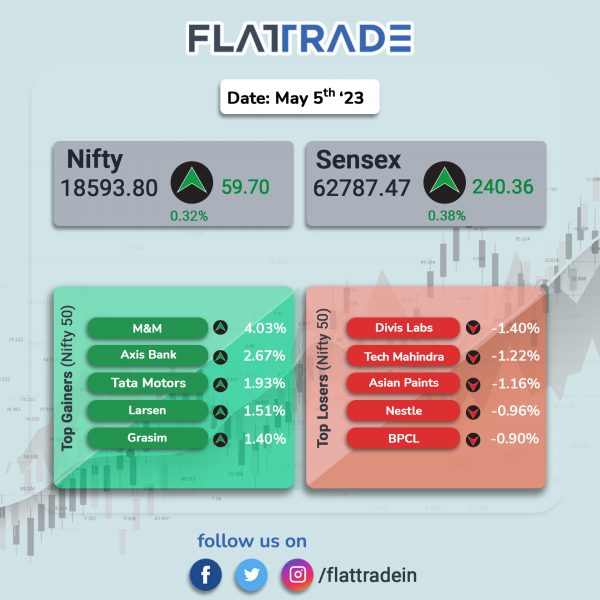

Sensex, Nifty closed higher on investors’ optimism amid positive global cues. The Sensex closed 0.38% higher, while the Nifty 50 index advanced 0.32%.

In broader markets, the Nifty Midcap 100 jumped 0.14% and the BSE Smallcap index rose 0.51%.

Top gainers among Nifty sectoral indices were Auto [1.26%], Media [0.88%], Private Bank [0.68%], Energy [0.49%], Bank [0.37%], and Financial Services [0.36%]. Top losers were FMCG [-0.45%], PSU Bank [-0.43%], and IT [-0.3%].

Indian rupee fell 36 paise to 82.68 against the US dollar on Monday.

Crude oil prices rallied nearly 2% on Monday, with the global benchmark Brent oil surging above $77 per barrel, after Saudi Arabia decided to cut oil production by a further 1 million barrels per day (bpd) to 9 million bpd from July. Brent crude futures gained 1.73% to $77.45 per barrel, while the US West Texas Intermediate crude climbed 1.87% to $73.08.

Stock in News Today

Embassy Office Parks REIT: The company announced that it has raised Rs 1,050 crore non-convertible debentures (NCDs) at 7.77% coupon rate. Embassy REIT will utilize the proceeds to refinance bank loans, which are due for an interest reset in the coming months. The NCDs will be listed on the wholesale debt market of Bombay Stock Exchange (BSE). The rating agency CRISIL has assigned “AAA/Stable” rating to these debentures.

Tata Power Company: The company said that its subsidiary, Tata Power Renewable Energy (TPREL), has commissioned a 110 megawatt (MW) solar power project in Bikaner, Rajasthan. The project will supply 110 MW of green power to the Kerala State Electricity Board and it is expected to generate approximately 211 million units (MUs) and reduce a 2,58,257 MT (metric tonne) carbon footprint annually. The company said that the project has used 2,59,272 mono bifacial PERC half-cell modules.

One 97 Communication (Paytm): The fintech company said that its lending business witnessed a 169% YoY growth in disbursement to Rs 9,618 crore ($1.2 billion) for April and May 2023 and the number of loan disbursed jumped to Rs 85 lakh in April and May 2023. Paytm said that its loan distribution business in partnership with large lenders continues to witness robust growth with total disbursements through our platform. Merchant payment volumes (GMV) in the said period was at Rs 2.65 lakh crore ($32.1 billion), year-on-year growth of 35%. The company said that its focus over the past few quarters continues to be on payment volumes that generate profitability for the company. The Paytm Super App continues to see growing consumer engagement with average monthly transacting users for the quarter to date (for April & May) at 9.2 crore, registering growth of 24% year on year.

Suzlon Energy: The renewable energy company said in an exchange filing that it has become the first Indian wind energy company to cross 20 GW of wind energy installations through 12,467 wind turbines installed across 17 countries.

Greaves Cotton: The company said that its NBFC arm has launched a platform for electric vehicle financing. Greaves Finance, a non-banking financial company (NBFC) and a wholly owned subsidiary of Greaves Cotton, has introduced a financial platform called “evfin”. This platform aims to provide accessible and cost-effective financing options for electric vehicles.

Angel One: The company’s client base jumped 44.5% to 14.59 million in May 2023 as against 10.10 million in May 2022. On sequential basis, the company’s client base rose by 3.3% month-on-month from 14.13 million clients in April 2023. Gross client acquisition stood at 0.46 million in May 2023 as compared with 0.38 million in April 2023 (up 20.4%) and 0.47 million in May 2022 (down 1.7%). Angel’s overall average daily turnover (ADTO) was at Rs 22,037 crore in May 2023, up 0.3% MoM and up 146.4% YoY.

Som Distilleries & Breweries: The company announced that it had achieved a market share of 42% in May 2023 in the beer industry of Madhya Pradesh (MP). Shares of the company soared by 9.72% to Rs 253.5 apiece.

Patel Engineering: The company received letter of acceptance (LOA) from City and Industrial Development Corporation (CIDCO) for the design & construction of water tunnel and aliied works in Raigad, Maharashtra. The company will construct 6.7 km long treated water tunnel and also complete associated works from Sai Village to Vindhane Village in Raigad District, Maharashtra, within 60 months. The water tunnel project worth Rs 519.50 crore is going to be executed without any joint venture partnership.

Ramco Systems: The company inaugurated its subsidiary office located in Doha, Qatar to support and transform the region’s business houses and MNCs in the area of ERP, HR, and payroll. As one of the fastest growing countries in the Middle East, Qatar presents a wealth of opportunities for Ramco to further strengthen its position as a key enterprise software provider, the company said.

Dr.Reddy’s Laboratories (DRL): The pharma company informed that its tocilizumab biosimilar candidate, DRL_TC, successfully met its primary and secondary endpoints in a Phase I study. This Phase I study used an intravenous (IV) formulation to evaluate the pharmacokinetic equivalence, safety and immunogenicity of Dr. Reddy’s tocilizumab biosimilar candidate in comparison to reference products. The clinical trial also confirmed the similarity between DRL_TC and the EU and U.S. reference products in terms of pharmacodynamic parameters and found no noteworthy differences in safety and immunogenicity across these three treatment groups.

Indoco Remedies: The company announced that the USFDA has classified the inspection conducted at its Goa plant II in the February 2023 as OAI (Official Action Indicated). The USFDA had inspected company’s Sterile Facility (Plant II) located at Goa from 20 to 28 of February 2023. The said Facility had 4 observations in Form 483.

PVR INOX: The theatre has has opened a new 7-screen multiplex at Global Mall in Bengaluru as part of its expansion plans in Karnataka. The cinema, located next to Nayandahalli Metro Station, boasts a seating capacity of 1189 and features the latest in theatrical technology, including SP4K next-generation laser projectors, Dolby Atmos audio, and Next-Gen 3D technology. The multiplex also has a 4DX auditorium, which delivers a fully immersive cinematic experience.

Nava: Shares of the company surged over 11% in intraday trade after the supplier of ferro alloys said that its Zambia-based colliery has lowered its overall liabilities by about $277 million. The company’s unit, Maamba Collieries, reduced its liabilities on the back of improved operational cash flows and discharged overdue loan installment aside, the company said in a statement. The unit has reduced its overall liabilities by $277 million since the start of December to $206 million as the subsidiary has been receiving payments for all energy sales since May last year, resulting in incremental cash flows, including that from coal sales.