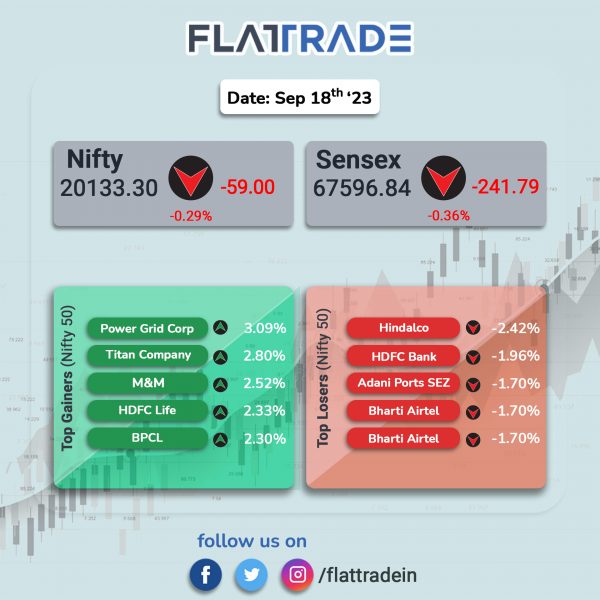

Benchmark equity indices closed lower as investors remained cautious ahead of key central bank meetings and concerns over global economic growth. The Sensex fell 0.35% and the Nifty lost 0.29%.

In broader markets, the Nifty Midcap 100 dropped by 0.42% and the BSE Smallcap shed 0.6%.

Top losers were Realty [-1.37%], Media [-1.27%], Metal [-1.11%], Private Bank [-0.83%], and IT [-0.68%]. Top gainers were PSU Bank [3.39%], Auto [0.84%], and FMCG [0.58%]

The Indian rupee depreciated 9 paise to close at 83.27 against the US dollar on Monday.

Stock in News Today

Adani Total Gas: The company said that it has received a work order from Ahmedabad Municipal Corporation (AMC) to operate 500 tonnes per day (TPD) capacity of bio-CNG (CBG) plant located in Ahmedabad. The order includes designing, building, financing and operating 500 tonnes per day (TPD) capacity bio-CNG (CBG) plant on public-private partnership (PPP) Model at Pirana / Gyaspur, Ahmedabad. The said project will be executed in concession period of 20 years and the cost of the project will be in the range of Rs 130 to Rs 150 crore.

Tata Consultancy Services (TCS): The company has launched the TCS Product Life Cycle Profiler, a life cycle assessment (LCA) tool that offers a scalable and dynamic approach to product LCA by computing environmental impacts across product lines. TCS Product Life Cycle Profiler enables simultaneous LCA for all products originating from a specific manufacturing facility and offers a comprehensive view of the impact from materials, transportation, suppliers, energy consumption, and processes. It computes environmental impact across multiple dimensions, beyond greenhouse gas emissions, from human toxicity and water use to ozone depletion and particulate matter – and highlights impact hotspots to alert the organization to possible changes.

Vedanta: The minerals and mining company announced that it’s committee of directors will meet on Thursday (21 September 2023) to consider the proposal for issuance of non-convertible debentures (NCDs) on a private placement basis. The company stated that the proposal is part of its routine refinancing that is undertaken in ordinary course of business.

HFCL: The Company has secured work order worth Rs 1015 crore from Madhya Pradesh Jal Nigam, a Government of Madhya Pradesh Undertaking (“MPJN”). The order entails provision for laying of optical fiber cables on critical and important routes, execution of multi–village drinking water supply network in Sheopur district of Madhya Pradesh (“Project”).

Radico Khaitan: The company said that it has commissioned the 350 KLPD greenfield grain distillery along with a captive power plant of 15 MW at Sitapur, Uttar Pradesh. The entire campus will be self-sufficient for its power requirement primarily using biomass or non-carbon fuels, the company added. The company also said that the campus will have a bottling capacity of over 15 million cases.

D B Realty: The company said that it had raised Rs 1,544 crore by way of preferential issue of 25,75,00,000 convertible warrants to promoter group / non promoter group in two phases / rounds in the month of February and March 2022. The funds will be utilised for debt reduction (including release of contingent liabilities) of Rs 1404 crore and further investments/acquisition of new assets and to meet various requirements of its ongoing projects and working capital of the Company.

Ugro Capital: The company said that the investment and borrowing committee of its board allotted 5,000 non-convertible debentures (NCDs) aggregating to Rs 50 crore through private placement basis. The senior, secured, rated, listed, redeemable, taxable, transferable NCDs have a face value of Rs 1 lakh each. These NCDs have a coupon rate of 8.56% per annum and will mature on 18 March 2025. The NCDs shall be be listed on the Bombay Stock Exchange.

Indigo Paints: The company said that its fully automated manufacturing facility at Pudukkottai, Tamil Nadu, has commenced its commercial production on 18 September 2023.The company said that new manufacturing facility has the capacity to produce over 50,000 kilolitres (KL) per annum of water-based paint products.

Responsive Industries: The company announced that it has received a work order for its waterproofing membranes for the RVNL Rishikesh-Karan Prayag Railway Project. Employing waterproofing solutions from Responsive Industries will be instrumental in ensuring the project’s robustness and extended durability.

Salasar Techno Engineering (STEL): The company has received a contract valued at $9.40 million (equivalent to Rs 75.24 crore) from Energy Development Corporation for the Rwanda transmission system reinforcement. The said order is in line with the managements vision to provide EPC solutions across international markets. The order entails providing end-to-end EPC solution of designing, supplying, and installation of 110kv transmission lines connecting the African regions of Rwinkwavu-Kirehe, GabiroNyagatare, and Rulindo-Gicumbi. The contract is expected to be completed within 18 months.

Capacite lnfraprojects: The company has received repeat order from Raymond for total contract value of Rs 281 crore for project – Codename Xception at Thane.

Genesys International Corporation: The company has bagged a contract for production and updating of national coverage maps in Saudi Arabia from AL Moammar Information Systems Co. The project is valued at Rs 67 crore and involves creating elevation models, digital form outputs, updation of buildings layer, transport network, hydrographic network, land cover database and alignment with the national geospatial platform.

63 Moons Technologies: The company announced the cessation of Suresh Salvi as independent director of the company on completion of his first term of two consecutive years at the close of business hours on September 17, 2023.

Intellect Design Arena: The company announced the launch of iGTB Copilot, a suite of AI solutions for commercial and corporate banking. iGTB Copilot integrates Microsoft Azure OpenAI Service to reinvent customer experiences and revitalize productivity for both commercial banks and their clients.

Jupiter Life Line Hospitals: The company shares opened at Rs 973 per share against an issue price of Rs 735 per share. The shares rose to a high of Rs 1,108.95 and closed at Rs 1,075.75 per share.

Ashapura Minechem: The company’s two step-down subsidiaries have signed two contracts for the supply of bauxite from Guinea and supply of iron ore from Guinea. The contract for supply of 24 million tons of bauxite from Guinea were signed with State Power Investment Corp (“SPIC”) and the contract to supply 10 million tons of iron ore was signed with Tai He Mining.