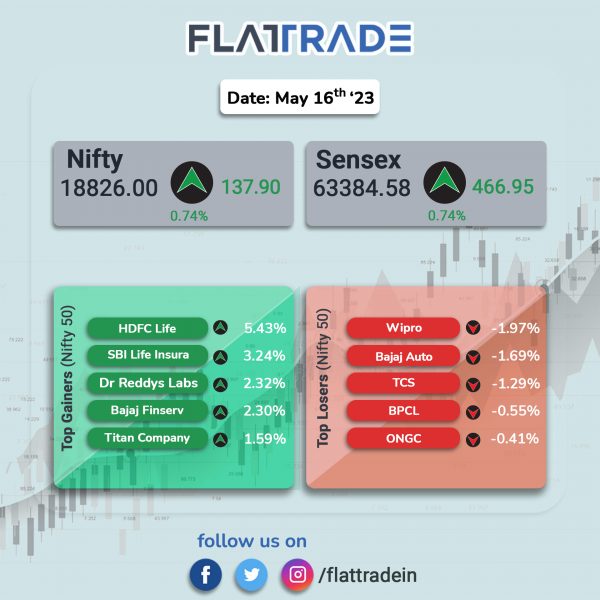

Dalal street ended higher on the back of consistent buying support amid positive global sentiments. The Sensex and the Nifty 50 indices closed 0.74% higher, each.

In broader markets, the Nifty Midcap 100 index rose 0.68% and the BSE Smallcap gained 0.76%.

Top gainers were PSU Bank [1.46%], Private Bank [1.29%], Financial Services [1.19%], Bank [1.14%], Media [1.08%]. Top losers were IT [-0.38%] and Realty [-0.21%].

Indian rupee appreciated by 25 paise to close 81.94 against the US dollar on Friday.

Stock in News Today

Tata Consultancy Services: The company and Transamerica have mutually agreed to end a $2 billion contract, citing challenging macro environment among others. The 10-year contract with Transamerica was signed in early 2018 for digitization of more than 10 million policies into a single integrated platform. Administration of those policies, including life insurance and retirement and investment solutions, will be moved to a new servicing model, which will take about 30 months, TCS said.

Kotak Mahindra Bank: The private lender announced that its board has approved raising up to Rs 7,000 crore in one or more tranches by issuing non convertible debentures (NCDs) on private placement basis during FY24.

IndusInd Bank: The lender has announced that it has entered into partnership with Wise to offer online inward remittance services to Non Resident Indians (NRIs) residing in US and Singapore. The users of Indus Fast Remit will have an option to choose from multiple exchange houses and money transfer companies offering competitive rates with a single sign on and an end-to-end digital journey.

IKIO Lighting: The company had a strong stock market debut. Shares of the company opened at Rs 392.5 per share against the issue price of Rs 285 apiece. The share price touched a high of Rs 427.50 and pared some gains to closed at Rs 403.85 per share.

Vodafone Idea: The telecom company has cut ties with approximately 25,000 retail partners across India to reduce costs. It decided to stop paying commissions to these partners in a bid to save money, according to Economic Times.

Paras Defence and Space Technologies: The company said that it has secured a contract worth Rs 53 crore from India’s Ministry of Defence. The contract is for supplying optronic periscopes, including installation support, for Integrated Combat System (ICS). The contract will be executed in two phases, with partial delivery in FY24 and balance delivery by FY25 or earlier.

PDS: The company said that its subsidiary, PDS Lifestyle, has proposed to acquire 100% stake in UK-based New Lobster for a total cash consideration of Rs 150.51 crore. PDS said that this acquisition enables PDS Group to expand its offering into brand management services & wholesale distribution. The acquisition is expected to be completed on or before 31 July 2023.

Heranba Industries: The company said that it has obtained seven registrations from the Central Insecticide Board (CIB) in May 2023. These registrations cover a range of products, including insecticides and fungicides with varying formulations and concentrations. The products are Ethion Technical, Pyraclostrobin Technical, Captan 50% WG, Tebuconazole 38.39% SC, Thiophanate Methyl 70% WG, Tricyclazole 70% WG, and Carboxin 37.5% + Thiram 37.5% WS. The registrations are part of Heranba’s strategy to launch seven new products in FY24. The products will be launched in both technical and formulation segments.

RITES: The miniratna state-owned company said that it has signed contract agreements with National Railways of Zimbabwe (NRZ) for supply of rolling stock (3,000 HP diesel electric locomotives and high sided open wagons) valuing at $81,175,500. The civil construction company said that the contract agreements are subject to approval of funding by funding agency.

Natco Pharma: The company has received the final approval from US Food and Drug Administration (USFDA) for its abbreviated new drug application (ANDA), Tipiracil Hydrochloride and Trifluridine Tablets. It is indicated primarily for the treatment of colorectal cancer. As per IQVIA data, Lonsurf had generated annual sales of $211 million in USA during the twelve months ending December 2022.

GAIL (India): Sanjay Kumar assumed charge as director (marketing) of GAIL (India) on Thursday, 15 June 2023. Prior to his new role, Kumar was the managing director of Indraprastha Gas, largest CNG distribution company of India, since April 2022. Kumar, a mechanical engineer from IIT Kharagpur and an MBA, has a rich domain experience of over 35 years in the natural gas sector.

Equitas Small Finance Bank (SFB): The Reserve Bank of India has approved the re-appointment of P N Vasudevan as the managing director (MD) and chief executive officer (CEO) of the lender for a three-year term. The reappointment is with effect from July 23, 2023, Equitas SFB said in an exchange filing.