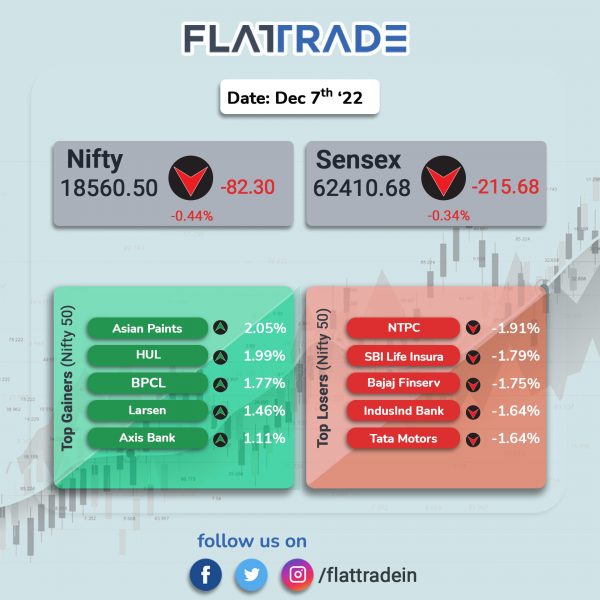

Dalal Street ended lower on negative global cues and also due to the hawkish stance by the Reserve Bank of India. The Sensex fell 0.34% and the Nifty dropped 0.44%.

In broader markets, Nifty Midcap 100 index lost 0.58% and the BSE Smallcap fell 0.44%.

Top losers among Nifty sectoral indices were Media [-1.45%], Realty [-1.19%], Energy [-1.13%], Metal [-0.88%] and IT [-0.84%]. Top gainers were FMCG [0.96%] and PSU Bank [0.26%].

Indian rupee fell 13 paise to 82.48 against the US dollar on Wednesday.

The Reserve Bank of India’s Monetary Policy Committee (MPC) hiked the repo rate by 35 basis points (bps) to 6.25 % in its recent meeting. The RBI cut its FY23 GDP growth rate forecast to 6.8% from 7% earlier. The RBI Governor said that the Indian economy remains resilient and the country is seen as a bright spot in a gloomy world.

The RBI estimated the real GDP growth for FY23 at 6.8%, with the third quarter at 4.4% and the fourth quarter at 4.2%. Gross Domestic Product (GDP) growth is projected at 7.1% for April-June period of FY24 and at 5.9% for Q2FY24.

The MPC said that the inflation forecast for the current financial year will be 6.7%. CPI inflation is seen at 6.6 per cent in October-December compared with 6.5% projected earlier. In January-March, headline retail inflation is seen at 5.9% as against 5.8% estimated earlier. For the first quarter of the next fiscal, the MPC has retained its inflation forecast at 5%, while inflation is seen at 5.4% in the second quarter of the next financial year.

Stock in News Today

Larsen & Toubro (L&T): The company’s arm, L&T Construction, secured orders from ArcelorMittal Nippon Steel India to carry out their expansion plans in Gujarat and Odisha. The orders involve installation of two blast furnaces at Hazira, Gujarat, building a 6 MTPA ore beneficiation plant at Sagasahi, Odisha among others. The said order is a ‘mega’ order and L&T classifies ‘mega’ orders as those valued above Rs 7,000 crore.

5Paisa Capital: In an exchange filing, the company’s board announced that they have acquired IIFL Securities’ online retail trading business. IIFL Securities shareholders will receive 1 share of Rs 10 paid up of 5Paisa Capital for every 50 shares of Rs 2 paid up of IIFL Securities held by them as on the record date. The company’s customer base will increase by 40% after the acquisition, while the equity dilution will be at 20%.

ITC: The FMCG company acquired 1,967 compulsorily convertible preference shares of Rs 10 each of Delectable, in the fourth tranche on December 6.

Dabur India: Shares of the company rose over 3% in intraday trade after investment bank Morgan Stanley raised the target price and upgraded it rating to overweight. Morgan Stanley upgraded the company’s rating on account of accelerating signs of rural recovery and improving portfolio mix in favour of food & beverages to drive top-line growth.

GlaxoSmithKline Pharmaceuticals and Sanofi India: Shares of both the companies rose in intraday trade after a US judge rejected the scientific evidence behind claims that heartburn drug Zantac can cause cancer, CNBCTV18 reported. In Florida, District Court Judge Robin Rosenberg ruled that claims that Zantac causes cancer lack scientific merit, dismissing about 50,000 cases.

Tata Tele Business Services (TTBS): The company plans to offer Microsoft Azure to Small and Medium Businesses (SMBs) and this will help SMBs to use predictive and agile cloud platform to install, scale, and upgrade business solutions more quickly and securely across different geographies. The pay as you go model will deliver better experience and help SMBs to cut cost.

GMR Airports Infrastructure: The National Investment and Infrastructure Fund will invest in three of GMR’s airport projects, including the greenfield international airports at Mopa, Goa and Bhogapuram, Andhra Pradesh. NIIF will invest Rs 631 crore in GMR Goa International Airport.

Aster DM Healthcare: The company said that it has signed a contract with Faruk Medical City to collaborate on academic and professional training programs for clinical staff and healthcare professionals in Iraq. Under the partnership, doctors from Aster DM will visit Faruk Medical City’s facilities to consult and provide surgical services. Aster will also play an advisory role in guiding Faruk Medical City to apply for international accreditation.

Star Housing Finance: The company announced that its board has approved 2-for-1 stock split and 1:1 issue of bonus shares. In other words, one new bonus equity share will be allotted for every one existing fully paid-up equity share. The company will also split one equity share of face value of Rs 10 each into two equity shares of face value of Rs 5 each.

Bikaji Foods International: In an exchange filing, the company announced the conversion of its 28,13,050 preferential shares in Hanuman Agrofood Private Limited into equity shares. The preferential shares will be converted into 28,13,050 equity shares and after the conversion, Hanuman Agrofood will become a subsidiary of Bikaji Foods.

Krsnaa Diagnostics: The company announced that it has started operating a diagnostics center at Lokbandhu Hospital in Lucknow, Uttar Pradesh. The diagnostics center is one of the eight diagnostics centers to be established as a part of the agreement with Uttar Pradesh’s health department.

Ahluwalia Contracts: The construction company announced that it has secured an order worth Rs 55.39 crore in Punjab. The order comprises of construction of shell & core, facade and MEPF work for Phase-2A (Hostel-2) Plaksha University at IT City Road, SAS Nagar, Punjab. The company’s total order inflow during the FY23 stands at Rs 4017.63 crore.