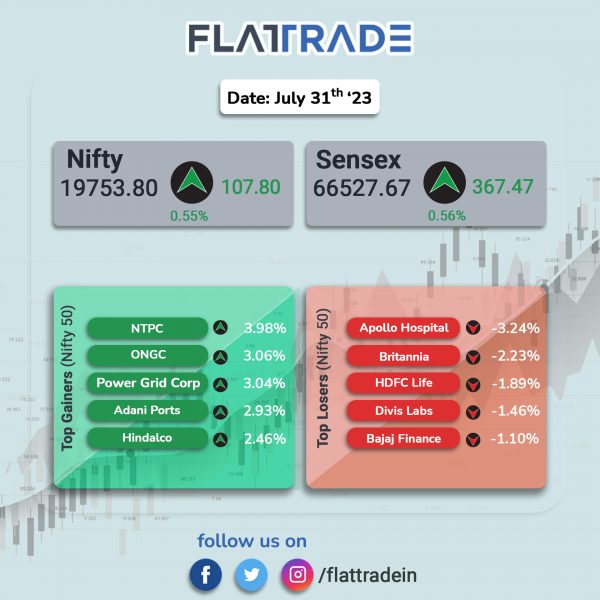

Dalal Street ended higher, aided by strong global macroeconomic indicators such as cooling inflation and the Fed nearing the end of rate hike cycle. The Sensex jumped 0.56% and the Nifty gained 0.55%. On a monthly basis, the Nifty ended 2.94% higher and the Sensex rose 2.72%

Broader markets outperformed the headline indices today. The Nifty Midcap 100 index advanced 0.97% and the BSE Smallcap surged 1.31%.

Top gainers among Nifty sectoral gainers were Metal [1.77%], IT [1.49%], Auto [1.1%], Oil & Gas [1.03%], and Realty [0.68%]. Nifty FMCG [-0.62%] was the only loser among Nifty sectoral indices.

The Indian rupee stood at 82.25 against the US dollar on Monday.

Stock in News Today

GAIL India: The state-owned company recorded a revenue of Rs 32,212.1 crore in Q1 FY24 as against Rs 32,843 crore in Q4 FY23. The company’s profit jumped 1,412 crore in Q1 FY24 from Rs 603 crore in the preceding quarter. The company’s EBITDA soared to Rs 2,432.6 crore in Q1 FY24 from Rs 307 crore in Q1 FY23.

Meanwhile, UBS Securities upgraded its rating on the shares to ‘buy’ from ‘sell’ and hiked its target price on the stock to Rs 150 from Rs 80. UBS Securities cited the potential benefits of realised tariffs from tariff integration and the positive impact of India’s increasing gas demand and GAIL’s pipeline expansion.

Bharti Airtel: The telecom provider said that it has prepaid Rs 8,024 crore to the Department of Telecom (Government of India) towards part prepayment of deferred liabilities pertaining to spectrum acquired in auction of year 2015. The said instalments had an interest rate of 10% and have been prepaid by Airtel, leveraging much lower cost financing available to it.

UPL: The agrochemicals major said its consolidated net profit plummeted 81% YoY to Rs 166 crore in Q1 FY24. Its consolidated revenue from operations plunged more than 17% YoY to Rs 8,963 crore. Further, UPL cut its earnings guidance to 1-5% in FY24, compared to earlier guidance of 6-10%. The company’s operating profit is expected to grow by 3-7%, as against 8-12%, projected earlier. EBITDA declined 32% YoY to Rs 1,593 crore.

Adani Green: The company’s consolidated net profit rose 51% year-on-year (YoY) to Rs 323 crore for the quarter ended June 2023. It was Rs 214 crore in the same quarter of last fiscal. Revenue from operations jumped 33% to Rs 2,176 crore for the April-June period, compared with Rs 1,635 crore in the corresponding period of last year. The sale of energy has increased by 70% YoY to 6,023 million units in Q1 FY24 on the back of strong capacity addition.

