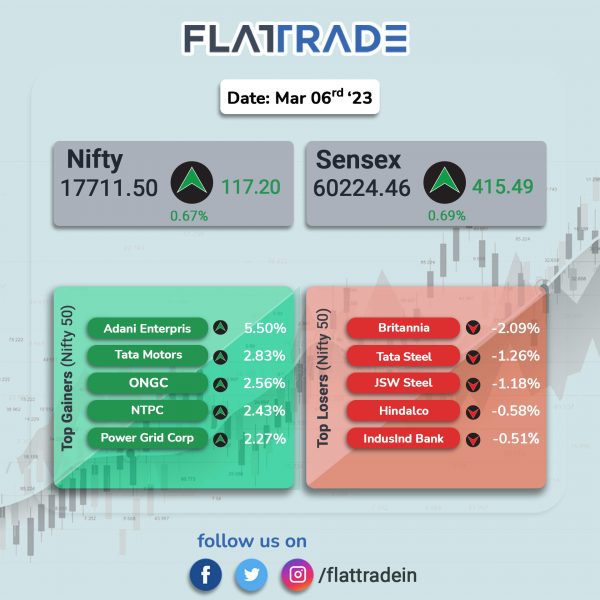

Benchmark equity indices rose as positive global market sentiments boosted investors’ risk appetite. The Sensex jumped 0.69% and the Nifty gained 0.67%.

In broader markets, the Nifty Midcap 100 index climbed 0.85% and the BSE Smallcap advanced 0.9%.

Top gainers were Nifty Energy [1.93%], Oil & Gas [1.92%], IT [1.22%], Auto [0.96%], and Financial Services [0.58%]. Top losers were Realty [-0.52%] and PSU Bank [-0.23%].

Indian rupee strengthened by 5 paise to 81.91 against the US dollar on Monday.

Stock in News Today

Computer Age Management Services (CAMS): The company said that it has acquired majority stake in Think Analytics India (Think360 AI), a full-stack AI and data sciences firm. Founded in 2013, Think360 AI offers Software as a service (SaaS) based products, data science and technology advisory services to market-leading firms in India and across the globe. It is one of the pioneers in using alternate data for financial inclusion and has recently launched analytical solutions within the ‘account aggregator’ framework.

Olectra Greentech: The company said that Evey Trans (EVEY) has received two letter of awards (LoAs) from Telangana State Road Transport Corporation (TSRTC) for 550 electric buses. According to the LoA, the company will supply 550 electric buses consisting of 500 buses for intra-city and 50 buses for inter-city operations. These orders for supply of 500 electric buses and 50 electric buses are to be on gross cost contract (GCC) / OPEX model basis for a period of 12 years and 10 years (contract period), respectively.

Hero MotoCorp: The Indian two-wheeler manufacturer and Zero Motorcycles, a US-based manufacturer of premium electric motorcycles and powertrains, have signed agreements to collaborate on premium electric motorcycles. he collaboration combines the expertise of Zero in developing power trains and electric motorcycles with the scale of manufacturing, sourcing and marketing of Hero MotoCorp. In September 2022, the Indian company’s board approved an equity investment of up to US$60 million in Zero Motorcycles.

In other news, the company has launched the Super Splendor XTEC. The motorcycle has been launched in two variants, the Super Splendor XTEC is available at Hero MotoCorp dealerships across the country at Rs 83,368 (Drum Variant) & Rs 87,268 (Disc Variant) (ex-showroom, Delhi).

Tata Motors: The automaker said that the total Jaguar Land Rover (JLR) registrations in the UK increased 33.28% to 1,670 units in February 2023 from 1,253 units in February 2022. Jaguar registrations declined by 11.1% to 351 units, while Land Rover registrations surged by 50.6% to 1,358 units in February 2023 over February 2022.

Neogen Chemicals: The company’s board has approved to acquire 100% stake in BuLi Chemicals India for Rs 25 crore. BuLi Chem is a subsidiary of a foreign company owned by Livent USA Corporation. It owns the technology to manufacture N Butyl Lithium and other organolithium products using lithium metal, which are key reagents for lithiation reaction used in manufacturing of several complex pharmaceutical and agrochemical intermediates. BuLi Chem manufactures and supplies N Butyl Lithium to several leading pharmaceutical and agrochemical companies in India and across the world.

