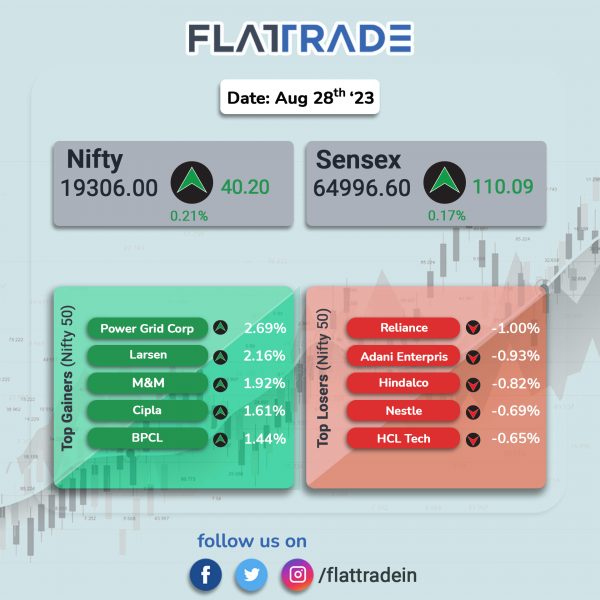

Dalal Street ended higher amid positive global cues after China announced new measures to support its economy. The Sensex rose 0.17% and the Nifty 0.21%.

In broader markets, the Nifty Midcap 100 jumped 0.5% and the BSE Smallcap gained 0.67%.

Top gainers were Pharma [0.91%], PSU Bank [0.75%], Auto [0.73%], Private Bank [0.61%], and Bank [0.6%]. Top losers were IT [-0.46%], FMCG [-0.23%], and Oil & Gas [-0.12%].

The Indian rupee rose 3 paise to 82.63 against the US dollar on Monday.

Stock in News Today

Reliance Industries (RIL): The company announced that Nita Ambani will step down from the board of the company. Akash Ambani, Anant Ambani and Isha Ambani were appointed as non-executive directors by the board. At the 46th annual general meeting of the company, Ambani announced that the company will launch its Jio AirFiber on September 19. He also said that the company is adding one 5G cell every 10 seconds and will have over one million subscribers by December 2023.

Life Insurance Corporation of India (LIC) and Tata Chemicals: LIC has increased its stake in Tata Chemicals from 7.123% to 9.177%. LIC bought 1,81,45,978 shares at an average price of Rs 999.35 via open market during the period, June 27, 2023 to August 24, 2023.

Bharat Forge: The company’s wholly owned defence subsidiary Kalyani Strategic Systems’ joint venture bagged an order amounting to Rs 287.51 crore from the Indian Ministry of Defence. The order is won by Kalyani Rafael Advanced Systems, a joint venture company between Kalyani Strategic Systems and Rafael Advanced Systems of Israel for the supply of missile systems. The order is expected to be executed over the next twelve months. Meanwhile, the forging company informed that Vivek Dwivedi, president and chief technology officer has resigned from the services of the company due to health reasons. His last date with the company will be 1 September 2023. .

Indian Bank: The bank said that a meeting of directors is scheduled on 30 August 2023 to consider a proposal for raising the equity capital within the limit of Rs 4,000 crore. The public sector bank may raise equity capital of the bank through QIP/FPO/rights issue or in combination thereof.

LT Foods: Shares of the company jumped over 9% from day’s low after the company clarified that the recent notification by the Government of India regarding the minimum export price of Basmati Rice does not impact its exports. The Government of India on Sunday issued a notification setting the minimum export price of Basmati Rice at $1200 per ton. Any export below this limit will be placed on hold and evaluated by a committee formed by the government. LT Foods said it primarily exports premium and aged rice under its trusted brands, DAAWAT and Royal, which are priced above the minimum export price limit of $1200 per ton. Therefore, LT Foods remains unaffected by the new export regulations.

Patel Engineering: The company along with JV partner was declared as the lowest bidder and it has received a letter of award (LoA) for Dibang multipurpose project for construction of civil works. The value of the project stood at Rs 3,637.12 crore and it is expected to be completed within 86 months. The project includes construction of head race tunnels including intake, pressure shafts, penstocks, power house & transformer cavern, tail race tunnels, pothead yard, adits etc. for Dibang multipurpose project 2,880 MW (12 X 240 MW) in Arunachal Pradesh.

Man Infraconstruction: The company announced that it has secured a redevelopment project in western suburbs of Mumbai city. The project will have a carpet area of about 17 lakhs square feet with potential to generate revenue of Rs 4,000 crore in next five years.

Procter & Gamble Hygiene & Health Care: The company’s net profit zoomed to Rs 151.24 crore in June 2023 quarter as against Rs 42.55 crore posted in June 2022 quarter. Revenue from operations rose 9.8% to Rs 852.53 crore in the quarter ended June 2023 as compared to the year-ago period, driven by strong brand fundamentals and integrated growth strategy. Meanwhile, the board has recommended a final dividend of Rs 105 per equity share for the financial year ended 30 June 2023, subject to shareholders’ approval.

Venus Remedies: The company has received marketing approval from Saudi Arabia for production of Enoxaparin in pre-filled syringes. Venus Remedies has an annual capacity of producing more than 5 million units of Enoxaparin.

Sprayking Agro Equipment: The company received a repeat order worth Rs 1.5 crore for supplying Brass parts. Further the company has launched five new products such as Rectangle profile, Section rode, Electrical Section rode, Agricultural gun parts (which is assembly of 15 products) which shall be used in manufacturing , Agricultural and Electrical industry. Subsequently, the company is in advance talks with Lixil Group South Africa for future business order.

Schaeffler India: The company said that it has signed share purchase agreement to acquire 100% stake in KRSV Innovative Auto Solutions (Koovers) for a consideration of approximately Rs 142.4 crore. The deal will be fully funded by own cash generation and the transaction is expected to be completed by third quarter of CY2023.

Gulf Oil Lubricants India (GOLIL): The company’s board has approved to acquire 51% stake in Tirex Transmission for Rs 103 crore subject to the completion of definitive agreements. Tirex Transmission is a key player in manufacturing DC Fast Chargers for EVs in India. The capital infusion into Tirex is earmarked for R&D initiatives and scaling up production capacities and extending the service network. The company will complete the acquisition within 2-3 months.

CCL Products (India): The company has reported a breakdown of a key equipment at its wholly-owned subsidiary, Ngon Coffee Company in Vietnam. The equipment breakdown is likely to impact approximately 6-10% of the normal net profit on a consolidated basis for CCL Products (India). However, the company has assured stakeholders that the damage to the equipment and resulting loss of profit are fully covered by insurance.

Jonjua Overseas: The company announced that the routes created by Jonjua Air under the UDAN 5.1 scheme have been validated. With this development, Jonjua Air will proceed with submitting its bid for these routes, opening up new opportunities for the airline. Jonjua Overseas is listed on BSE SME.

Manappuram Finance: The company said that the Kerala High Court has dismissed Enforcement Directorate’s case against its MD and CEO V P Nandakumar. Earlier, the ED had frozen assets worth Rs 143 crore belonging to V P Nandakumar as part of an investigation into a money laundering case. The ED alleged that Nandakumar was involved in money laundering and large-scale cash transactions through his proprietary firm, Manappuram Agro Farms (MAGRO), without the approval of the Reserve Bank of India (RBI).