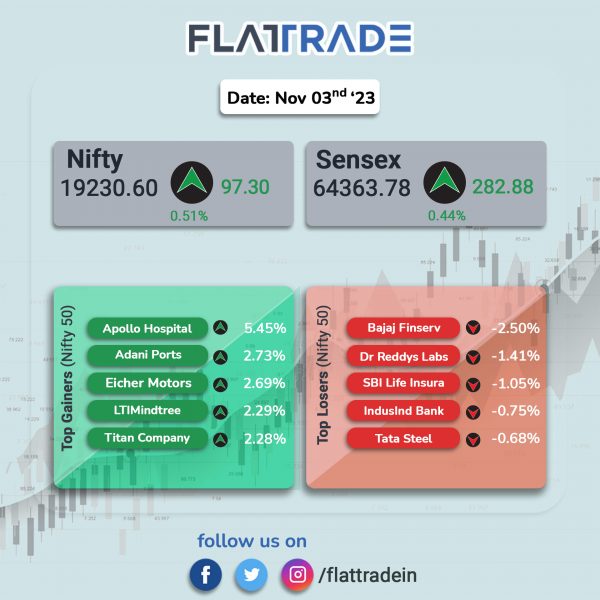

Dalal Street ended higher on broad-based buying as risk appetite improved on bets that the end of rate hike cycle is near and easing of bond yields. The Sensex rose 0.44% and the Nifty gained 0.51%.

In broader markets, the BSE Smallcap jumped 0.93% and teh Nifty Midcap 100 index advanced 0.7%.

Top gainers were Realty [2.54%], Media [1.38%], Oil & Gas [0.77%], Bank [0.7%], and Private Bank [0.67%]. All Nifty sectoral indices ended in the green.

The Indian rupee fell 2 paise to 83.28 against the US dollar on Friday.

Stock in News Today

Titan: The company reported a nearly 10% YoY rise in net profit at Rs 940 crore in Q2FY24. Revenue from operations grew by 34% YoY to Rs 11,660 crore in the quarter under review. EBIT rose 13% YoY to Rs 1,367 crore, while EBIT margin fell by 87 basis points to 13.6%. The other income for the quarter rose to Rs 122 crore in Q2FY24 from Rs 60 crore in the year-ago period. Its jewellery segment recorded 19% YoY growth in total revenue at Rs 8,575 crore in Q2FY24. Tanishq expanded its presence in Gulf Co-operation Countries (GCC) to enter Qatar with 2 new stores in Doha.

Bajaj Finance: The company’s board has approved the allotment of 15.50 lakh warrants to the promoter at the Issue price of Rs 7,670 per warrant totalling Rs 1,188 crore via preferential allotment of warrants.

Raymond: The company announced the acquisition of 59.25% stake in Maini Precision Products Limited (MPPL) for Rs 682 crores funded by a mix of debt and internal accruals. The transaction is expected to be completed during the current fiscal. The acquisition is a strategic move to further strengthen Raymond’s existing engineering business with a complementing business that has presence in the sunrise sectors of Aerospace, Electric Vehicles (EV) and Defense. Moreover, for the purpose of consolidation of Engineering Business of Raymond Group, the company has approved incorporation of a wholly owned subsidiary.

Adani Ports and SEZ (APSEZ): The company said that it has handled 37 MMT of total cargo in October 2023, a 48% YoY growth. Its Haifa Port in Israel handled over 1.1 MMT of cargo in October, marginally better than the average cargo volume run rate of the last six months. In the initial seven months of FY24, APSEZ has handled 240 MMT of total cargo, up 18% YoY growth.

Zomato: The consolidated revenue was up 17.9% at Rs 2848 crore in Q2FY24 as against Rs 2416 crore in Q1FY24. Consolidated Ebitda loss was at Rs 47 crore in Q2FY24 as against a net loss of Rs 48 crore in Q1FY24. The company reported a net profit of Rs 36 crore in Q2FY24 as against Rs 2 crore in Q1FY24.

