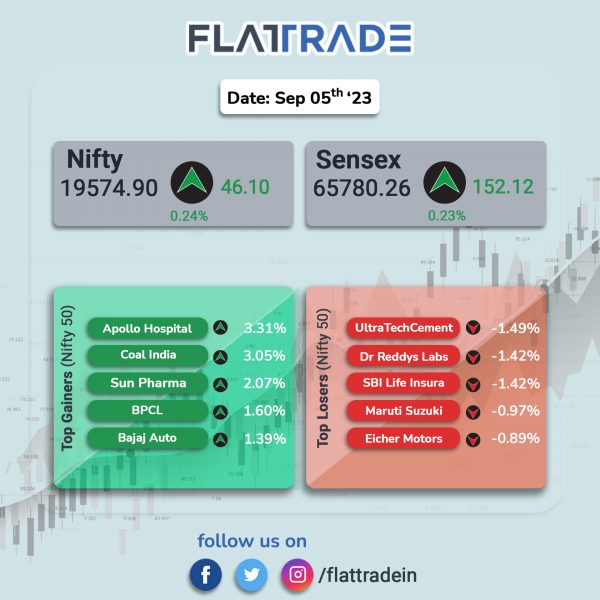

Dalal Street ended higher as investors’ optimism was boosted by strong services activity data. The Sensex rose 0.22% and the Nifty 50 index gained 0.24%.

The S&P Global India Services Purchasing Managers’ Index (PMI) slipped to 60.1 in August from 62.3 recorded in July, according to data released by S&P Global on Tuesday. However, the reading indicated that the sector was expanding.

In broader markets, the Nifty Midcap 100 surged 1.06% and the BSE Smallcap rose 0.61%.

Top gainers were Media [3.19%], Pharma [1.1%], Realty [1.06%], Oil & Gas [0.76%], and PSU Bank [0.74%]. Top losers were Financial Services [-0.17%] and Bank [-0.1%].

The Indian rupee plunged by 29 paise to 83.04 against the US dollar on Tuesday.

Stock in News Today

One97 Communications (Paytm): The fintech company said that its loan disbursements grew by 137% to Rs 10710 crore in July–August 2023 from Rs 4,517 crore in the year-ago period. The number of loans disbursed during the period stood at 88 lakh, up 47% YoY. The total merchant Gross Merchandise Value (GMV) processed through the Paytm platform for July-August 2023 stood at Rs 3 lakh crore, up 43% YoY. The company strengthened their leadership in offline payments, with 87 lakh merchants now paying subscription fees for payment devices, an increase of 42 lakh devices in the past 12 months and 5 lakh devices in the month of August.

Tata Motors: The company said its JLR unit registered a sales of 1,479 units, down 23.56% YoY. Jaguar sales stood at 348 units, a fall of 42.95% YoY and Land Rover sales fell 14.64% YoY to 1,131 units.

Hinduja Global Solutions (HGS): The company announced a strategic partnership with the Government Digital Service (GDS) in the UK, to provide contact centre support for GOV.UK One Login users. GDS is a business unit within the Cabinet Office, created to maintain and improve several cross government platforms and tools including GOV.UK, GOV.UK One Login, Emergency Alerts Service, GOV.UK Pay and GOV.UK Notify, etc.

Jupiter Wagons: The company said that its board has approved raising up to Rs 700 crore through Qualified Institutions Placement (QIP). The company will raise funds through public and/or private offerings of equity shares and/or any other convertible securities, in one or more tranches.

3i Infotech: Shares of the company hit an upper limit of 20% after the company announced its partnership with InsureMO, a world leading Insurance Middleware Platform. This partnership allows 3i Infotech to expand its services by implementing the InsureMO platform, which modernises and transforms insurance providers’ offerings without changing their core solutions.

Indian Energy Exchange (IEX): The company said that it has achieved 8,469 million units (MU) total electricity volume in August 2023, a growth of 21% YoY. The overall volume in August 2023 was 8,865 MU including green market trade of 242.3 MU, ancillary market trade of 40MU, 2.53 lakh RECs (equivalent to 253 MU) and 1.03 lakh ESCerts (equivalent to 103 MU). The power exchange said that the country experienced its lowest August rainfall since 1901, resulting in hot weather conditions. This, in turn, led to an unprecedented surge in electricity demand for the month. Prices on the Indian Energy Exchange (IEX) during the month reached Rs 6.89/unit, a rise of 33% YoY, due higher demand and supply constraints.

Jyoti Structures: The company received a Letter of Acceptance from Apraava Energy for a 400 KV double circuit transmission line in Rajasthan. The contract is valued at Rs 260.85 crore and it is expected to be executed by November 2024.

Patel Engineering: The company along with its joint venture (JV) partner has received a letter of award for an urban infrastructure development project worth Rs 1,275.30 crore from Madhya Pradesh Jal Nigam. The project entails engineering, procurement, construction, testing, commissioning, trial run and operation & maintenance for 10 years of Narmada-Gambhir, district Ujjain & Indore multi-village drinking water supply scheme in a single package on ‘turn-key job basis’. The project is to be completed within 24 months and further operations and maintenance for the whole scheme to be carried out for a period of 10 years.

Ramco Cements: The company said that its Kolimigundla Plant has commissioned the balance capacity of 3 MW of Waste Heat Recovery System out of 12 MW capacity. With this commissioning of the capacity, total operating capacity of waste heat recovery system for the company has increased to 43 MW. The firm’s wind power capacity stands at 166 MW. The company said that its entire green power capacity of 85 MW including the capacity available in the subsidiary company would be used for captive purposes.

KIOCL: The company announced that it has resumed the pellet production at Pellet Plant Unit of the company situated at Mangalore. KIOCL is a flagship company under the Ministry of Steel, GOI, with Mini Ratna status.

Vishnu Prakash R Punglia: The company shares witnessed a strong stock market debut. The scrip was listed at Rs 165, a premium of 64.95% to the issue price, on the NSE. Shares of the company closed at Rs 145.7 apiece.

Zen Technologies: The company announced that it has won an order worth Rs 123 crore from the Ministry of Defence. During the current quarter, it has successfully secured new orders worth about Rs 733 crore, raising its total order book to about Rs 1,275 crore. Its order book comprises training simulators, counter drone systems, and services.

Satia Industries: The company announced that it has bagged major contracts for supply of paper for printing textbooks from Orissa, Himachal Pradesh and West Bengal for a total value of Rs 96.50 crore.

Ethos: The company’s board has approved the company’s proposal to raise 250 crore by issuing equity and debt instruments.

RattanIndia Enterprises: The company announced that its board has appointed Vijay Nehra as the chief operating officer (COO) of the company with effect from 4th September 2023. Nehra has an experience of more than 26 years in various sectors like FMCG, real estate, financial services and angel investing. In the past, he has worked with Hindustan Unilever, Anglo Eastern Group and in his last stint as the CEO of Indiabulls Asset Reconstruction Company.

Som Distilleries & Breweries: The company said that its board has approved raising of funds worth Rs 350 crore by issue of equity shares and/or other securities convertible into equity shares, through public and/or private offerings and/or by way of a qualified institutions placements or any combination thereof, in one or more tranches.