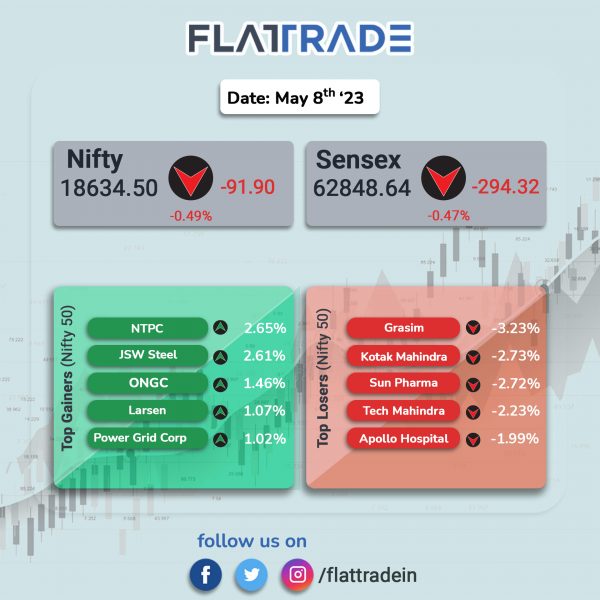

Domestic equity indices closed lower due to heavy selling at the end of the session amid the RBI keeping the key interest rates unchanged at 6.5%. The Sensex fell 0.47% and the Nifty 50 index dropped 0.49%.

In broader markets, the Nifty Midcap 100 index lost 0.55% and the BSE Smallcap shed 0.47%.

Top losers among Nifty sectoral indices were Realty [-1.59%], Media [-1.52%], IT [-1.12%], Pharma [-1.03%] FMCG [-0.9%]. Top gainers Energy [0.37%] and Metal [0.16%].

Indian rupee weakened 2 paise to close at 82.57 against the US dollar on Thursday.

Stock in News Today

Zydus Lifesciences: The drug major announced that it has received final approval from the United States Food and Drug Administration (USFDA) for Esomeprazole Magnesium for delayed-release oral suspension. Esomeprazole is used to treat certain stomach and esophagus problems (such as acid reflux and ulcer). The pharma company said that the drug will be manufactured at the group’s formulation manufacturing facility in Moraiya, Ahmedabad (India). According to IQVIA MAT April 2023, Esomeprazole Magnesium for Delayed-Release Oral Suspension, 20 mg and 40 mg had annual sales of $42 million the United States.

Delhivery: The logistics announced that it has partnered with Mystore, an ONDC-powered marketplace for Indian sellers, to provide express parcel shipping for rural entrepreneurs nationwide. Through ONDC, Mystore’s e-commerce platform is leveraging Delhivery’s extensive pan-India network of over 18,500 pin codes to offer affordable and reliable shipping to rural entrepreneurs.

L&T Finance: The company’s board of directors has recommended a final dividend of Rs 2 per share for a face value of Rs 10 per share gor FY23. The dividend, if approved by the members at the upcoming Annual General Meeting (AGM), will be credited within 30 days from the date of AGM.

Spicejet: The company said that it will partner with FTAI Aviation to restore fleet under CFM56 revitalization program. FTAI Aviation is a leading aftermarket provider of engine services, and under this program, FTAI Aviation will provide SpiceJet with up to 20 engines for lease, inclusive of maintenance services. With FTAI Aviation managing the engines, SpiceJet will strengthen its resource allocation and focus on delivering an exceptional travel experience while maximizing their operational potential.

IndusInd Bank: The lender said that it has been appointed as an authorized ‘agency bank’ by the Ministry of Finance, Madhya Pradesh State Government. This appointment will enable IndusInd Bank for online collection of state government revenue and receipts such as GST and VAT, collection of stamp duty and pension amounts on behalf of the Madhya Pradesh state government.

Schneider Electric Infrastructure: Shares of the company exited the BSE’s short-term ASM framework from Thursday, 8 June 2023. Schneider Electric Infrastructure was placed under the BSE’s short-term Additional Surveillance Measure (ASM) framework Stage-I between 30 May to 7 June 2023. ASM is a system put in place by the Securities and Exchange Board of India (SEBI) and stock exchanges to keep a closer eye on certain stocks that are considered to be risky.

Zen Technologies: The company announced that it has bagged an order from the Ministry of Defence (MoD), Government of India, valued at approximately Rs 202 crore. The company looks forward to securing additional sizeable contracts within the next quarter, the anti-drone solutions provider said.

KPI Green Energy: The company received commissioning certificates from Gujarat Energy Development Agency (GEDA) for 26.10 MW wind-solar hybrid power project under independent power producer (IPP) segment. The project is located at Bhungar site in Bhavnagar, Gujarat.

PTC Industries: The company said it has received listing and trading approval from the National Stock Exchange (NSE). The company’s equity shares will be listed on NSE’s main board with effect from 9 June 2023 under symbol “PTCIL”. “Listing of equity shares at NSE will provide more liquidity and better options to investors at large and will further broaden the base of investors,” PTC Industries said in a statement.

Inox Wind: The wind energy producer has bagged an order for a 100 MW wind power project from ABEnergia Renewables (ABEnergia). The order is for Inox Wind’s 3.3 MW turbine. The project will be executed on a turnkey basis at Dayapar site in the Kutch district, Gujarat and is scheduled to be commissioned by 2024. The necessary infrastructure facilities have already been commissioned successfully, therefore the project will be executed on a plug and play basis. Additionally, as part of the agreement, Inox Wind will be responsible for comprehensive multi-year operation and maintenance (O&M) services for the project. ABEnergia is an end-to-end partner for renewable energy solutions across India.

CCL Products: The company has acquired six brands from Lofbergs Group for £550,000. The various brands are “Percol”, “Plantation Wharf”, “Rocket Fuel”, Percol Fusion”, “The London Blend” and “Perk Up”. The acquisition will give CCL an access to major supermarkets in the UK, which is Europe’s largest instant coffee market with annual retail sales of US$850 million, the press release said.

Wockhardt: The company announced that CARE Ratings has reaffirmed the ratings of ‘CARE BBB-‘ for the long/short term bank facilities and non-convertible debentures of the company. The credit rating agency has revised outlook on the debt instruments of the company from ‘stable’ to ‘negative’. CARE Ratings said that the revision in outlook and the reaffirmation of ratings was on the back of moderation in revenue and operating profitability during FY23, weakening of overall credit risk profile of the company, significant one time provisioning made on account of write-off of the inventory and shut down of the plant located at United States of America (U.S.A) and considerable repayment obligations during FY24. Further, the outlook on the long-term rating of WL has been revised from ‘Stable’ to ‘Negative’ due to deteriorating operational and financial performance and uncertainty associated with future improvement. The ‘negative’ outlook also factors in significant increase in pledge of promoter’s shares.

Five-Star Business Finance: The company said that CARE Ratings has upgraded the credit rating of the bank facilities of the company to ‘CARE AA-; Stable’ from ‘CARE A+; Stable’. CARE Ratings said that the revision was due to the improvement in the scale of operations over the last two fiscals ending FY23, improvement in capitalisation levels with net worth base of Rs 4,285 crore as on March 31 2023, and continuation of healthy profitability indicators while maintaining the asset quality.

Atishay: The company has secured a tender worth Rs 47 crore for the computerisation of all data of Primary Agriculture Cooperative Society (PACS) in Madhya Pradesh. The project was issued by National Bank for Agriculture and Rural Development, involving the digitisation of financial documents.