Infosys: The IT company opened a new proximity center in Sofia, Bulgaria as part of its continued growth in Europe. The new center will enable Infosys to attract, re-skill, and up-skill 500 new employees. Over the course of the next four years, these new employees will work on global opportunities around next-gen digital technologies including Infosys Cobalt Cloud Solutions, Infosys Topaz AI & Automation, Data and Insights, IoT, 5G, and software engineering.

KPI Green Energy: The company informed that new orders aggregating to 5.70 MW for executing solar power projects was received by Sun Drops Energia Private Limited, a wholly owned subsidiary of the company under ‘Captive Power Producer (CPP)’ segment. With this addition, the company’s cumulative orders of solar power projects have crossed over 112 MW under CPP segment of the company.

Arvind Fashions (AFL): The clothing company has signed definitive agreements with Reliance Beauty & Personal Care Limited (RBPCL) to sell its wholly owned subsidiary Arvind Beauty Brand Retail Limited (ABBRL) which runs its Sephora India business, in an all cash transaction. AFL intends to utilise the proceeds to invest in growth of its brands portfolio and repayment of debt. RBPCL is a wholly owned subsidiary of Reliance Retail Ventures Limited.

Zydus Lifesciences: The company and Lupin have entered into a licensing and supply agreement to co-market, Saroglitazar Mg for the treatment of Non-Alcoholic Fatty Liver Disease (NAFLD) and Non-Alcoholic Steato Hepatitis (NASH) in India. Under the terms of this agreement, Lupin will have semi-exclusive rights to co-market the product in India under the brand name LINVAS. Lupin will pay Zydus upfront licensing fees and milestone payments based on the achievement of pre-defined milestones.

MRF: The tyre maker said its consolidated revenue was up 6.7% at Rs 6217.1 crore in Q2FY24 from Rs 5826.3 crore in Q2FY23. Consolidated Ebitda was up 140.7% at Rs 1157 crore in Q2FY24 from Rs 480.6 crore in Q2FY23. The company’s net profit zoomed 352% to Rs 587 crore in Q2FY24 from Rs 130 crore in Q2FY23. The board has recommended an interim dividend payout of Rs 3 per share, and fixed November 17 as the record date for the same.

Whirlpool India: The company’s consolidated revenue declined 5.6% to Rs 1522 crore in Q2FY24 from Rs 1612 crore in Q2FY23. The company’s Ebitda fell 17.7% to Rs 73.1 crore in Q2FY24 as against Rs 88.9 crore in Q2FY23. The company’s net profit was down 22.1% to Rs 38.2 crore in Q2FY24 from Rs 49 crore in Q2FY23.

UCO Bank: The company reported a 20.3% fall in its net profit to Rs 401.67 crore in Q2FY24 from Rs 504.52 crore in the same quarter last year. The bank’s gross NPA ratio fell to 4.14% in the quarter as compared to 6.58% in the year-ago period. The net NPAs of the bank fell to 1.11% as compared to 1.99% in the same quarter last year. The bank’s total interest income jumped 24.7% to Rs 5,218.82 crore in the quarter from Rs 4,184.89 crore a year ago. Net interest income (NII) for the quarter was up 8.3 per cent YoY at Rs 1,917 crore compared with about Rs 1,770 crore in the same quarter last year.

Chambal Fertilisers: The company’s consolidated revenue fell 37.3% to Rs 5386 crore in Q2FY24 from Rs 8587 crore in Q2FY23. Consolidated Ebitda was up 38.4% at Rs 615 crore in Q2FY24 as against Rs 444 crore in Q2FY23. The company’s net profit was up 38.9% at Rs 381 crore in Q2FY24 compared with Rs 274 crore in Q2FY23.

