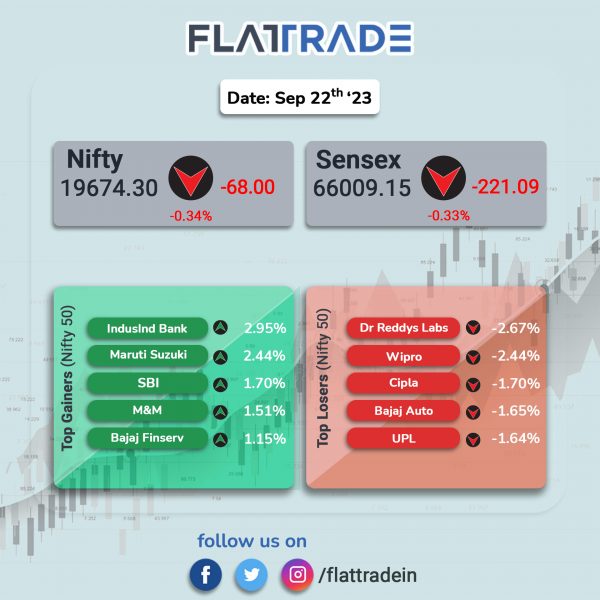

Benchmark stock indices closed lower due to investors’ risk-off sentiments on the back of weak global cues, rising US Treasury Yields and elevated crude oil prices. The Sensex fell 0.33% and the Nifty lost 0.34%.

In broader markets, the Nifty Midcap 100 shed 0.11%, while the BSE Smallcap inched up by 0.03%.

Top losers were Pharma [-1.55%], Metal [-0.66%], Realty [-0.66%], Energy [-0.46%], and Financial Services [-0.41%]. Top gainers were PSU Bank [3.51%] and Auto [0.21%].

The Indian rupee rose by 18 paise to 82.93 against the US dollar on Friday.

Stock in News Today

Lupin: The pharma major announced that it has signed an agreement to acquire five brands in strategic therapy areas from an Italian pharma group, Menarini, for an aggregate amount of Rs 101 crore. The five brands are Piclin (Picosulphate Sodium), Menoctyl (Otilonium Bromide), Sucramal O (Sucralfate + Oxetacaine), Pyridium (Phenazopyridine) and Distaclor (Cefaclor).

KPI Green Energy: The company has received letter of intent (LoI) from Ayana Renewable Power Four for a wind and solar hybrid power project. The order comprises 145.20 MW of wind power project and and 50 MW of solar power project. The project will be located in Gujarat and the company will be responsible for providing a range of services, including engineering, procurement, construction, and commissioning (EPCC). The project is scheduled to be completed in the financial year 2024-25.

Suzlon Energy: The company announced that it has bagged an order for the development of a 29.4 MW of wind installed capacity for 100 MW co‐located wind‐solar hybrid project of BrightNight, a global renewable power producer. Suzlon will install 14 units of their S120 – 140m wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 2.1 MW each at Osmanabad in Maharashtra. The project is expected to be commissioned in phases, beginning in April 2024. The project entails supply, installation, commissioning, and maintenance services.

Ambuja Cements: The company has incorporated three new wholly owned subsidiary companies, namely, Lotus IFSC Private Limited, Ambuja Concrete North Private Limited, and Ambuja Concrete West Private Limited.

Kaynes Technology: The company plans to invest Rs 22.40 crore to acquire 49,12,281 equity shares of Kemsys Technologies (Kemsys), a wholly owned subsidiary of company, of Rs 1 each at a premium of Rs 44.60 on rights issue basis.

Ratnamani Metals (RMTL): The company said that it has executed a joint venture agreement with Technoenergy AG (TEAG), Switzerland. Upon incorporation of the JV company with Rs 2.70 crore as initial paid up capital, the shareholding shall be in the ratio of 51% to be held by RMTL and 49% to be held by TEAG.

HPL Electric and Power: The company informed that CRISIL Ratings has upgraded the long-term rating on the bank facilities of the company to ‘CRISIL A-/Stable from ‘CRISIL BBB+/Positive and short-term rating to CRISIL A2+ from CRISIL A2. The rating agency said the revised ratings continue to reflect HPL’s established presence in metering industry, operating efficiencies due to in-house research and development facilities, diversified product profile and robust net worth and healthy capital structure.

NCC: The company said that its joint venture with J Kumar Infra Projects (JKIL), has received contract from Brihanmumbai Municipal Corporation (BMC) for constructing twin tunnel. The contract includes design, construction and operation of twin tunnel from Film City Goregaon to Khindipada (Amar nagar) Mulund including box tunnel at Film City, electrical, mechanical and associated works. The value of the contract is Rs 6,301.08 crore and the sharing ratio of the parties in the JV is NCC (51%) & JKIL (49%).

Ugro Capital: The financial services company has approved the issuance of listed commercial paper to the tune of Rs 14 crore for a period of 183 days.

Lloyds Enterprises: The company’s board has accorded its approval to enter into partnership agreement with Lloyds Metals & Minerals Trading LLP for a partnership interest of 7%.

Lux Industries: The company said that the Income Tax Dept is conducting a survey at its unit in Kolkata and it is extending its full cooperation to the authorities. The company further said that it is unable to assess impact of survey.

Zaggle Prepaid Ocean Services: The company shares opened at Rs 164 apiece on the NSE as against an issue price of Rs 164. The shares hit a high of Rs 176 and a low of Rs 155.3 apiece. The shares closed at Rs 158.35, which was lower than its issue price.

SAMHI Hotels: The shares of the company opened at Rs 134.5 per share on the NSE against an issue price of Rs 126. The shares hit a high of Rs 146.6 and a low of Rs 127.25 apiece. Finally, the shares closed at Rs 143.4 apiece.

Dhampur Sugar Mills: The company informed that Anant Pande, chief executive officer (CEO) and whole time director of the company tendered his resignation with effect from closure of business hours of 21 September 2023 due to personal reasons. He will continue to act as whole time director of the company until his resignation is accepted by the board.