NTPC: The company’s consolidated net profit jumped 23.8% to Rs 4,873.24 crore in Q1 FY24 from Rs 3,936.82 crore recorded in Q1 FY23. Revenue from operations declined marginally to Rs 43,075.09 crore in Q1 FY24 as against Rs 43,177.14 crore posted in Q1 FY23. The company’s operating margin improved to 20.74% in Q1 FY24 as against 17.67% reported in Q1 FY23. The Group’s total installed capacity increased to 73,024 megawatt (MW) as on 30 June 2023 from 69,114 MW posted on 30 June 2022. Meanwhile, the company’s board has approved to hive-off its coal mining business to a wholly owned subsidiary, NTPC Mining, through a business transfer agreement.

IDFC First Bank: The private sector bank’s net profit surged 61.3% to Rs 765.16 crore in Q1 FY24 as compared with Rs 474.33 crore in Q1 FY23. Total income stood at Rs 8,281.54 crore in quarter ended 30 June 2023, up 43.3% from Rs 5,777.35 crore recorded in quarter ended 30 June 2022. Net interest income (NII) grew by 36% year on year (YoY) to Rs 3,745 crore in Q1 FY24 as against Rs 2,751 crore reported in Q1 FY23. The ratio of net NPAs to net advances stood at 0.70% as on 30 June 2023 as against 0.86% as on 31 March 2023 and 1.30% as on 30 June 2022.

Heritage Foods: The dairy company said its net profit stood at Rs 16.7 crore in Q1 FY24 as against Rs 7.3 crore in Q1 FY23. Revenue was up 12.5% at Rs 923.6 crore in Q1 FY24 as against Rs 821 crore in Q1 FY23. EBITDA soared 67.8% to Rs 40.1 crore in Q1 FY24 from Rs 24 crore in Q1 FY23.

Castrol India: The lubricant manufacturer said its net profit was up 9.2% at Rs 225.3 crore in Q1 FY24 as against Rs 206.3 crore in Q1 FY23. Revenue rose 7.4% at Rs 1,333.8 crore in Q1 FY24 as against Rs 1,241.7 crore in Q1 FY23. EBITDA rose 8.2% to Rs 309.8 crore in the quarter under review as against Rs 286.2 crore in the year-ago period.

Navin Fluorine: The company posted a revenue of Rs 491 crore in Q1 FY24, up 23.5% from Rs 397 crore in Q1 FY23. Its net profit fell 17.3% to Rs 61.5 crore in Q1 FY24 from Rs 74 crore in Q1 FY23. The company’s EBITDA rose 15% to Rs 114 crore in the quarter under review as against Rs 99 crore in the preceding quarter.

Transport Corporation of India: The company’s net profit rose 5.8% to Rs 83.2 crore in Q1 FY24 as against Rs 78.6 crore in Q1FY23. Revenue was up 5.1% to Rs 949.8 crore in the reported quarter as against Rs 903.4 crore in the same period last fiscal. EBITDA fell 3.5% YoY to Rs 100.8 crore in the quarter under review as against Rs 104.5 crore in the year-ago period.

Stove Kraft: The company’s net profit rose 1.5% to Rs 8.20 crore on 8.2% increase in revenue to Rs 297.75 crore in Q1 FY24 over Q1 FY23. EBITDA in Q1 FY24 was at Rs 23.4 crore, registering a growth of 8.7% YoY. EBITDA margin was unchanged at 7.9% in Q1 FY24 as compared to Q1 FY23.

Rossari Biotech: The speciality chemicals manufacturer company reported a 2% rise in net profit to Rs 29.2 crore as revenues from operations declined by 6% to Rs 410.6 crore in Q1 FY24 as compared with Q1 FY23. EBITDA remained flat at Rs 57.7 crore, while EBITDA margin improved by 80 bps to 14.1% in Q1 FY24 over Q1 FY23.

Laxmi Organic Industries: The company’s board approved a capital expenditure of Rs 710 crore for setting up a new manufacturing site at Dahej, Gujrat. The plant would have a capacity of more than 100,000 tonnes per annum. The new manufacturing site is expected to come on stream approximately in 3 years. The Project will be funded through a mix of internal accruals, debt and equity. The company reported a 40.51% decline in consolidated net profit to Rs 38.33 crore on a 3.04% fall in sales to Rs 733.58 crore in Q1 FY24 as compared with Q1 FY23.