Patel Engineering: The company reported that its consolidated revenue from operations was up 23% to Rs 1021 crore in Q2FY24 from Rs 830 crore in Q2FY23. Consolidated Ebitda rose 18.1% to Rs 140 crore in Q2FY24 from Rs 119 crore in Q2FY23. Consolidated net profit was up 87.1% at Rs 37.6 crore in Q2FY24 as against Rs 20.1 crore in Q2FY23.

Bayer Cropscience: The company’s revenue grew 11.4% to Rs 1617 crore in Q2FY24 as against Rs 1452 crore in Q2FY23. Ebitda was up 28.2% at Rs 305 crore in Q2FY24 as against Rs 238 crore in Q2FY23. The company’s net profit climbed 37.1% to Rs 223 crore in Q2FY24 from Rs 163 crore in Q2FY23.

Aegis Logistics: The company’s consolidated revenue from operations fell 42.6% to Rs 1235 crore in Q2FY24 from Rs 2151 crore in Q2FY23. Consolidated Ebitda was up 23.5% at Rs 208 crore in Q2FY24 as against Rs 169 crore in Q2FY23. Consolidated net profit jumped 48.4% to Rs 150 crore in Q2FY24 from Rs 101 crore in Q2FY23.

Prism Johnson: The company’s consolidated revenue was up 10.5% at Rs 1838 crore in Q2FY24 as against Rs 1663 crore in Q2FY23. Consolidated Ebitda jumped 182.2% to Rs 92.4 crore from Rs 32.7 crore in Q2FY23. The consolidated net profit was at Rs 183 crore in Q2FY24 as against a net loss of Rs 82.6 crore in Q2FY23.

Godfrey Phillips India: The company’s consolidated revenue was up 15.4% at Rs 1158 crore in Q2FY24 from Rs 1019 crore in Q2FY23. Consolidated Ebitda fell 7.1% at Rs 224 crore in Q2FY24 as against Rs 241 crore in Q2FY23. The company’s consolidated net profit nearly remained flat at Rs 202 crore in Q2FY24.

Usha Martin: The company’s consolidated revenue from operations fell 4.3% to Rs 785 crore in Q2FY24 as against Rs 820 crore in Q2FY23. Consolidated Ebitda jumped 25.5% to Rs 144 crore in Q2FY24 from Rs 115 crore in Q2FY23. Consolidated profit grew 38.7% to Rs 110 crore in Q2FY24 from Rs 78.9 crore in Q2FY23.

Kirloskar Oil Engines: The company’ consolidated revenue was up 6.24% at Rs 1,305 crore in Q2FY24 from Rs 1,228 crore in Q2FY23. Consolidated Ebitda rose 11.8% at Rs 202 crore in Q2FY24 from Rs 181 crore in Q2FY23. Consolidated net profit fell 5.5% to Rs 77.9 crore in Q2FY24 from Rs 82.5 crore in Q2FY23.

Omaxe: The company plans to invest Rs 300 crore in Uttar Pradesh Township Project. The company had signed a MoU with other realty companies to develop the township on land admeasuring about 100 acres.

Gabriel India: The company’s standalone revenue from operations was up 7.7% at Rs 864 crore in Q2FY24 as against Rs 803 crore in Q2FY23. Ebitda rose 25.8% to Rs 73.7 crore in Q2FY24 as against Rs 58.6 crore in Q2FY23. The company’s standalone net profit grew 28.1% to Rs 46.9 crore in Q2FY24 from Rs 36.6 crore in Q2FY23.

Orient Electric: The company’s revenue from operations was up 11% at Rs 567 crore in Q2FY24 as against Rs 511 crore in Q2FY23. Consolidated Ebitda rose 78.4% at Rs 20.7 crore in Q2FY24 as against Rs 11.6 crore in Q2FY23. The company’s consolidated net profit was at Rs 18.45 crore in Q2FY24 as against a net loss of Rs 0.3 crore in Q2FY23.