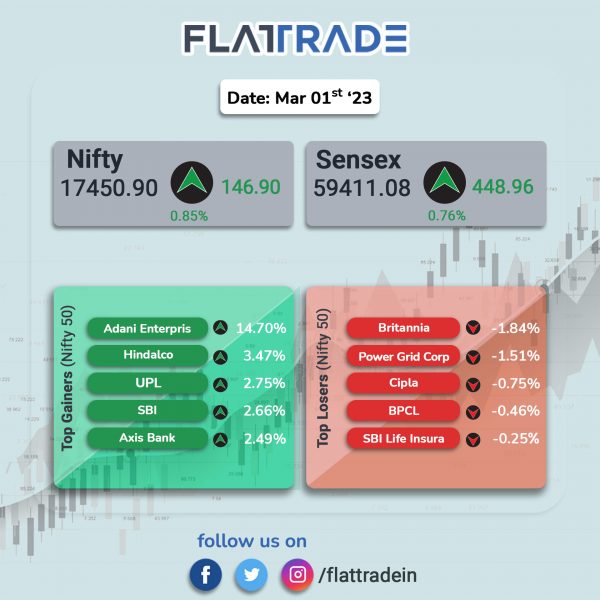

Dalal Street ended on a positive note on bargain hunting as investors bought beaten down shares. IT, state-owned banks and metal were top gainers among Nifty sectoral indices, while shares of Adani Group also closed with strong gains. The Sensex rose 0.76% and the Nifty 50 index jumped 0.85%.

Broader indices such as Midcaps and Smallcaps outperformed the benchmark equity indices. The Nifty Midcap 100 index surged 1.55% and the BSE Smallcap advanced 1.38%.

Top gainers were Metal [3.96%], PSU Bank [2.98%], Media [1.92%], IT [1.46%] and Realty [1.16%]. All indices ended in the green.

Indian rupee rose 16 paise to 82.50 against the US dollar on Wednesday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index stood at 55.3 in February 2023, little-changed from 55.4 in January 2023. The headline figure was above its long-run average of 53.7. The marginal decline was attributed to further increase in input costs in the manufacturing industry and new export orders rose fractionally, said the private survey by S&P Global.

The gross GST collected in February rose 12% YoY to Rs 1,49,577 crore. GST collections have remained above Rs 1.4 lakh crore in the past 12 months,a ccording to government data.

Stock in News Today

Maruti Suzuki India (MSI): The automaker said that its total sales rose 5.04% to 172,321 units in February 2023 from 164,056 units in February 2022. The sales of passenger vehicles increased by 10.09% to 147,467 units, while sales of light commercial vehicles fell 8.28% to 3,356 units in February 2023 over February 2022. The company’s total domestic sales advanced 10.77% to 155,114 units, while total exports contracted 28.37% to 17,207 units in February 2023 over February 2022.

Bajaj Auto: The two-wheeler manufacturer said that its total wholesales declined by 11% YoY to 2,80,226 units in February. The company had dispatched 3,16,020 units to its dealers in February 2022. In a regulatory filing, the company said its total domestic sales increased by 36% to 1,53,291 units last month, as compared with 1,12,747 units in the year-ago period. Exports declined 38% to 1,26,935 units in February 2023, as against 2,03,273 units in February 2022.

Tata Motors: The automaker said that its total sales in February 2023 stood at 79,705 units, compared to 77,733 units during February 2022, recording a growth of 2.5%. The company’s domestic sales stood at 78,006 units, recording a YoY growth of 6%. Domestic sales include commercial vehicle sales of 35,144 units (YoY growth of 45) and passenger vehicle sales of 42,862 units (YoY growth of 7%). Total commercial vehicles sales declined 3% to 36,565 units, while passenger vehicle sales rose 7% to 43,140 units. The company’s electric vehicle sales (included in passenger vehicle sales) rose 81% to 5,318 units.

Ashok Leyland: The truck and bus manufacturer said its total sales rose 27% YoY to 18,571 units in February. Medium and heavy commercial vehicle sales grew 35% YoY to 12,668 units. Light commercial vehicle sales rose 12% to 5,903 units.

