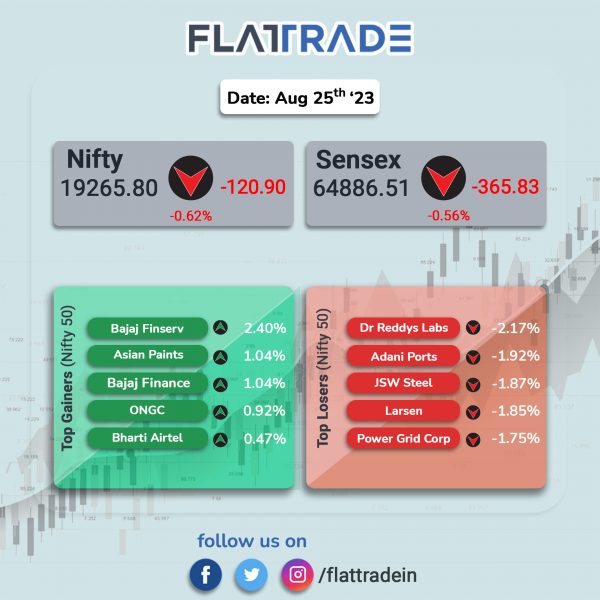

Dalal Street ended lower as investor sentiments were dampened after the minutes of the RBI MPC meeting hinted at the central bank’s commitment to tame inflation and bring it down to the 4% target and also due to weak global cues. The Sensex fell 0.56% and the Nifty lost 0.62%.

In broader markets, the Nifty Midcap 100 slumped 0.82% and the BSE Smallcap fell 0.24%.

Top losers were PSU Bank [-1.51%], Realty [-1.31%], Metal [-1.26%], Pharma [-1.11%], FMCG [-1.02%]. All Nifty sectoral indices closed in the red.

The Indian rupee depreciated by 6 paise to 82.65 against the US dollar on Friday.

Stock in News Today

Union Bank Of India (UBI): The state-owned lender has raised Rs 5,000 crore Via QIP. The bank has allotted 57.77 crore shares at Rs 86.55 apiece, a discount of 4.99% to the floor price. More than 5% of equity shares offered were allotted to Bajaj Allianz Life Insurance, ICICI Prudential Life Insurance, LIC, PNB Paribas Arbitrage, and Morgan Stanley Asia (Singapore).

Suzlon Energy: The company has secured 201.6 MW order from O2 Power Private. The company will supply 64 of their largest wind turbines with a rated capacity of 3.15 MW each and the project is expected to be completed in 2025. The project is estimated to curb 6.55 lakh tonnes of CO2 emissions per year.

V.S.T. Tillers Tractors: The company announced that it has entered into a master service agreement with Solectrac Inc., USA, to jointly develop electric power tiller and other agricultural machineries.

Mahanagar Telephone Nigam (MTNL): The company has allotted 1,05,500 non-convertible bonds aggregating to Rs 1,055 crore on August 24, 2023. These Government of India guaranteed unsecured rated listed redeemable non-convertible and taxable bonds are in the nature of debentures, Series VIII-B having face value of Rs 1 lakh each. The bonds have a coupon rate of 7.61% and will be matured on 24 August 2033.

Tatva Chintan Pharma Chem: The company said that its board has approved to raise Rs 200 crore through Qualified Institutional Placement (QIP). The company has authorised the opening of the proposed issue of such number of equity shares to eligible qualified institutional buyers, aggregating to an amount up to Rs 200 crore, through a qualified institutions placement. The floor price in respect of the Issue has been determined at Rs 1,704.74 per equity share.

Coforge: BPEA EQT sold its entire 26.63% stake in Coforge for Rs 7,684 crore to multiple investors through bulk deals. With this transaction, the company is entirely owned by public investors without a promoter. SBI Mutual Fund, Aditya Birla Mutual Fund, Capital Group and Kotak Mahindra Group were the buyers.

Max Financial Services: Max Ventures Investment Holdings, one of the promoters of Max Financial Services, offloaded a 3.6% stake in the company for Rs 1,091 crore through open market transactions. HDFC Standard Life Insurance, International Monetary Fund, ICICI Prudential MF, Kotak MF, Kotak Mahindra Life Insurance, Morgan Stanley Asia (Singapore), Nippon India Mutual Fund (MF), and Plutus Wealth Management among others were the buyers of the company shares.

Infosys: The IT major announced a three-year partnership with tennis star Rafael Nadal. “Nadal is a perfect embodiment of what it takes individuals or business leaders to evolve and continually navigate their next,” the company said in a statement.

Knowledge Marine & Engineering Works: The company announced that its Bahraini subsidiary has received a letter of intent (LoI) from Eastern Asphalt & Mixed Concrete Co. W.L.L worth approximately Rs 41.51 crore. The contract is for the supply of dredged marine sand in Bahrain. The said contract will commence during the third quarter of FY24 and spans over a period of five years.

Lupin: The pharma major said that it has received approval from the US Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Pirfenidone tablets. Pirfenidone is used to treat a certain lung disease called idiopathic pulmonary fibrosis (IPF). This product will be manufactured at Lupin’s Pithampur facility in India. Pirfenidone tablets (RLD Esbriet) had an estimated annual sales of $ 218 million in the U.S. (IQVIA MAT June 2023).

Indus Towers: The telecom infrastructure provider announced that its chief information officer (CIO), Vinod Sivarama Krishnan has tendered his resignation to pursue opportunities outside the company. He will be relieved from his duties by 30 September 2023.

Universal Autofoundry: Ace investor Ashish Kacholia bought about 8.54% equity in the company via bulk deal on the BSE on August 24, 2023. As per the bulk deal data on the BSE, Ashish Kacholia bought 10.34 lakh shares worth Rs 16.7 crore at an average price of Rs 161.59 per share in the firm. In addition, Himalaya Finance & Investment Company also bought 10.34 lakh shares at an average price of Rs 161.49 per share in the company.

Shilpa Medicare: The company’s manufacturing facility situated at pharma SEZ, Jadcherla, Telangana, has cleared a GMP inspection conducted by ANVISA, Brazil. The facility is involved in manufacturing, packaging, labelling and testing of finished dosage forms (sterile injections and non‐sterile oral solids) for the treatment of various forms of cancer and adjuvant therapy.

Power Mech Projects: The company has received two orders aggregating to Rs 723.90 crore from Raichur Power Corporation and Madhya Pradesh State Mining Corporation. The first contract received from Raichur Power Corporation if for a consideration of Rs 158.67 crore and it is to be executed for a period of 36 months. The second contract bagged from Madhya Pradesh State Mining Corporation is worth Rs 565.23 crore and it is for a period of three years.

Syrma SGS Technology: The company’s board has approved the appointment of Satendra Singh as chief executive officer (CEO) of the company with immediate effect. Satendra holds a master’s degree in manufacturing management from BITS Pilani, and has completed an advanced management program from IIM Bangalore, and several executive leadership program.

Vedanta: The mining company has been granted an arbitration award that supports its position in the Rajasthan block case, the company said in an exchange filing. The company said that according to the terms of the production sharing contract for the Rajasthan block, there is no obligation to pay additional profit petroleum.