 crore during the quarter ended September 2022. Sales declined 5.94% to Rs 762.16 crore in the quarter ended September 2023 as against Rs 810.32 crore during the previous quarter ended September 2022.