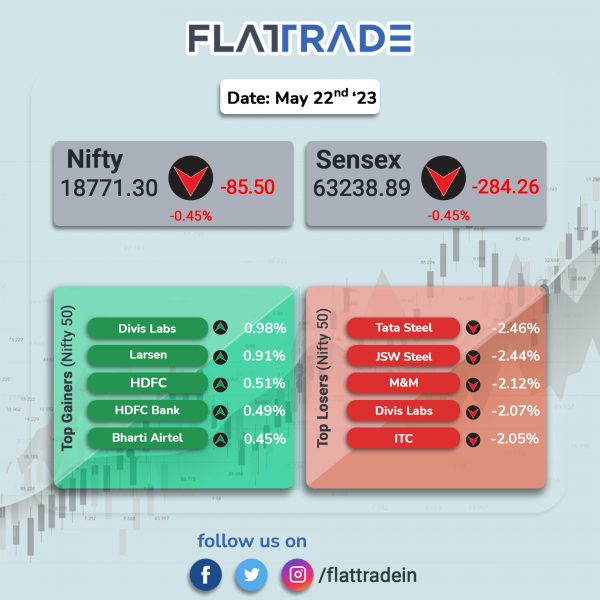

Benchmark indices closed lower weighed down by losses in IT and PSU Bank stocks. The Sensex hit a fresh record high of 63,602 in intraday trade on Thursday, the Sensex closed lower by 0.45% at 63,239.89. The Nifty 50 index came close to hitting a fresh record high but missed by just 1 point as it halted its intraday rally at 18,886.6. The index closed at 18,771.30, down 0.45%.

In broader markets, the Nifty Midcap 100 index tanked 1.06% and the BSE Smallcap index dropped 0.64%.

Top losers were PSU Bank [-1.67%], Energy [-1.04%], Realty [-0.8%], Oil & Gas [-0.79%], and IT [-0.74%]. Nifty Metal [0.05%] and Media [0.04%] ended nearly flat.

Indian rupee rose 10 paise to close 81.95 against the US dollar on Thursday.

Stock in News Today

Hindustan Aeronautics Limited (HAL): General Electric (GE) Aerospace, a subsidiary of General Electric, has signed a Memorandum of Understanding (MoU) with HAL to co-produce its F414 engines in India. Separately, HAL and Fabrica Argentina de Aviones (FAdeA) have signed a Memorandum of Understanding (MoU) to explore potential collaboration opportunities in the field of Maintenance, Repair, and Overhaul. It also plans to address any offset requirements that may arise from the possible sale of HAL-made platforms in the Latin American (LATAM) region.

Larsen & Toubro (L&T): The company announced that it has signed a contract with DRDO for realisation of two Air Independent Propulsion (AIP) System Modules for Kalvari Class of Submarines of the Indian Navy. After realisation and integration of these modules in the submarines, India will join an elite club of a handful of nations who have indigenously developed fuel cell based submarine AIP technology which is critical for increasing the endurance of conventional submarines. L&T said that it is the recipient of Transfer of Technology (ToT) for this DRDO developed AIP System.

L&T said in an exchange filing that it has expanded its hi-tech manufacturing capability by inaugurating a new advanced Heavy Wall Pressure Vessel facility in Saudi Arabia, that mimics L&T’s bespoke capabilities in India, as a part of the IKTVA initiative of Aramco and Saudi Vision 2030, to enhance local manufacturing.

Raymond: The clothing company said that the board has approved allotment of non-convertible debentures (NCDs) for Rs 1,100 crore on private placement basis to its associate company, Raymond Consumer Care. The deemed date of allotment is on 22 June 2023. The NCDs will have a coupon rate of 8.75% p.a. and has tenure of 730 days.

Rail Vikas Nigam (RVNL): The company announced that it has emerged as the lowest bidder (L1) for two projects from Madhya Pradesh Poorv Kshetra Vidyut Vitaran Company worth Rs 281.03 crore in Jabalpur. The orders include supply, installation, testing and commissioning of new KV lines, low tension lines on AB cable and distribution transformer substation.

JSW Energy: The company shares rose after brokerage firm Antique Stock Broking upgraded the stock to ‘buy’ rating from a ‘sell’ with a price target of Rs 316 apiece. The brokerage firm said: with the company’s renewed focus on renewable energy and first mover advantage in the energy storage space, the company is considered the best proxy for energy transition.

Fortis Healthcare: The company has announced signed a definitive agreements for sale of its hospital business operations at Vadapalani, Chennai to Sri Kauvery Medical Care (India) Limited for a consideration of Rs 152 crore. The transaction will be an all-cash deal and is estimated to be completed by end of July 2023, subject to certain conditions as stipulated in the definitive agreements. It currently has 110 operational beds with a potential to scale up to 200 beds.

Carborundum Universal (CUMI): The company announced that its board has approved the appointment of Sridharan Rangarajan as the managing director of the company for a period of five years, with effect from August 3, 2023. Rangarajan will replace N Ananthaseshan, the current managing director, who will retire from the services at the close of business hours on August 2, 2023 due to personal commitments.

Venus Remedies: Shares of the company hit an upper circuit of 5% after the company, through its German subsidiary Venus Pharma, received marketing authorisation from Spain for Meropenem, a last-recourse antibiotic. The pharmaceutical firm said that it expects to capture a 10% share in Spain’s $6.34 million meropenem market and consolidate its position in other European countries. The company has been the largest exporter of meropenem from India in the last three years.

Hazoor Multi Projects: Shares of the company were locked in upper circuit of 5% after the company said it has received a work order worth Rs 352.80 crore for earthwork & subgrade work of Mumbai Expressway project in Maharashtra on EPC mode under Bharatmala Pariyojana.