Eicher Motors: The company said its commercial vehicle sales in February rose 24.5% YoY to 7,289 units. Domestic sales grew 33.5% YoY to 6,799 units. Exports fell 53.8% YoY to 301 units.

Dilip Buildcon: The infrastructure company announced that Mehgama-Hansdiha Highways, a wholly-owned subsidiary of the company, has executed the concession agreement with the National Highways Authority of India for the Rs 976 crore road project (Mehgama-Hansdiha section of NH-133) in Jharkhand.

Separtely, the company said in an exchange filing said that project — Development of Bundelkhand Expressway (Package-VI) — from Bakhariya in Auraiya district to Kudrail in Etawah district in Uttar Pradesh basis has been completed.

G R Infraprojects: The company has received Letter of Award from National Highways Logistics Management for a project worth Rs 758.10. The project entails development, operation and maintenance of multi modal logistics park (MMLP) near Pithampur, in Dhar district of Madhya Pradesh through public private partnership on design, build, finance, operate and transfer basis.

Punjab National Bank (PNB): The lender has approved the withdrawal of the process for divestment of Bank’s stake in Canara HSBC Life Insurance Co. The bank shall hold its stake in the company as an investor, subject to regulatory approval.

Mahindra & Mahindra (M&M): The automaker announced that its overall auto sales for the month of February 2023 stood at 58,801 units, recording a YoY growth of 8%. The company sold 30,221 units of utility vehicles, recording a YoY growth of 10% despite disruptions in supply chain of Crash Sensors and Air Bag ECUs due to unavailability of semi-conductors. The passenger vehicle segment recorded YoY growth of 22% at 30,358 units in February 2023. Exports for the month were at 2,250 units. In the commercial vehicles segment, M&M sold 20,843 units in February 2023.

Rainbow Children’s Medicare: The hospital chain announced that its latest hospital at Financial District, Hyderabad, Telangana has commenced operations. With this development, the company plans to further strengthen its presence, reaching a cumulative bed strength of 830 beds in Hyderabad. As on date, the company along with its subsidiaries has an existing total bed capacity of 1,555 beds in India. The company’s occupancy was 44.59% of its capacity during FY 2021-22 and 57.06% during Q3FY23.

Alembic Pharma: The drugmaker announced that it has received final approval from the USFDA for its abbreviated new drug application (ANDA), Docetaxel injection. Docetaxcel injections are indicated for the breast cancer, non-small cell lung cancer, castration-resistant prostate cancer, gastric adenocarcinoma and squamous cell carcinoma of head and neck. Docetaxel injection have an estimated market size of $11 million for twelve months ending Dec 2022, according to IQVIA.

NCC: The construction company has received three new orders worth Rs 2374 crore last month from state government agencies and PSU. The company’s transportation division received orders worth Rs 1224 crore, water and environment division secured worth Rs 830 crore and mining division won orders worth Rs 320 crore.

Escorts Kubota: The company’s agri machinery business in February 2023 sold 7,811 tractors, registering a growth of 27.8% as against 6,114 tractors sold in February 2022. Domestic tractor sales in February 2023 were at 7,245 tractors registering a growth of 27.4% as against 5,686 tractors sold in February 2022. Export tractor sales in February 2023 was at 566 tractors registering a growth of 32.2% as against 428 tractors sold in February 2022.

Sonata Software: The company announced that it has signed up with Mumbai Indians as an associate partner ahead of the premier T20 women’s league in India. Sonata Software logo will be prominently visible on the players kits and this partnership marks Sonata Software’s first-ever cricket sponsorship, globally.

Natco Pharma: The company announced the launch of Pomalidomide capsules in Canada, the first generic alternative to POMALYST brand in the country approved by Health Canada. Pomalidomide is used in combination with Dexamethasone and Bortezomib for the treatment of adult patients with multiple myeloma. Natco launched pomalidomide under their brand NAT-POMALIDOMIDE in strengths of 1 mg, 2 mg, 3 mg and 4 mg capsules and available through the RevAid risk management platform.

Hinduja Global Solutions: The company announced that it has completed the acquisition of 100% stake in TekLink International for $58.8 million, subject to earnouts and other customary and agreed adjustments. The acquisition will strengthen HGS’ digital solutions business by adding enhanced expertise in building data platforms, analytics, and financial planning.