Birlasoft: The IT company announced the opening of a new Delivery Centre in Coimbatore to enable enterprises scale up their delivery and optimize cost. The new facility will focus on Birlasoft’s delivery capabilities in cloud space, digital and testing requirements. Birlasoft’s newest centre will initially have 245 workstations. Presently, Birlasoft has 75 employees on-board at its newest facility and plans to expand it to full capacity in the next 2-3 years.

Best Agrolife: The company’s board has approved a capex of Rs 200 crore which includes Rs 150 crore towards brownfield expansion in the technical manufacturing unit of Best Crop Science, a wholly-owned subsidiary of the company, and Rs 50 crore towards brand building and market expansion.

Bajaj Electricals: The company said that its EPC business segment (power distribution) secured contracts for supply of goods and services from the South Bihar Power Distribution Company (SBPDCL) for Rs 564.87 crore and shall be completed within 30 months from the date of issue of contracts. The order entails supply of Plant and Installation Services for development of distribution infrastructure of electric supply circle in Sasaram and Munger located in Bihar.

Add-Shop E-Retail: The company said it opened 10 new franchises in Tamil Nadu and West Bengal as well as seven new franchises in Bihar, last month. The company expects the new franchises to boost their retail business. The company also said it has launched Instant Green Tea with Tulsi Extract products.

Zydus Lifesciences: The drug maker said that it has received final approval from the USFDA for Vigabatrin for Oral Solution USP, 500 mg. The said drug is equivalent to reference listed drug, Sabril for oral solution. The drug will be manufactured at the group’s formulation manufacturing facility at Moraiya, Ahmedabad (India).

Vigabatrin for oral solution is indicated for the treatment of refractory complex partial seizures as adjunctive therapy in patients 2 years of age and older. It is also used to treat infantile spasms in babies and children between the ages of 1 month and 2 years.

Indian Energy Exchange (IEX): The company announced that it has recorded 7,673 MU electricity volume in February 2023, a 6% decline on year-on-year (YoY) basis. On a sequential basis, the company’s electricity volume decreased by 7% month-on-month (MoM) in February 2023. IEX achieved 8,200 MU total volume in February 2023, including Green Power trade of 341 MU, 3.74 lac RECs (equivalent to 374 MU) and 1.54 Energy Saving Certificates (ESCerts) (equivalent to 154 MU).

Manappuram Finance: SBI Mutual Fund acquired 48 lakh equity shares, 0.57% equity, in Manappuram Finance through a bulk deal on the NSE at an average price of Rs 106.59 per share. Manappuram Finance is one of India’s leading gold loan NBFCs.

Alembic Pharmaceuticals: The company said it has received approval from the USFDA to market a generic drug to treat cancer. The drug maker has received approval from the USFDA for Fluorouracil Injection, it said in an exchange filing. The approved product is therapeutically equivalent to Spectrum Pharmaceuticals Inc.’s product.

TVS Motor: The company said that the TVS HLX series has achieved a milestone of 3 million sales across 54 countries. This is the fastest million milestone that the brand has achieved in 17 months and it represents the trust and loyalty of the global customers. The brand has accomplished the mobility demands of the market, particularly in rural and semi-urban regions across Africa, Middle East, and Latin America.

Mastek: S. Sandilya has resigned as the non-executive chairman and independent director of Mastek. As a consequence, Sandilya has also resigned from the membership on the boards of subsidiary companies. Rajeev Grover has been appointed as the Independent Director Chairperson and Ashank Desai is named the Vice Chairman and Managing Director of the company.

Easy Trip Planners (EaseMyTrip): Shares of the travel company rose after the company signed a pact with the Andhra Pradesh government for promotion of tourism in the state. Easy Trip Planners will undertake certain marketing initiatives for the promotion of tourism in the state while the state government will help secure necessary permissions, approvals and clearances from its various departments.