Five-Star Business Finance: The company’s net profit jumped 31.8% to Rs 183.71 crore in Q1 FY24 as compared with Rs 139.43 crore in Q1 FY23. Total income increased 42.6% to Rs 483.57 crore in Q1 FY24 as against Rs 339.06 crore in Q1 FY23. Net Interest Income (NII) for the period under review was Rs 463.7 crore, up 38.34% YoY. Net Interest Margin was 17.74% in Q1 FY24 as compared with 16.97% in Q1 FY23.

RITES: The civil construction company’s consolidated net profit declined 21.5% to Rs 108.01 crore on 10% decrease in Rs 544.35 crore in Q1 FY24 over Q1 FY23. EBITDA declined 10% year on year to Rs 161 crore during the quarter. EBITDA margin was at 29.6% in Q1 FY24 as against 29.7% recorded in the corresponding quarter previous year. The company has secured more than 70 orders (including extension of works) worth more than Rs 300 crore in Q1 FY24. As on 30 June 2023, its order book stood at Rs 5,702 crore.

MCX: The exchange and data platform’s consolidated net profit tumbled 52.6% to Rs 19.66 crore in Q1 FY24 as compared with Rs 41.46 crore in Q1 FY23. Total income jumped 40.8% to Rs 166.21 crore in Q1 FY24 as compared with Rs 118.05 crore in corresponding quarter last year. EBITDA for the quarter ended 30 June 2023 declined 47% to Rs 31.13 crore from Rs 58.52 crore over the corresponding quarter ended 30 June 2022. During Q1 FY24, the average daily turnover of futures and options increased 26% to Rs 83,341 crore, compared to the turnover of the previous quarter.

Sonata Software: The company reported a 6% jump in consolidated net profit to Rs 120.12 crore on 5% increase in net sales to Rs 2,015.53 crore in Q1 FY24 over Q4 FY23. As compared to Q1 FY23, the IT firm’s net profit increased by 11.46%, and revenue from operations advanced 13.29%. EBITDA stood at Rs 206.4 crore, registering a growth of 17% as compared with Rs 176 crore posted in corresponding quarter last year.

Welspun India: The company’s net profit stood at Rs 161.6 crore in Q1 FY24 as against Rs 22.4 crore in Q1 FY23. Revenue was up 10.6% to Rs 2,184 crore in Q1 FY24 as against Rs 1,975.2 crore in Q1 FY23. EBITDA was up 83% to Rs 310.6 crore in Q1 FY24 as against Rs 151.6 crore in Q1 FY23.

HIL: The company’s net profit fell 33.2% to Rs 57.9 crore in Q1FY24 as against Rs 87 crore in Q1 FY23. Revenue fell 6.4% YoY to Rs 1,015.5 crore in Q1 FY24 as against Rs 1,084.6 crore in Q1 FY23. EBITDA was down 29% to Rs 87.3 crore in Q1 FY24 as against Rs 123 crore in Q1 FY23.

Prakash Industries: The company’s net profit jumped to Rs 89.4 crore in Q1 FY24 from Rs 43.2 crore in Q1 FY23. Revenue rose 13.2% YoY to Rs 1,013.3 crore Q1 FY24 as against Rs 895.5 crore in Q1 FY23. EBITDA was up 17.2% YoY at Rs 118 crore in Q1 FY24 as against Rs 101 crore in Q1 FY23.

Go Fashion: The clothing retailer said its net profit rose 7.8% to Rs 26.3 crore in Q1 FY24 from Rs 24 crore in Q1 FY23. The company’s revenue climbed 15.1% to Rs 190.1 crore in Q1 FY24 as against Rs 165.2 crore in Q1 FY23. EBITDA rose 20.5% to Rs 64.2 crore in Q1 FY24 as against Rs 53.3 crore in the year-ago period.